Sc1120 Form 2020

What is the Sc1120 Form

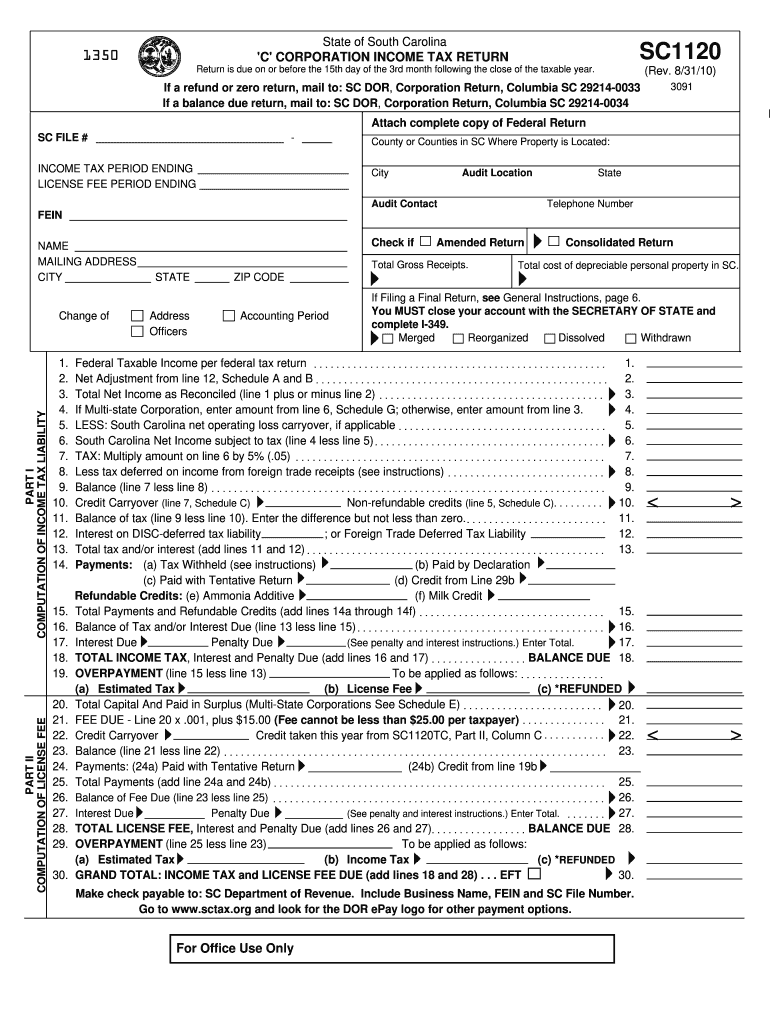

The Sc1120 Form is a tax document used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal income tax liability. It provides a comprehensive overview of a corporation's financial activities over the tax year, ensuring compliance with Internal Revenue Service (IRS) regulations. Completing the Sc1120 Form accurately is crucial, as it impacts the corporation's tax obligations and potential refunds.

How to use the Sc1120 Form

Using the Sc1120 Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, fill out the form by entering your corporation's identifying information, such as its name, address, and Employer Identification Number (EIN). Then, report all income sources and deductions in the appropriate sections. Finally, review the completed form for accuracy before submitting it to the IRS.

Steps to complete the Sc1120 Form

Completing the Sc1120 Form requires careful attention to detail. Follow these steps:

- Gather financial statements, including profit and loss statements and balance sheets.

- Provide the corporation's identifying information, including the name and EIN.

- Report total income, including sales revenue and other income sources.

- List all allowable deductions, such as operating expenses, salaries, and benefits.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Sign and date the form, ensuring that it is filed by the deadline.

Legal use of the Sc1120 Form

The Sc1120 Form is legally binding when completed and submitted in accordance with IRS guidelines. Corporations must ensure that all information provided is accurate and truthful to avoid penalties. Misrepresentation or failure to file can lead to legal consequences, including fines and audits. It is essential for corporations to keep records of all submitted forms and supporting documents for at least three years, as the IRS may request these during an audit.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Sc1120 Form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request a six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the Sc1120 Form, several documents are necessary. These include:

- Financial statements, such as income statements and balance sheets.

- Records of all income sources, including sales and investment income.

- Documentation of all deductions, including payroll records and operating expenses.

- Previous tax returns, if applicable, to ensure consistency in reporting.

Form Submission Methods

The Sc1120 Form can be submitted in various ways, including:

- Electronically through IRS e-file services, which is the fastest method.

- By mail, using the appropriate address based on the corporation's location and whether a payment is included.

- In-person at designated IRS offices, although this method is less common.

Quick guide on how to complete sc1120 2010 form

Complete Sc1120 Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow offers all the tools required to create, modify, and eSign your documents quickly without hindrances. Manage Sc1120 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Sc1120 Form effortlessly

- Find Sc1120 Form and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize important parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), or invite link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in a few clicks from any device you choose. Edit and eSign Sc1120 Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc1120 2010 form

Create this form in 5 minutes!

How to create an eSignature for the sc1120 2010 form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the SC1120 Form and how can airSlate SignNow help?

The SC1120 Form is used for reporting certain tax and financial information. airSlate SignNow streamlines the eSignature process, allowing you to complete the SC1120 Form electronically and securely. With our platform, you can simplify document workflows, reduce turnaround times, and ensure compliance with legal standards.

-

How does airSlate SignNow ensure the security of the SC1120 Form?

airSlate SignNow takes security seriously, providing features like end-to-end encryption and secure cloud storage. When you eSign the SC1120 Form through our platform, you can trust that your sensitive information is protected. Additionally, we comply with HIPAA and GDPR regulations for enhanced data security.

-

Is there a cost associated with using airSlate SignNow for the SC1120 Form?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet diverse business needs. You can choose from various subscription options that provide you with tools to manage the SC1120 Form effectively. Enjoy a cost-effective solution with no hidden fees or surprises.

-

Can I integrate airSlate SignNow with other applications while working on the SC1120 Form?

Absolutely, airSlate SignNow integrates seamlessly with many popular applications. Whether you're using Salesforce, Google Workspace, or Microsoft, you can easily manage and share the SC1120 Form alongside your existing tools. This integration helps streamline workflows and enhances productivity.

-

What features does airSlate SignNow offer for efficiently handling the SC1120 Form?

airSlate SignNow provides features such as customizable templates, automated reminders, and in-depth tracking. These tools specifically facilitate the effective handling of the SC1120 Form and ensure every step in the signing process is accounted for. Our user-friendly interface makes it easy to navigate the document signing journey.

-

How can using airSlate SignNow benefit my business with the SC1120 Form?

Utilizing airSlate SignNow for the SC1120 Form can signNowly enhance operational efficiency. It reduces the time and resources required for manual signatures, mitigates errors, and ensures compliance. By automating the eSigning process, your business can focus more on growth and less on paperwork.

-

Is support available for using airSlate SignNow with the SC1120 Form?

Yes, airSlate SignNow offers robust customer support to assist users with the SC1120 Form. Whether you need help with technical issues, setup, or any questions, our dedicated team is here to help. Access helpful resources and guides to make your experience seamless and productive.

Get more for Sc1120 Form

Find out other Sc1120 Form

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself