Ct 1040x How to Fill Form 2019

What is the Ct 1040x How To Fill Form

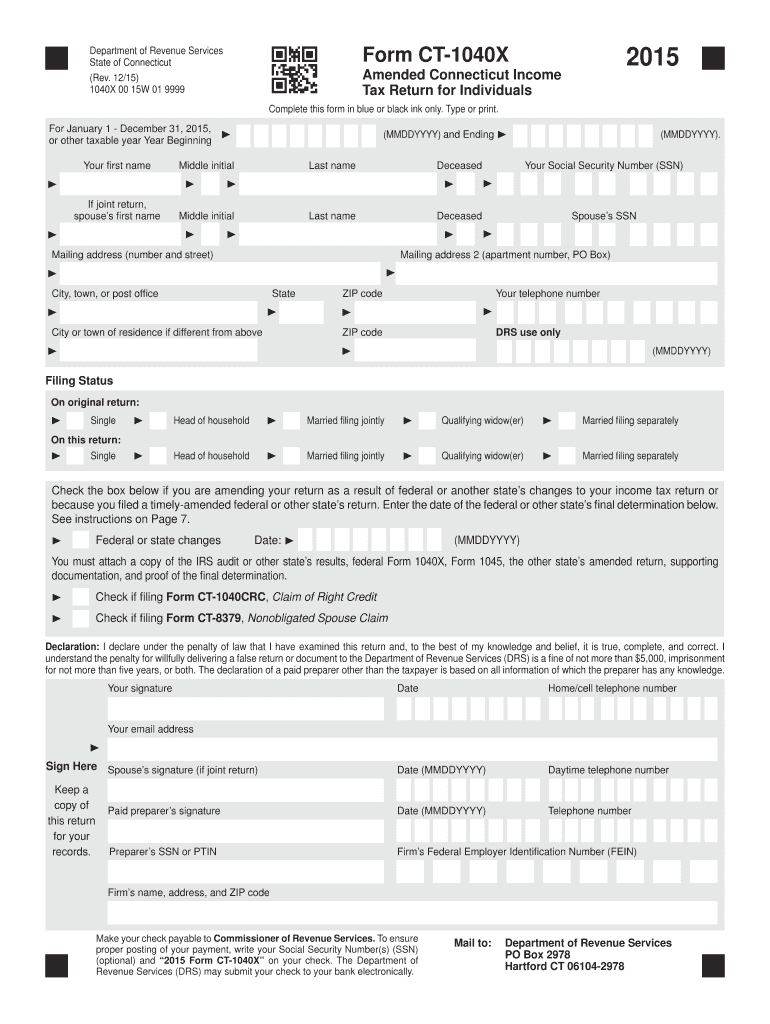

The Ct 1040x is a tax form used by individuals in Connecticut to amend their state income tax returns. This form allows taxpayers to correct errors or make changes to their previously filed tax returns. Common reasons for filing the Ct 1040x include correcting income, changing filing status, or claiming additional deductions or credits. Understanding the purpose of this form is essential for ensuring accurate tax reporting and compliance with state tax laws.

Steps to complete the Ct 1040x How To Fill Form

Filling out the Ct 1040x requires careful attention to detail. Here are the essential steps to complete the form:

- Gather your original Ct 1040 return and any supporting documents.

- Clearly indicate the tax year you are amending at the top of the form.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the corrected amounts in the appropriate sections, ensuring you explain each change in the space provided.

- Calculate the new tax liability or refund amount based on the changes made.

- Sign and date the form to validate your submission.

Legal use of the Ct 1040x How To Fill Form

The Ct 1040x is legally binding when filled out correctly and submitted to the Connecticut Department of Revenue Services. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or legal issues. By using this form, taxpayers can amend their returns in compliance with state tax laws, which helps maintain transparency and accountability in their tax obligations.

Required Documents

To complete the Ct 1040x, you will need several documents to support your amendments. These may include:

- Your original Ct 1040 tax return.

- Any W-2 or 1099 forms relevant to the tax year being amended.

- Receipts or documentation for any additional deductions or credits claimed.

- Any correspondence from the Connecticut Department of Revenue Services regarding your original return.

Form Submission Methods (Online / Mail / In-Person)

The Ct 1040x can be submitted through various methods. Taxpayers have the option to file the form online, which is often the quickest method. Alternatively, you can mail the completed form to the appropriate address provided by the Connecticut Department of Revenue Services. In some cases, individuals may choose to submit the form in person at designated tax offices. Each submission method has specific guidelines, so it is important to follow the instructions carefully to ensure proper processing.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 1040x are crucial to avoid penalties. Typically, the form must be submitted within three years from the original due date of the tax return being amended. This means that if you are amending a return for a specific tax year, you should be aware of the deadline to ensure compliance. Additionally, if you are expecting a refund, filing the Ct 1040x promptly can expedite the processing of your amended return.

Quick guide on how to complete ct 1040x how to fill 2015 form

Complete Ct 1040x How To Fill Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Ct 1040x How To Fill Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Ct 1040x How To Fill Form effortlessly

- Find Ct 1040x How To Fill Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct 1040x How To Fill Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 1040x how to fill 2015 form

Create this form in 5 minutes!

How to create an eSignature for the ct 1040x how to fill 2015 form

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Ct 1040x form and why do I need to fill it out?

The Ct 1040x form is used to amend your Connecticut state tax return. Understanding how to fill this form correctly is crucial for ensuring your tax records are accurate and up to date. Properly completing the Ct 1040x form can help you claim additional deductions or correct any errors in your previous filings.

-

What features does airSlate SignNow offer for filling out the Ct 1040x form?

airSlate SignNow provides a user-friendly platform that allows you to digitally fill out and sign the Ct 1040x form. Its features include customizable templates, easy document sharing, and secure eSigning capabilities. By using airSlate SignNow, you can streamline the process of completing your Ct 1040x form efficiently.

-

Is there a cost associated with using airSlate SignNow for the Ct 1040x form?

Yes, airSlate SignNow offers various pricing plans that are designed to fit different business needs. The cost is competitive, especially when considering the time and resources saved by using an efficient digital solution for filling out the Ct 1040x form. Your investment in airSlate SignNow can lead to enhanced productivity and ease in managing documents.

-

How can airSlate SignNow benefit me when filling out the Ct 1040x form?

Using airSlate SignNow can signNowly simplify the process of filling out the Ct 1040x form. The platform allows for real-time collaboration, ensuring that you can easily share the form with tax professionals if needed. Additionally, electronic signatures can expedite the submission process, saving you time.

-

Does airSlate SignNow integrate with other software for filing the Ct 1040x form?

Yes, airSlate SignNow is designed to integrate seamlessly with various software applications, enhancing your experience in filling out the Ct 1040x form. This includes compatibility with popular tax software and document management systems. Such integrations ensure a smooth workflow while completing your tax forms.

-

What support does airSlate SignNow provide if I have questions about the Ct 1040x form?

airSlate SignNow offers comprehensive customer support for any inquiries related to filling out the Ct 1040x form. You can access detailed resources, instructional materials, and customer service representatives to assist you. This dedicated support gives you peace of mind as you navigate the complexities of tax amendment.

-

Can I save my progress when filling out the Ct 1040x form on airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your progress while filling out the Ct 1040x form. This feature enables you to return at any time to complete or review your form, ensuring that you have the flexibility to work at your own pace without losing any entered information.

Get more for Ct 1040x How To Fill Form

Find out other Ct 1040x How To Fill Form

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract