1040 X Form 2019

What is the 1040 X Form

The 1040 X Form is an official document used by taxpayers in the United States to amend their federal income tax returns. This form allows individuals to correct errors or make changes to previously filed tax returns, ensuring that their tax records are accurate. The 1040 X Form can be used to adjust income, deductions, credits, and filing status. It is essential for taxpayers who discover discrepancies after filing their original return, as it helps in maintaining compliance with IRS regulations.

How to use the 1040 X Form

Using the 1040 X Form involves a few straightforward steps. First, gather the necessary information from your original tax return, including your filing status and any changes you wish to make. Next, complete the 1040 X Form by providing the corrected information in the appropriate sections. It is important to clearly explain the reasons for the amendments in the designated area of the form. Finally, submit the completed form to the IRS following the submission guidelines, which may vary based on your state and the nature of the amendments.

Steps to complete the 1040 X Form

Completing the 1040 X Form requires careful attention to detail. Here are the steps to follow:

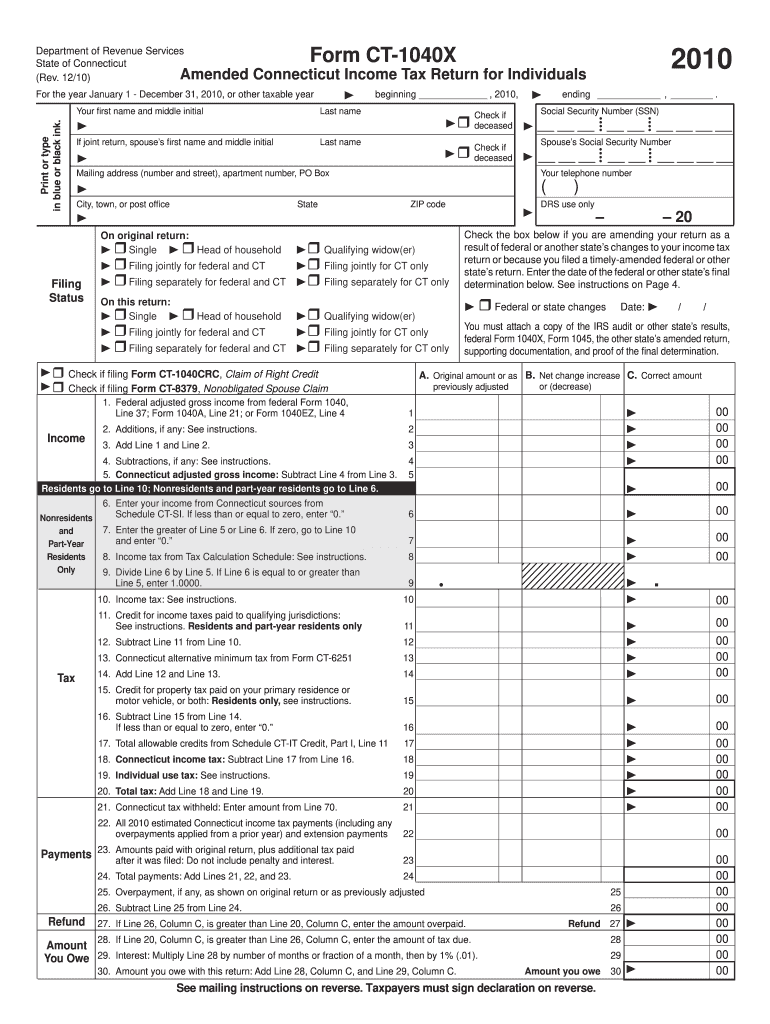

- Obtain a copy of the 1040 X Form from the IRS website or authorized providers.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide information from your original return in the first section of the form.

- In the second section, enter the corrected amounts and explain the changes made.

- Review the form for accuracy and completeness.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040 X Form

The 1040 X Form is legally recognized by the IRS as a valid method for amending tax returns. To ensure its legal standing, taxpayers must adhere to specific guidelines, including timely submission within the allowed period, which is generally three years from the original filing date. It is also crucial to provide accurate information and documentation to support the changes being made. Failure to comply with these regulations may result in penalties or denial of the amendments.

Filing Deadlines / Important Dates

Timely filing of the 1040 X Form is critical for taxpayers seeking to amend their returns. The general deadline for submitting the form is three years from the due date of the original return, including any extensions. Additionally, if the amendment results in a refund, it is advisable to file as soon as possible to ensure prompt processing. Taxpayers should also be aware of any specific deadlines related to their individual circumstances, such as changes in tax laws or IRS announcements.

Form Submission Methods (Online / Mail / In-Person)

The 1040 X Form can be submitted to the IRS through various methods. Currently, taxpayers have the option to file the form electronically using approved tax software that supports e-filing of amended returns. Alternatively, the form can be printed, signed, and mailed to the appropriate IRS address based on the taxpayer's location. In-person submission is typically not available for this form, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete 2010 1040 x form

Complete 1040 X Form effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without delays. Manage 1040 X Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to adjust and electronically sign 1040 X Form with ease

- Find 1040 X Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your preferred device. Edit and electronically sign 1040 X Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 1040 x form

Create this form in 5 minutes!

How to create an eSignature for the 2010 1040 x form

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is a 1040 X Form and when should I use it?

The 1040 X Form is an amendment to the taxpayer's original federal income tax return, which allows individuals to correct any mistakes or change their filing status. You should use the 1040 X Form if you discover errors after filing your tax return, such as incorrect income or filing status that could impact your tax liability.

-

How can airSlate SignNow help me with the 1040 X Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your 1040 X Form. Our solution allows you to streamline the amendment process, ensuring that your 1040 X Form is securely delivered and tracked, much more efficiently than traditional methods.

-

Is there a cost associated with using airSlate SignNow for the 1040 X Form?

airSlate SignNow offers flexible pricing plans to suit various business needs, including those who need to submit the 1040 X Form. You can choose a plan that fits your budget, with options for monthly or annual billing, making it a cost-effective solution for all your eSignature needs.

-

What features does airSlate SignNow offer for managing the 1040 X Form?

With airSlate SignNow, you can benefit from features like custom templates, automated reminders, and real-time tracking for your 1040 X Form. These features simplify the document management process, ensuring that you stay organized and your forms are handled efficiently.

-

Can I integrate airSlate SignNow with other software when preparing my 1040 X Form?

Yes, airSlate SignNow supports integrations with popular tools like Google Drive, Dropbox, and various CRM systems. This makes it easier to access your documents and manage your 1040 X Form in conjunction with your existing workflows, increasing overall efficiency.

-

How secure is the data when submitting the 1040 X Form via airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting your 1040 X Form, all data is encrypted both in transit and at rest, ensuring that your sensitive information remains protected throughout the entire signing process.

-

How long does it take to complete and submit the 1040 X Form with airSlate SignNow?

Completing and submitting your 1040 X Form with airSlate SignNow can be done in just minutes. Our user-friendly interface guides you through the necessary steps, allowing you to quickly amend your tax return without unnecessary delays.

Get more for 1040 X Form

Find out other 1040 X Form

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer