Kettering Ohio Tax Form 2019

What is the Kettering Ohio Tax Form

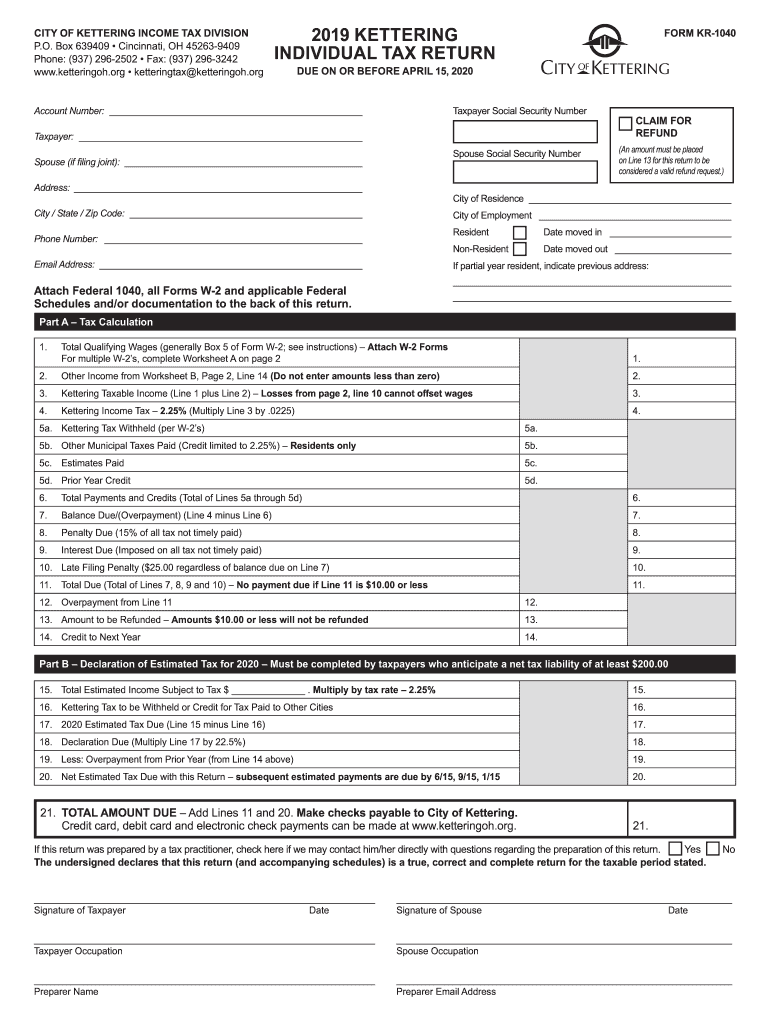

The Kettering Ohio tax form is a specific document used by residents and businesses in Kettering, Ohio, to report their income and calculate their local tax obligations. This form is essential for ensuring compliance with the city’s tax regulations. It typically includes sections for reporting various types of income, deductions, and credits applicable to Kettering residents. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Kettering Ohio Tax Form

Using the Kettering Ohio tax form involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, carefully fill out the form, ensuring that all income is reported accurately. Pay attention to any specific instructions provided on the form to ensure compliance with local tax laws. Once completed, the form must be submitted by the designated deadline to avoid late fees or penalties.

Steps to complete the Kettering Ohio Tax Form

Completing the Kettering Ohio tax form requires a systematic approach:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Report all sources of income, ensuring that you include wages, interest, and any other taxable income.

- Apply any eligible deductions or credits as outlined in the form instructions.

- Review the completed form for accuracy before submission.

Legal use of the Kettering Ohio Tax Form

The Kettering Ohio tax form is legally binding when filled out and submitted according to local regulations. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be signed, either physically or electronically, to validate its authenticity. Understanding the legal implications of this form helps residents and businesses maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Kettering Ohio tax form are critical for compliance. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. It is essential to stay informed about any changes to deadlines or extensions that may be announced by the city. Missing the deadline can result in penalties, so planning ahead is advisable.

Form Submission Methods (Online / Mail / In-Person)

The Kettering Ohio tax form can be submitted through various methods to accommodate different preferences. Residents can file online using the city’s designated tax portal, which offers a convenient and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate tax office or delivered in person. Each method has its advantages, so it is important to choose the one that best fits your needs.

Quick guide on how to complete kettering ohio tax form 2019

Complete Kettering Ohio Tax Form effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without any holdups. Manage Kettering Ohio Tax Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Kettering Ohio Tax Form with ease

- Obtain Kettering Ohio Tax Form and click Get Form to begin.

- Use the features we provide to fill out your document.

- Emphasize crucial sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you choose. Edit and electronically sign Kettering Ohio Tax Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kettering ohio tax form 2019

Create this form in 5 minutes!

How to create an eSignature for the kettering ohio tax form 2019

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Kettering Ohio tax form 2019?

The Kettering Ohio tax form 2019 is a specific document required for filing municipal taxes in Kettering, Ohio for that tax year. It collects information regarding your income, deductions, and any taxes owed to the city. It's important to complete this form accurately to avoid any penalties.

-

How can I access the Kettering Ohio tax form 2019?

You can access the Kettering Ohio tax form 2019 by visiting the official Kettering city website or through local tax preparation services. Many tax software solutions also provide the necessary forms for download or e-filing. Make sure to use the official form to ensure compliance with local tax regulations.

-

What are the key features of airSlate SignNow for filing the Kettering Ohio tax form 2019?

airSlate SignNow offers robust features that simplify the process of filling out and eSigning the Kettering Ohio tax form 2019. Its user-friendly interface allows for easy document creation and sharing. Additionally, built-in compliance and security features ensure that your sensitive tax information is protected.

-

Is there a cost associated with using airSlate SignNow for the Kettering Ohio tax form 2019?

Yes, using airSlate SignNow involves a subscription fee, but it is a cost-effective solution compared to traditional methods. Various pricing plans are available that cater to different business needs. This makes it a worthwhile investment for efficiently managing the Kettering Ohio tax form 2019 and other essential documents.

-

Can airSlate SignNow integrate with accounting software for the Kettering Ohio tax form 2019?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to handle the Kettering Ohio tax form 2019 alongside your financial documents. This seamless integration helps to streamline filing and ensures that all financial records are up-to-date.

-

What benefits does airSlate SignNow provide when using the Kettering Ohio tax form 2019?

Using airSlate SignNow provides several benefits when dealing with the Kettering Ohio tax form 2019. It enhances efficiency through easy document sharing and electronic signatures, reduces the potential for errors, and provides a secure method to submit your tax forms. This ensures that your tax filings are timely and compliant.

-

How does airSlate SignNow ensure the security of my Kettering Ohio tax form 2019?

airSlate SignNow employs advanced security measures, such as encryption and two-factor authentication, to protect your Kettering Ohio tax form 2019. This ensures that all your sensitive information remains confidential and secure from unauthorized access. You can submit your tax forms with peace of mind knowing they’re protected.

Get more for Kettering Ohio Tax Form

Find out other Kettering Ohio Tax Form

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later