Dr 1094 Income Withholding Tax Return State Legal Forms 2020

What is the Dr 1094 Income Withholding Tax Return State Legal Forms

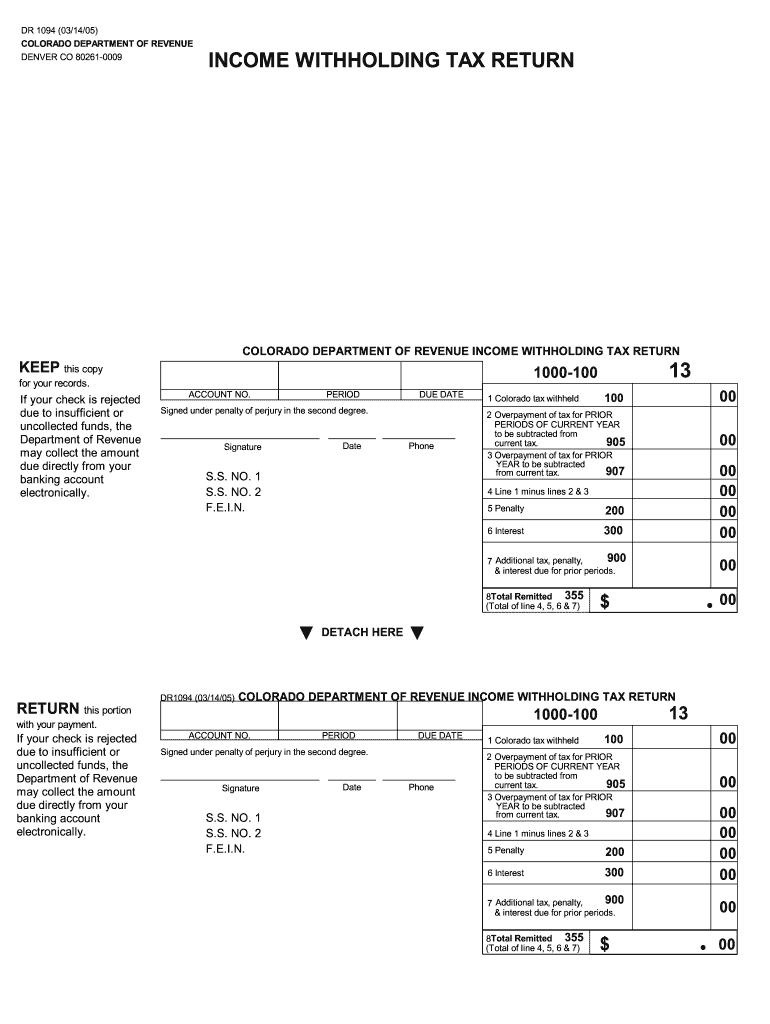

The Dr 1094 Income Withholding Tax Return is a specific form used by employers in the United States to report income withholding taxes. This form is essential for ensuring compliance with state tax regulations. It serves as a declaration of the amounts withheld from employees' wages for state income taxes. The form is typically required to be submitted periodically, depending on state requirements, and is crucial for maintaining accurate tax records.

How to use the Dr 1094 Income Withholding Tax Return State Legal Forms

Using the Dr 1094 Income Withholding Tax Return involves several straightforward steps. First, gather all necessary information regarding employee wages and the amounts withheld for state income tax. Next, accurately fill out the form, ensuring that all details are correct to avoid potential penalties. Once completed, the form can be submitted electronically or via mail, depending on the state’s submission guidelines. Utilizing digital tools can streamline this process, making it easier to manage and submit the form on time.

Steps to complete the Dr 1094 Income Withholding Tax Return State Legal Forms

Completing the Dr 1094 Income Withholding Tax Return involves a series of steps:

- Collect employee wage information and withholding amounts.

- Access the Dr 1094 form, either online or in print.

- Fill in the required fields accurately, including employer details and employee information.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to your state’s requirements.

Legal use of the Dr 1094 Income Withholding Tax Return State Legal Forms

The legal use of the Dr 1094 Income Withholding Tax Return is paramount for employers. This form must be completed accurately to ensure compliance with state tax laws. Failure to submit the form or inaccuracies in reporting can lead to penalties, including fines or audits. It is essential to understand the legal implications of withholding taxes and to keep thorough records of all submissions to safeguard against potential disputes with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Dr 1094 Income Withholding Tax Return vary by state. Generally, employers are required to submit this form on a quarterly or annual basis. It is crucial to be aware of specific deadlines to avoid late fees or penalties. Employers should consult their state’s tax authority for precise dates and any changes to the filing schedule, ensuring timely compliance with all regulations.

Required Documents

To complete the Dr 1094 Income Withholding Tax Return, several documents may be required:

- Employee wage statements for the reporting period.

- Records of amounts withheld from employee paychecks.

- Employer identification information, such as a tax ID number.

- Any relevant state-specific tax forms or documentation.

Form Submission Methods (Online / Mail / In-Person)

The Dr 1094 Income Withholding Tax Return can typically be submitted through various methods, depending on state regulations. Many states allow electronic submission, which can expedite the process and reduce errors. Alternatively, forms can be mailed to the appropriate tax authority or submitted in person at designated locations. It is advisable to confirm the preferred submission method with your state’s tax office to ensure compliance.

Quick guide on how to complete dr 1094 income withholding tax return state legal forms

Effortlessly Complete Dr 1094 Income Withholding Tax Return State Legal Forms on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle Dr 1094 Income Withholding Tax Return State Legal Forms on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

The Easiest Way to Edit and Electronically Sign Dr 1094 Income Withholding Tax Return State Legal Forms with Ease

- Obtain Dr 1094 Income Withholding Tax Return State Legal Forms and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Dr 1094 Income Withholding Tax Return State Legal Forms and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 1094 income withholding tax return state legal forms

Create this form in 5 minutes!

How to create an eSignature for the dr 1094 income withholding tax return state legal forms

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Dr 1094 Income Withholding Tax Return State Legal Form?

The Dr 1094 Income Withholding Tax Return State Legal Form is a document required for reporting income withholding tax in specific states. This form helps ensure compliance with state tax regulations, allowing businesses to accurately report income tax withheld from employees' wages. Using airSlate SignNow, you can easily create and eSign this form to streamline your tax reporting process.

-

How does airSlate SignNow simplify the completion of the Dr 1094 Income Withholding Tax Return State Legal Forms?

airSlate SignNow simplifies the completion of the Dr 1094 Income Withholding Tax Return State Legal Forms by providing an intuitive interface that allows users to fill out and eSign the document quickly. Our platform also offers templates specifically designed for this form, ensuring that all necessary fields are included. This saves you time and reduces errors in your tax reporting.

-

What are the pricing options for using airSlate SignNow for the Dr 1094 Income Withholding Tax Return State Legal Forms?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, making it easy to manage the Dr 1094 Income Withholding Tax Return State Legal Forms. You can choose from monthly or annual subscriptions based on your workflow needs. Additional features, such as advanced document management and storage, are also available at higher tiers.

-

Can I integrate airSlate SignNow with my existing accounting software to handle the Dr 1094 Income Withholding Tax Return State Legal Forms?

Yes, airSlate SignNow supports integrations with popular accounting software, allowing you to seamlessly handle the Dr 1094 Income Withholding Tax Return State Legal Forms within your existing systems. This integration helps maintain accurate records and ensures your tax data is up-to-date. Streamlining these tasks through integrations can signNowly enhance your overall efficiency.

-

What are the benefits of using airSlate SignNow for my HR department when managing Dr 1094 Income Withholding Tax Return State Legal Forms?

Using airSlate SignNow for managing the Dr 1094 Income Withholding Tax Return State Legal Forms brings numerous benefits to your HR department, including ease of access, faster document turnaround, and improved compliance. The platform allows your HR team to track the status of forms in real-time, reducing paperwork-related delays. Additionally, the secure eSigning feature enhances document security, ensuring sensitive information is protected.

-

Is airSlate SignNow secure for handling sensitive documents like the Dr 1094 Income Withholding Tax Return State Legal Forms?

Absolutely, airSlate SignNow prioritizes security for all documents, including the Dr 1094 Income Withholding Tax Return State Legal Forms. We implement industry-leading encryption protocols and follow strict compliance standards to ensure that your sensitive tax information remains confidential and secure. Our commitment to data protection gives you peace of mind while managing essential documents.

-

How can airSlate SignNow help improve the efficiency of filing the Dr 1094 Income Withholding Tax Return State Legal Forms?

airSlate SignNow enhances the efficiency of filing the Dr 1094 Income Withholding Tax Return State Legal Forms by streamlining the entire process from creation to submission. Our platform reduces manual errors, accelerates document sharing, and provides automated reminders for critical deadlines. This efficiency allows your team to focus on core business functions rather than getting bogged down in paperwork.

Get more for Dr 1094 Income Withholding Tax Return State Legal Forms

Find out other Dr 1094 Income Withholding Tax Return State Legal Forms

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself