Ct 941 Form 2020

What is the Ct 941 Form

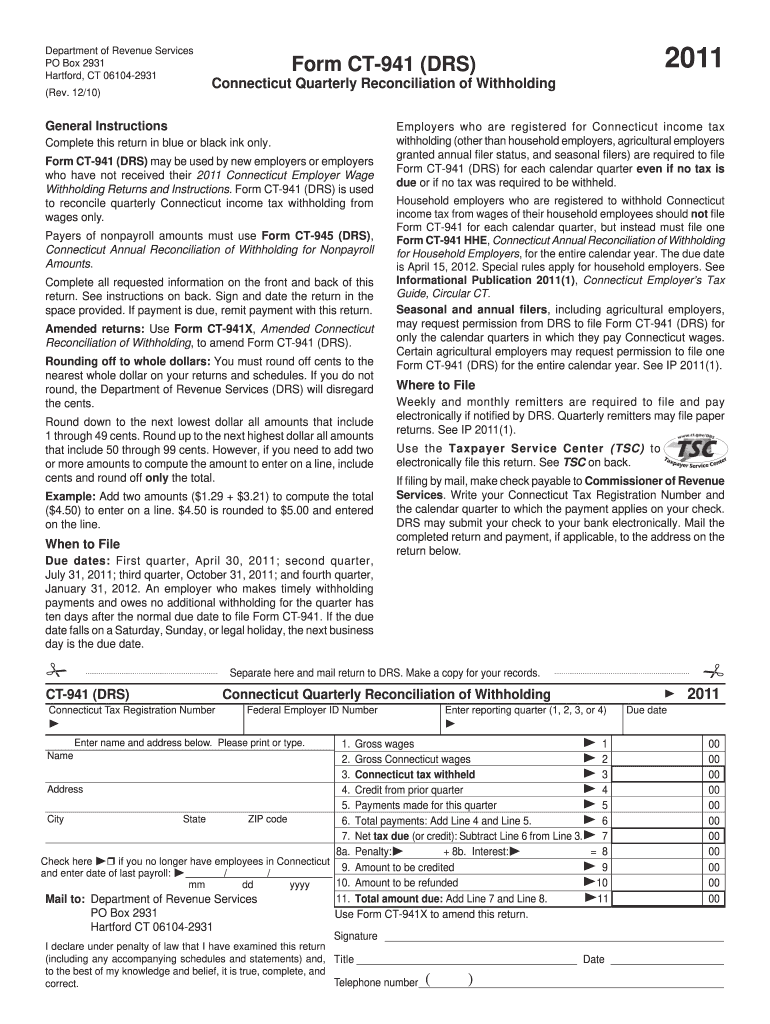

The Ct 941 Form is a tax document used by businesses in Connecticut to report and pay withholding taxes on wages paid to employees. This form is essential for employers who withhold state income tax from their employees' paychecks. It provides a summary of the total wages paid, the amount withheld, and any adjustments made during the reporting period. Understanding this form is crucial for compliance with state tax regulations.

How to use the Ct 941 Form

To effectively use the Ct 941 Form, employers should first gather all relevant payroll information for the reporting period. This includes total wages paid, the amount withheld for state income tax, and any other deductions. Once the information is compiled, employers can fill out the form accurately, ensuring that all figures are correct. After completing the form, it should be submitted to the Connecticut Department of Revenue Services by the specified deadline to avoid penalties.

Steps to complete the Ct 941 Form

Completing the Ct 941 Form involves several key steps:

- Gather payroll records for the reporting period, including total wages and tax withholdings.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail to the Connecticut Department of Revenue Services by the deadline.

Legal use of the Ct 941 Form

The Ct 941 Form must be used in compliance with Connecticut tax laws. Employers are legally required to submit this form to report withholding taxes accurately. Failure to file the form correctly or on time can result in penalties, interest, and potential legal issues. It is important for employers to understand their obligations under state law to ensure they remain compliant.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Ct 941 Form to avoid penalties. Generally, the form is due quarterly, with specific due dates set by the Connecticut Department of Revenue Services. It is crucial to mark these dates on a calendar and ensure that the form is submitted on time to maintain compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Ct 941 Form can be submitted through various methods. Employers have the option to file the form online through the Connecticut Department of Revenue Services website, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated offices. Each method has its own advantages, and employers should choose the one that best suits their needs.

Penalties for Non-Compliance

Non-compliance with the Ct 941 Form requirements can lead to significant penalties. These may include fines for late filing, interest on unpaid taxes, and additional charges for inaccuracies on the form. Employers should take these penalties seriously and ensure that they meet all filing requirements to avoid unnecessary financial burdens.

Quick guide on how to complete ct 941 form 2011

Prepare Ct 941 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, adjust, and electronically sign your documents quickly without any holdups. Manage Ct 941 Form on any platform using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

How to modify and eSign Ct 941 Form with ease

- Locate Ct 941 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information using the tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to preserve your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Ct 941 Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 941 form 2011

Create this form in 5 minutes!

How to create an eSignature for the ct 941 form 2011

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Ct 941 Form?

The Ct 941 Form is a quarterly tax return form used by employers in Connecticut to report income tax withheld from employees. Understanding how to fill out this form accurately is essential for compliance with state tax laws. Using airSlate SignNow can streamline the process of preparing and eSigning your Ct 941 Form for efficiency.

-

How can airSlate SignNow help with the Ct 941 Form?

airSlate SignNow simplifies the process of managing your Ct 941 Form by providing a straightforward platform to upload, edit, and eSign documents. Our solution ensures that you can handle your forms electronically, reducing paperwork and saving time. Additionally, its user-friendly interface is designed to improve your overall document workflow.

-

Is there a cost associated with using airSlate SignNow for the Ct 941 Form?

Yes, airSlate SignNow offers various pricing plans, including options for businesses of all sizes. Our pricing model is designed to be cost-effective, allowing you to choose a plan that best fits your needs, whether you're dealing with a Ct 941 Form or other business documents. You can start with a free trial to explore our features.

-

What features does airSlate SignNow offer for managing the Ct 941 Form?

airSlate SignNow includes essential features such as eSigning, document templates, and collaboration tools that support efficient management of the Ct 941 Form. Our platform also allows for secure storage and retrieval of your documents, ensuring that you can always access your completed forms when needed. This enhances your workflow and compliance with tax obligations.

-

Can I integrate airSlate SignNow with other applications for the Ct 941 Form?

Absolutely! airSlate SignNow offers seamless integration with various applications, enabling you to connect with your existing software solutions while managing the Ct 941 Form. This feature enhances your workflow by allowing you to transfer information between platforms effortlessly, thereby minimizing manual data entry and errors.

-

What are the benefits of using airSlate SignNow for eSigning the Ct 941 Form?

Using airSlate SignNow for eSigning your Ct 941 Form provides numerous benefits, including increased efficiency and reduced turnaround times. You can easily track the signing process, ensuring all necessary stakeholders are involved and informed. Additionally, the electronic signature is legally binding, assuring compliance with state regulations.

-

Is airSlate SignNow secure for handling the Ct 941 Form?

Yes, airSlate SignNow prioritizes security, providing a secure platform for handling sensitive documents like the Ct 941 Form. We implement advanced encryption and data protection measures to safeguard your information throughout the signing process. You can trust that your documents are handled securely and in accordance with privacy regulations.

Get more for Ct 941 Form

- Maternity allowance form 47398986

- Billing rate mappi form

- Dd form 771

- Aspca claim form 59821041

- Maine caregiver application form

- Physiotherapy consent form

- Certificate of compliance trailer caravan certificate of compliance trailer caravan catalogue no 45071569 form no 1590 571308942

- Application for asset protection permit city of boroondara form

Find out other Ct 941 Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy