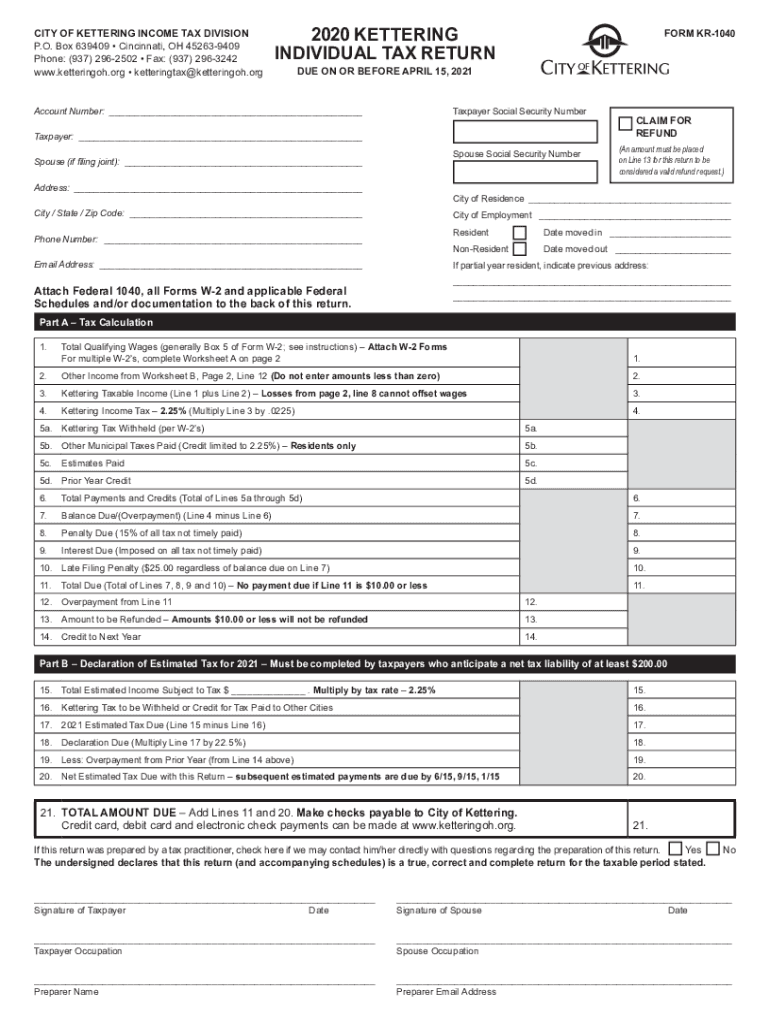

KETTERING INDIVIDUAL TAX RETURN 2020

What is the Kettering Individual Tax Return?

The Kettering Individual Tax Return is a specific form used by residents of Kettering, Ohio, to report their income and calculate their local income tax obligations. This form is essential for individuals who earn income within the city limits and is designed to ensure compliance with local tax laws. It includes information about the taxpayer's income sources, deductions, and credits applicable under Kettering's tax regulations.

How to Obtain the Kettering Individual Tax Return

To obtain the Kettering Individual Tax Return, individuals can visit the City of Kettering's official website or contact the local tax office directly. The form is typically available for download in a PDF format, allowing taxpayers to print it for completion. Additionally, residents may also request a physical copy to be mailed to them by providing their address and contact information to the tax office.

Steps to Complete the Kettering Individual Tax Return

Completing the Kettering Individual Tax Return involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include wages, self-employment income, and any other earnings.

- Calculate applicable deductions and credits based on Kettering's tax regulations.

- Review the form for accuracy before signing and dating it.

Legal Use of the Kettering Individual Tax Return

The Kettering Individual Tax Return is legally binding when properly completed and submitted. It must be signed by the taxpayer, affirming that the information provided is accurate and truthful. Failure to comply with local tax laws can result in penalties or legal repercussions. Therefore, it is crucial to ensure that all information is correct and that the form is submitted by the designated deadlines.

Filing Deadlines / Important Dates

Taxpayers in Kettering should be aware of the important deadlines associated with the Individual Tax Return. Typically, the filing deadline aligns with the federal tax deadline, which is April 15 each year. However, taxpayers should confirm any local extensions or specific dates that may apply. Late submissions may incur penalties, so timely filing is essential for compliance.

Form Submission Methods

The Kettering Individual Tax Return can be submitted through several methods:

- Online: Taxpayers may have the option to submit their forms electronically through the city's tax portal.

- Mail: Completed forms can be mailed to the Kettering tax office at the designated address.

- In-Person: Residents may also choose to submit their forms in person at the local tax office during business hours.

Quick guide on how to complete 2020 kettering individual tax return

Effortlessly prepare KETTERING INDIVIDUAL TAX RETURN on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents quickly and without any delays. Manage KETTERING INDIVIDUAL TAX RETURN on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign KETTERING INDIVIDUAL TAX RETURN effortlessly

- Find KETTERING INDIVIDUAL TAX RETURN and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign KETTERING INDIVIDUAL TAX RETURN to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 kettering individual tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 kettering individual tax return

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What are Kettering Ohio income tax forms?

Kettering Ohio income tax forms are official documents required by the city for filing taxes based on earned income within its jurisdiction. These forms facilitate the accurate reporting of income and help determine tax liabilities, ensuring compliance with local regulations. It's essential for residents and businesses to complete these forms correctly to avoid any penalties.

-

How can airSlate SignNow help with Kettering Ohio income tax forms?

airSlate SignNow provides an efficient platform to easily send, receive, and eSign Kettering Ohio income tax forms. With its user-friendly interface, you can streamline the process of completing and submitting these documents. This simplifies tax compliance for both individuals and businesses in Kettering.

-

Are there any costs associated with using airSlate SignNow for Kettering Ohio income tax forms?

Using airSlate SignNow for Kettering Ohio income tax forms comes at an affordable price, with various plans suited for different needs. Whether you're an individual or a business, you can find a plan that allows for seamless eSigning and document management. This cost-effective solution helps save time and resources during tax season.

-

What features does airSlate SignNow offer for Kettering Ohio income tax forms?

airSlate SignNow offers a range of features specifically designed for managing Kettering Ohio income tax forms efficiently. You can create templates, add fields for signatures, and securely store submitted forms all in one place. These features ensure that users can easily navigate tax documentation without hassle.

-

Can I integrate airSlate SignNow with other software for Kettering Ohio income tax forms?

Yes, airSlate SignNow allows for integration with various third-party applications that can facilitate the management of Kettering Ohio income tax forms. This interoperability enhances your existing workflows by connecting to accounting software, CRMs, and more. Such integrations streamline data transfer and simplify the overall process.

-

Is there a mobile app for managing Kettering Ohio income tax forms?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage Kettering Ohio income tax forms on the go. This feature ensures that you can eSign and share documents from anywhere, making it easy to stay compliant while being mobile. It's a great advantage for busy professionals who need flexibility.

-

What are the benefits of using airSlate SignNow for Kettering Ohio income tax forms?

The primary benefits of using airSlate SignNow for Kettering Ohio income tax forms include improved efficiency, enhanced security, and greater convenience. The platform reduces the chances of errors typically associated with paper forms and allows for faster processing times. With airSlate SignNow, managing your tax forms becomes a simplified and stress-free experience.

Get more for KETTERING INDIVIDUAL TAX RETURN

- Kat snips form

- Play observation scale form

- Standard bank confirmation form

- Harvard university application form pdf 20127903

- Mod 4 4 6 geu a c amap palermo form

- Worksheet 2 2 to be or not to be proportional form

- Declaration of english language competency requirements form

- Statement of property details and exclusive buyers agency form

Find out other KETTERING INDIVIDUAL TAX RETURN

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed