Ct 706 Nt Form 2020

What is the Ct 706 Nt Form

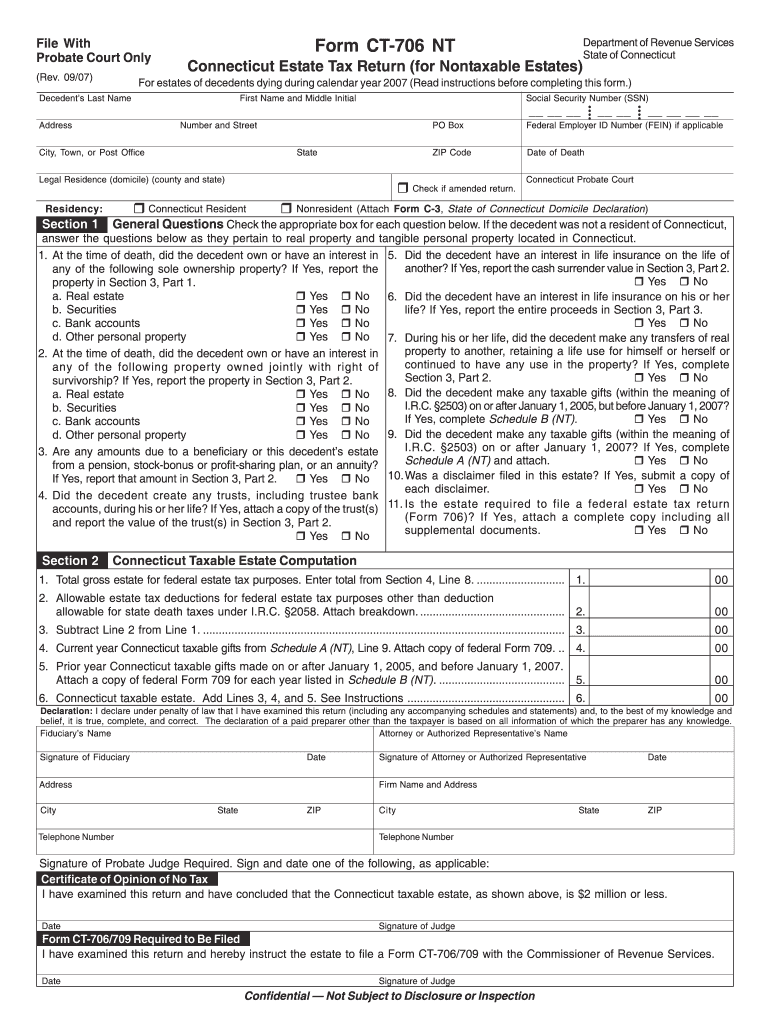

The Ct 706 Nt Form is a specific tax form used in the United States for estate tax purposes. It is designed for estates that are not subject to federal estate tax but may still be required to file a Connecticut estate tax return. This form is crucial for reporting the value of the estate and any applicable deductions. Understanding its purpose helps ensure compliance with state tax laws and provides a clear overview of the estate's financial standing.

How to use the Ct 706 Nt Form

Using the Ct 706 Nt Form involves several steps to ensure accurate completion. First, gather all necessary documentation related to the estate, including asset valuations and debts. Next, fill out the form with detailed information about the decedent, including their name, date of death, and the total value of the estate. It is essential to provide accurate figures and any required supporting documentation to avoid delays or penalties. Finally, submit the form to the appropriate state authority by the designated deadline.

Steps to complete the Ct 706 Nt Form

Completing the Ct 706 Nt Form requires careful attention to detail. Follow these steps:

- Gather Documentation: Collect all relevant financial documents, including bank statements, property appraisals, and debt records.

- Fill Out Personal Information: Enter the decedent's full name, date of death, and other identifying details accurately.

- Report Assets: List all assets owned by the decedent, ensuring each is valued correctly.

- Include Deductions: Identify and include any deductions applicable to the estate, such as debts and funeral expenses.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Send the completed form to the appropriate state agency by the deadline.

Legal use of the Ct 706 Nt Form

The Ct 706 Nt Form serves a vital legal function in estate administration. It must be filed to comply with Connecticut state law, ensuring that the estate is properly reported to the state tax authorities. Failure to file this form can result in penalties and interest on unpaid taxes. Additionally, the form provides a legal record of the estate's value and any deductions claimed, which can be essential in case of audits or disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706 Nt Form are critical to ensure compliance with state regulations. Generally, the form must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to check for any specific dates that may apply to your situation, as timely submission can prevent penalties and interest from accruing.

Required Documents

To successfully complete the Ct 706 Nt Form, several supporting documents are required. These typically include:

- Death certificate of the decedent

- Asset valuations, including appraisals for real estate and personal property

- Records of debts and liabilities

- Any prior tax returns that may be relevant

- Documentation of funeral expenses and other deductions

Having these documents ready will facilitate a smoother completion process and ensure all necessary information is provided.

Quick guide on how to complete 2007 ct 706 nt form

Complete Ct 706 Nt Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Ct 706 Nt Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign Ct 706 Nt Form without hassle

- Locate Ct 706 Nt Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Ct 706 Nt Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 ct 706 nt form

Create this form in 5 minutes!

How to create an eSignature for the 2007 ct 706 nt form

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Ct 706 Nt Form?

The Ct 706 Nt Form is a specific tax form used by estates in Connecticut to report estate taxes. It is essential for compliance with state tax laws and ensures that all applicable taxes are addressed. Understanding how to complete and submit the Ct 706 Nt Form correctly is crucial for effective estate planning.

-

How can airSlate SignNow assist with the Ct 706 Nt Form?

airSlate SignNow provides an efficient platform for electronically signing and sending the Ct 706 Nt Form. Our tailored features simplify the document management process, ensuring that you can focus on what matters most—completing your estate planning effectively. With airSlate SignNow, managing forms like the Ct 706 Nt Form becomes user-friendly and secure.

-

What are the costs associated with using airSlate SignNow for the Ct 706 Nt Form?

airSlate SignNow offers competitive pricing plans that cater to different business needs. There are no hidden fees, and you can choose a plan that fits your usage for handling documents such as the Ct 706 Nt Form. We provide value through our extensive features that streamline the signing process.

-

Is airSlate SignNow compliant with state regulations for the Ct 706 Nt Form?

Yes, airSlate SignNow is compliant with all relevant state regulations regarding electronic signatures, including those applicable to the Ct 706 Nt Form. Our platform ensures that your signed documents meet legal standards, providing peace of mind for users handling sensitive estate documentation. You can trust that your forms are securely managed and legally binding.

-

What features does airSlate SignNow offer to facilitate the completion of the Ct 706 Nt Form?

Our platform offers features such as customizable templates, electronic signatures, and document tracking to help you complete the Ct 706 Nt Form efficiently. You can collaborate with multiple parties in real time, ensuring that everyone involved in the estate planning process can contribute seamlessly. These features make managing the Ct 706 Nt Form easier than ever.

-

Can I integrate airSlate SignNow with other tools for managing the Ct 706 Nt Form?

Absolutely! airSlate SignNow integrates with various productivity tools and software that can help streamline the process of managing the Ct 706 Nt Form. This integration allows you to enhance your workflow, making it easier to access and share necessary documents while ensuring that all information is easily captured and maintained.

-

How quickly can I get started with airSlate SignNow for the Ct 706 Nt Form?

Getting started with airSlate SignNow is quick and straightforward. You can sign up for an account and familiarize yourself with our user-friendly interface in no time. Once you’re set up, you can easily start managing the Ct 706 Nt Form and other essential documents without any delays.

Get more for Ct 706 Nt Form

Find out other Ct 706 Nt Form

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer