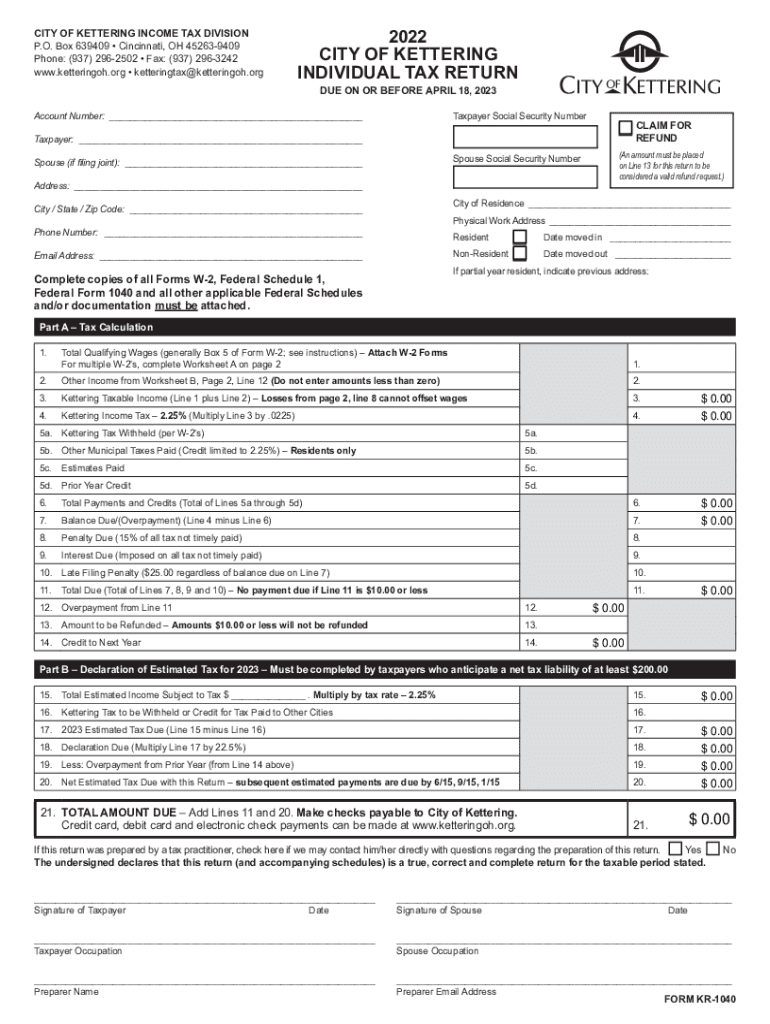

Business Tax Forms Kettering 2022

What is the Business Tax Forms Kettering

The Business Tax Forms Kettering refer to a set of documents required for businesses operating in Kettering, Ohio, to report their income, expenses, and other financial information to the Internal Revenue Service (IRS) and state tax authorities. These forms ensure compliance with tax regulations and help businesses calculate their tax liabilities accurately. Common forms include the IRS Form 1120 for corporations, Form 1065 for partnerships, and Form 1040 Schedule C for sole proprietorships. Each form serves a specific purpose and is tailored to different business structures.

Steps to Complete the Business Tax Forms Kettering

Completing the Business Tax Forms Kettering involves several key steps to ensure accuracy and compliance:

- Gather financial records: Collect all necessary documents, including income statements, expense receipts, and previous tax returns.

- Select the appropriate form: Determine which tax form is applicable based on your business structure.

- Fill out the form: Provide accurate information regarding income, deductions, and credits. Be sure to follow the instructions specific to each form.

- Review for accuracy: Double-check all entries to minimize errors that could lead to penalties or audits.

- Submit the form: Choose your preferred submission method—online, by mail, or in person—based on the requirements for your specific form.

Legal Use of the Business Tax Forms Kettering

The legal use of the Business Tax Forms Kettering is crucial for ensuring that businesses meet federal and state tax obligations. To be considered legally binding, these forms must be completed accurately and submitted by the designated deadlines. Compliance with IRS regulations, as well as state-specific laws, is essential to avoid penalties. Additionally, electronic submissions must adhere to eSignature laws, ensuring that signatures are valid and recognized by legal authorities.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting Business Tax Forms Kettering. These guidelines include instructions on eligibility, required documentation, and specific deadlines for filing. It is important for businesses to familiarize themselves with these guidelines to ensure compliance and avoid potential issues with the IRS. Regular updates are published by the IRS, so staying informed about changes in tax laws and requirements is essential for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Business Tax Forms Kettering vary depending on the type of business entity and the specific form being submitted. Generally, corporations must file their tax returns by the 15th day of the fourth month following the end of their fiscal year, while partnerships and sole proprietorships have different deadlines. It is crucial for businesses to keep track of these important dates to avoid late fees and penalties. Marking your calendar with these deadlines can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

Businesses in Kettering have several options for submitting their Business Tax Forms. These methods include:

- Online Submission: Many forms can be filed electronically through the IRS website or approved e-filing software, which often expedites processing times.

- Mail Submission: Forms can be printed and mailed to the appropriate IRS address. It is important to use certified mail for tracking purposes.

- In-Person Submission: Some local tax offices may accept forms submitted in person, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete business tax forms kettering

Effortlessly prepare Business Tax Forms Kettering on any device

Web-based document management has surged in popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your papers quickly without delays. Handle Business Tax Forms Kettering on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Business Tax Forms Kettering without hassle

- Locate Business Tax Forms Kettering and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal authority as a conventional ink signature.

- Verify all details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign Business Tax Forms Kettering and ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax forms kettering

Create this form in 5 minutes!

People also ask

-

What are Business Tax Forms Kettering, and why are they important?

Business Tax Forms Kettering are essential documents required for tax filings that ensure compliance with federal and state regulations. These forms help businesses report their earnings, expenses, and tax contributions accurately. Using the right forms is crucial for avoiding penalties and optimizing tax benefits.

-

How can airSlate SignNow help with Business Tax Forms Kettering?

airSlate SignNow simplifies the process of completing and signing Business Tax Forms Kettering by providing a user-friendly platform for eSigning and document management. With our solution, businesses can easily fill out their forms, send them for signatures, and store them securely. This streamlines the tax preparation process and saves valuable time.

-

What pricing options does airSlate SignNow offer for Business Tax Forms Kettering?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs for managing Business Tax Forms Kettering. Our plans are designed to be cost-effective while providing comprehensive features such as unlimited document signing and templates. You can choose a plan that best fits your budget and requirements.

-

Are there any specific features for managing Business Tax Forms Kettering?

Yes, airSlate SignNow includes several features tailored for managing Business Tax Forms Kettering. These features include customizable templates, automated reminders, and secure cloud storage. You can also track the status of your forms and access them from anywhere, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other software for Business Tax Forms Kettering?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and ERP software, enhancing your workflow for Business Tax Forms Kettering. This means you can export data directly into your preferred applications, saving time and reducing the chance of errors during the tax preparation process.

-

Is airSlate SignNow secure for handling Business Tax Forms Kettering?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your Business Tax Forms Kettering and sensitive data. Our platform is designed to ensure that all documents are stored safely and accessed only by authorized users.

-

How does airSlate SignNow benefit businesses dealing with Business Tax Forms Kettering?

Businesses can greatly benefit from using airSlate SignNow for Business Tax Forms Kettering by increasing efficiency and reducing administrative burdens. Our platform allows for faster processing, secure eSigning, and easy access to all forms in one centralized location. This means less time spent on paperwork and more time focusing on growing your business.

Get more for Business Tax Forms Kettering

- Lease subordination agreement new york form

- Apartment rules and regulations new york form

- Cancellation lease 497321535 form

- Amendment of residential lease new york form

- Payment rent form 497321537

- Commercial lease assignment from tenant to new tenant new york form

- Tenant consent to background and reference check new york form

- Residential lease or rental agreement for month to month new york form

Find out other Business Tax Forms Kettering

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free