Receive a Waiver from Electronic Filing from the Department of Revenue 2020

What is the Receive A Waiver From Electronic Filing From The Department Of Revenue

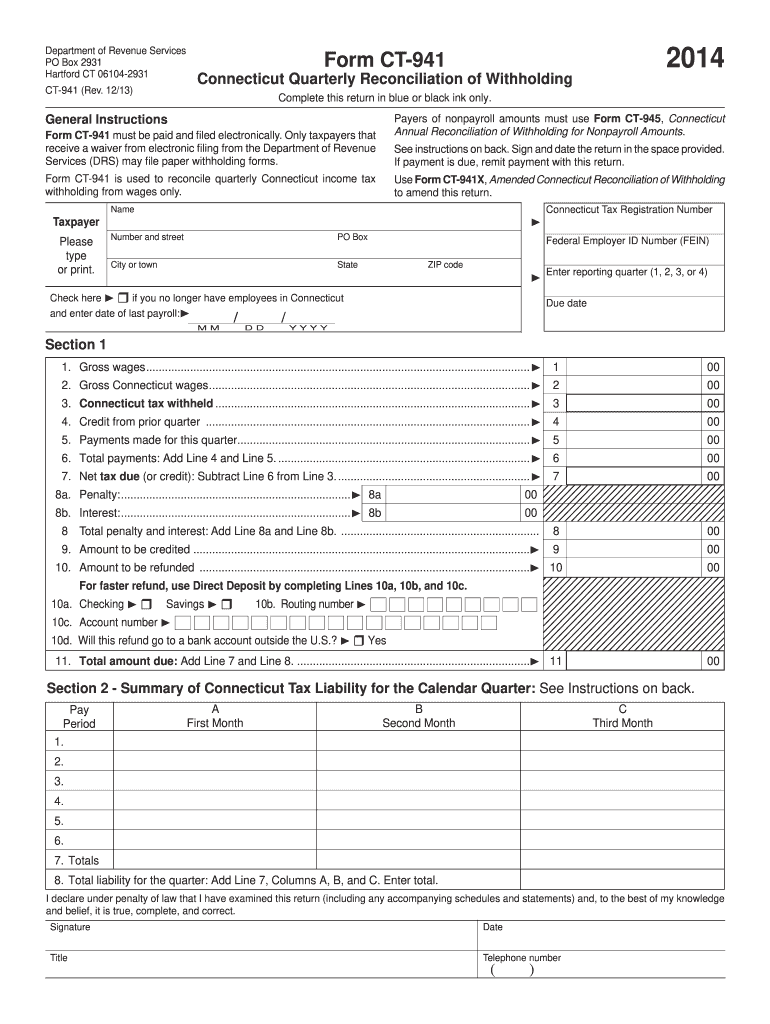

The form to receive a waiver from electronic filing from the Department of Revenue is a formal request that allows taxpayers to opt out of mandatory electronic filing requirements. This waiver is typically sought by individuals or businesses who may face challenges in filing electronically due to various reasons, such as lack of access to technology or specific circumstances that warrant an exception. Understanding the purpose of this form is essential for ensuring compliance with state regulations.

Steps to complete the Receive A Waiver From Electronic Filing From The Department Of Revenue

Completing the waiver form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and the reason for requesting the waiver. Next, fill out the form carefully, ensuring that all sections are completed. It is crucial to provide a clear explanation for the waiver request, as this will be evaluated by the Department of Revenue. After completing the form, review it for any errors or omissions before submission.

Eligibility Criteria

To qualify for a waiver from electronic filing, applicants must meet specific eligibility criteria set by the Department of Revenue. Generally, these criteria may include factors such as age, disability status, or lack of access to necessary technology. It is important to review the specific requirements for your state, as they can vary. Ensuring that you meet these criteria before applying can streamline the process and increase the likelihood of approval.

Required Documents

When applying for a waiver from electronic filing, certain documents may be required to support your request. Typically, this may include identification documents, proof of income, or any relevant correspondence from the Department of Revenue. Having these documents ready can facilitate a smoother application process. It is advisable to check with your state’s Department of Revenue for a complete list of required documents to ensure compliance.

Legal use of the Receive A Waiver From Electronic Filing From The Department Of Revenue

The legal use of the waiver form is governed by specific regulations that outline how and when it can be utilized. This form must be completed accurately and submitted within the designated time frame to be considered valid. Additionally, the waiver must be used for its intended purpose, which is to seek an exemption from electronic filing requirements. Misuse of the form can lead to penalties or denial of the request.

Form Submission Methods

The waiver form can typically be submitted through various methods, including online submission, mailing a hard copy, or delivering it in person to the appropriate office. Each submission method may have different processing times and requirements. It is essential to choose the method that best suits your circumstances and to ensure that the form is submitted by any applicable deadlines to avoid complications.

Penalties for Non-Compliance

Failure to comply with electronic filing requirements without an approved waiver can result in penalties imposed by the Department of Revenue. These penalties may include fines, interest on unpaid taxes, or additional scrutiny on future filings. Understanding the consequences of non-compliance emphasizes the importance of submitting the waiver form accurately and on time if you believe you qualify for an exemption.

Quick guide on how to complete receive a waiver from electronic filing from the department of revenue

Effortlessly Complete Receive A Waiver From Electronic Filing From The Department Of Revenue on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly and without delays. Handle Receive A Waiver From Electronic Filing From The Department Of Revenue on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-focused task today.

The easiest way to modify and electronically sign Receive A Waiver From Electronic Filing From The Department Of Revenue effortlessly

- Locate Receive A Waiver From Electronic Filing From The Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, exhaustive form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Receive A Waiver From Electronic Filing From The Department Of Revenue and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct receive a waiver from electronic filing from the department of revenue

Create this form in 5 minutes!

How to create an eSignature for the receive a waiver from electronic filing from the department of revenue

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the process to receive a waiver from electronic filing from the Department of Revenue?

To receive a waiver from electronic filing from the Department of Revenue, businesses must complete a specific application process. This typically involves submitting a request form alongside the necessary documentation that demonstrates the need for a waiver. Utilizing airSlate SignNow can streamline this process by enabling quick eSignatures and document management.

-

How can airSlate SignNow help in obtaining a waiver from electronic filing?

AirSlate SignNow simplifies the task of obtaining a waiver from electronic filing from the Department of Revenue by providing an intuitive platform for document handling. Users can easily prepare, send, and sign required documents, and ensure that all submissions meet the necessary compliance standards. Its user-friendly interface reduces the hassle of paperwork.

-

What are the costs associated with using airSlate SignNow for filing waiver requests?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, including those needing to receive a waiver from electronic filing from the Department of Revenue. Pricing varies based on the number of users and features desired. It's best to check the airSlate SignNow website for the latest offers and plan details.

-

Are there integration options with other software when applying for a waiver?

Yes, airSlate SignNow integrates seamlessly with a variety of business tools and platforms, making it easy to incorporate electronic filing waivers into existing workflows. This interoperability ensures that users can manage all documentation efficiently, whether they are preparing to receive a waiver from electronic filing from the Department of Revenue or handling other business processes.

-

What features does airSlate SignNow offer for tracking waiver requests?

AirSlate SignNow provides robust features for tracking waiver requests, including real-time notifications and document status updates. Users can easily monitor who has signed documents and which steps remain. This transparency is particularly beneficial when working to receive a waiver from electronic filing from the Department of Revenue.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital solutions?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it accessible even for users who may not be tech-savvy. Its straightforward navigation and clear instructions ensure that anyone can easily handle the process to receive a waiver from electronic filing from the Department of Revenue.

-

What benefits do businesses gain from using airSlate SignNow for document signing?

Businesses utilizing airSlate SignNow for document signing experience increased efficiency, reduced turnaround times, and enhanced security for their sensitive information. By simplifying the way to receive a waiver from electronic filing from the Department of Revenue, companies can focus more on their core operations without being bogged down by manual processes.

Get more for Receive A Waiver From Electronic Filing From The Department Of Revenue

- Top notch fundamentals workbook pdf form

- L 9 form

- Form 402540 durable power of attorney poa for ameriprise financial accounts and products enables account owners to designate an

- Identifying text structure 3 answer key form

- Bad check crime report form

- 322 application for order for publication of summons solano courts ca form

- Gc 400e2 gc 405e2 non cash assets on hand at end of account period standard and simplified accounts judicial council forms

- Affidavitcertificatedeclaration for subpoena duces tecum ventura courts ca form

Find out other Receive A Waiver From Electronic Filing From The Department Of Revenue

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself