KETTERING INDIVIDUAL TAX RETURN 2018

What is the KETTERING INDIVIDUAL TAX RETURN

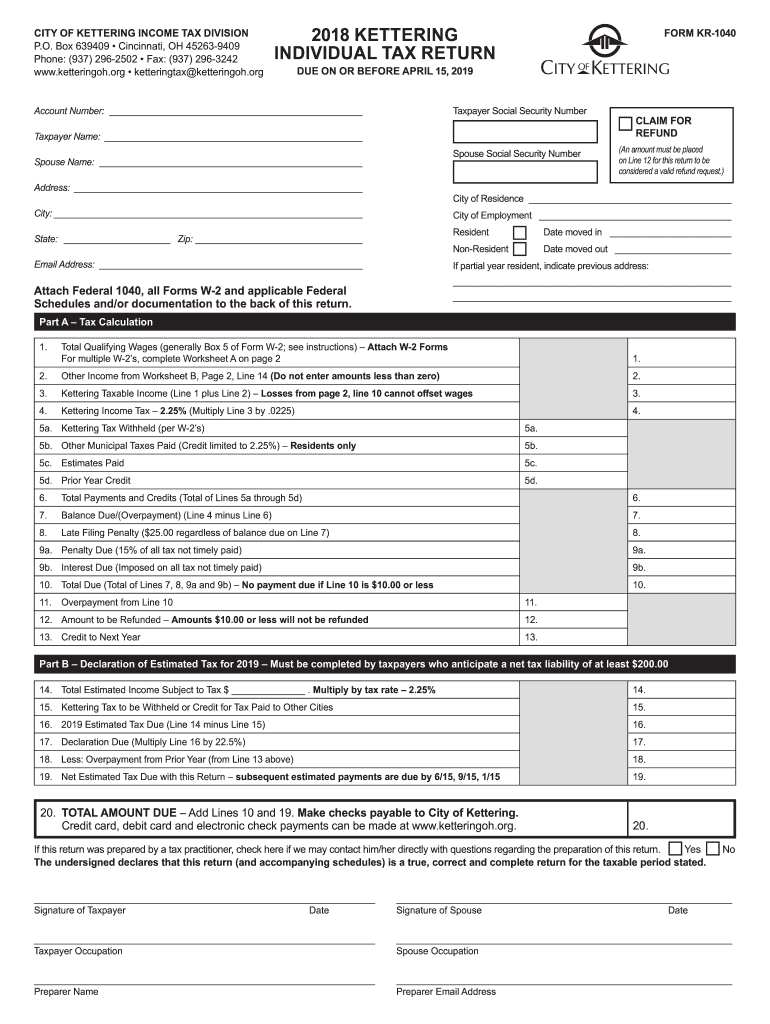

The Kettering Individual Tax Return is a specific tax form used by residents of Kettering, Ohio, to report their income and calculate their tax liability. This form is essential for individuals to fulfill their tax obligations to the local government. It includes various sections where taxpayers report income, deductions, and credits applicable to their financial situation. Understanding this form is crucial for accurate tax filing and compliance with local tax laws.

Steps to complete the KETTERING INDIVIDUAL TAX RETURN

Completing the Kettering Individual Tax Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as W-2 forms, 1099 forms, and records of any deductions or credits. Next, fill out the form carefully, ensuring that all information is accurate and complete. Pay particular attention to sections regarding income sources and applicable deductions. After completing the form, review it thoroughly for any errors before submission. Finally, submit the form either electronically or by mail, depending on your preference and the options available.

Legal use of the KETTERING INDIVIDUAL TAX RETURN

The Kettering Individual Tax Return is legally binding once it is completed and signed by the taxpayer. To ensure its validity, it must comply with local tax regulations and be submitted by the designated deadline. Electronic signatures are accepted, provided they meet the requirements set forth by relevant laws, including the ESIGN Act and UETA. This legal framework ensures that electronically signed documents are treated the same as traditional paper forms, provided that proper security measures are in place.

Required Documents

To successfully complete the Kettering Individual Tax Return, taxpayers need to gather specific documents. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Receipts for deductible expenses

- Documentation for any tax credits being claimed

Having these documents organized will facilitate a smoother filing process and help ensure that all income and deductions are accurately reported.

Form Submission Methods

The Kettering Individual Tax Return can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form electronically using secure e-filing systems, which often provide immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate local tax office. For those who prefer in-person interactions, submitting the form directly at designated tax offices is also an option. Each method has its own timeline for processing, so it's important to choose one that aligns with your filing needs.

Filing Deadlines / Important Dates

Filing deadlines for the Kettering Individual Tax Return are crucial for compliance with local tax laws. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, taxpayers should verify specific local deadlines, as they may vary. It is advisable to file early to avoid last-minute complications and to ensure that all necessary documentation is submitted on time. Keeping track of these important dates can help prevent penalties and interest on late filings.

Quick guide on how to complete 2018 kettering individual tax return

Complete KETTERING INDIVIDUAL TAX RETURN seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage KETTERING INDIVIDUAL TAX RETURN on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign KETTERING INDIVIDUAL TAX RETURN effortlessly

- Obtain KETTERING INDIVIDUAL TAX RETURN and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or mask sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign KETTERING INDIVIDUAL TAX RETURN and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 kettering individual tax return

Create this form in 5 minutes!

How to create an eSignature for the 2018 kettering individual tax return

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the process for submitting a KETTERING INDIVIDUAL TAX RETURN using airSlate SignNow?

The process for submitting a KETTERING INDIVIDUAL TAX RETURN with airSlate SignNow is straightforward. First, you upload your tax documents to our platform. Then, you can easily eSign the forms and send them to the necessary authorities securely.

-

How much does it cost to file a KETTERING INDIVIDUAL TAX RETURN with airSlate SignNow?

Pricing for filing a KETTERING INDIVIDUAL TAX RETURN with airSlate SignNow is competitive and designed to be cost-effective. We offer various subscription plans that cater to different business needs. You'll find that our pricing ensures you get excellent value for all the features provided.

-

What features does airSlate SignNow offer for KETTERING INDIVIDUAL TAX RETURNS?

airSlate SignNow offers several features tailored for KETTERING INDIVIDUAL TAX RETURNS, including customizable templates, secure eSignature capabilities, and document tracking. These features enhance efficiency and ensure compliance during the filing process. Plus, our user-friendly interface makes it easy to manage your tax documents.

-

Are KETTERING INDIVIDUAL TAX RETURNS secure when using airSlate SignNow?

Yes, KETTERING INDIVIDUAL TAX RETURNS are secure when filed through airSlate SignNow. We employ advanced encryption and security protocols to protect your sensitive data. Trust us to ensure that your tax documents remain confidential throughout the entire process.

-

Can I integrate airSlate SignNow with other platforms for my KETTERING INDIVIDUAL TAX RETURN?

Absolutely! airSlate SignNow integrates seamlessly with various applications to streamline your KETTERING INDIVIDUAL TAX RETURN process. Whether you use accounting software or collaboration tools, our integration options enhance your workflow and improve overall efficiency.

-

How can airSlate SignNow help me save time on my KETTERING INDIVIDUAL TAX RETURN?

airSlate SignNow helps save time on your KETTERING INDIVIDUAL TAX RETURN by simplifying the document preparation and signing process. Our platform allows for quick uploads, instant eSigning, and automated workflows, reducing the minutes spent on each task. This means you can focus more on personal activities rather than paperwork.

-

What support is available for users filing a KETTERING INDIVIDUAL TAX RETURN?

Users filing a KETTERING INDIVIDUAL TAX RETURN can expect robust support from airSlate SignNow. Our dedicated customer service team is ready to assist via chat, email, or phone. We also offer extensive resources, including guided tutorials and FAQs, to help you navigate the process successfully.

Get more for KETTERING INDIVIDUAL TAX RETURN

Find out other KETTERING INDIVIDUAL TAX RETURN

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer