Kr 1040 Forms 2006

What are Kettering OH Tax Forms?

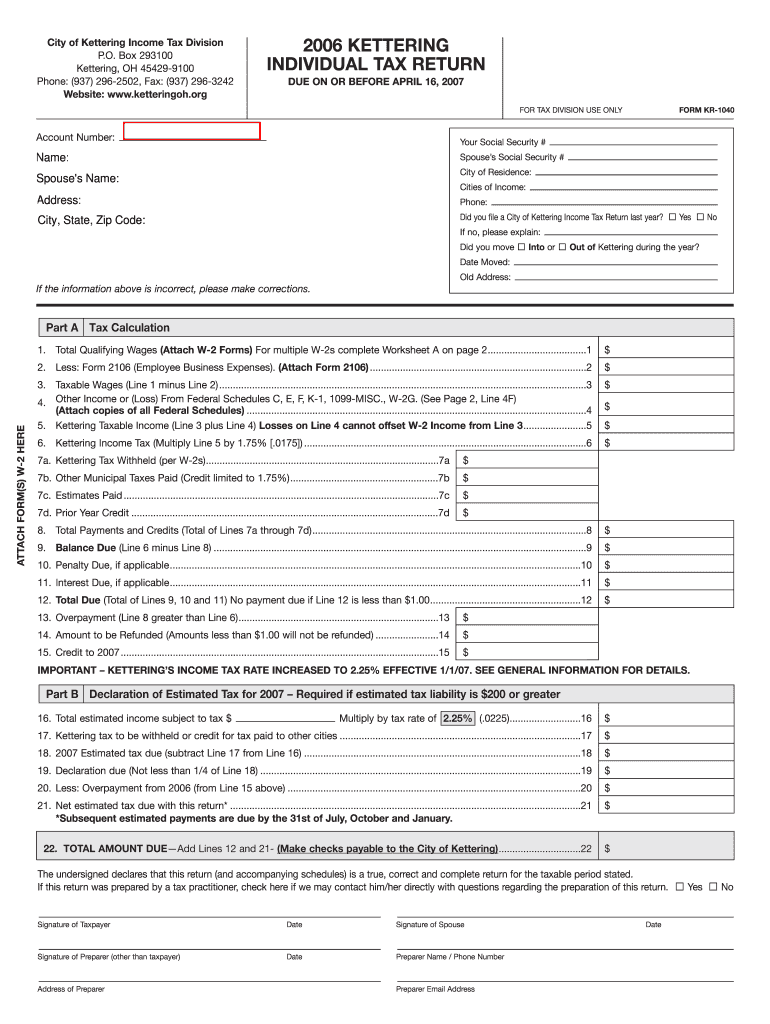

Kettering OH tax forms are essential documents used by residents and businesses in Kettering, Ohio, to report income, claim deductions, and fulfill their tax obligations to the state and federal government. One of the most common forms is the KR-1040, which is specifically designed for individual income tax reporting in Ohio. This form allows taxpayers to detail their income, calculate their tax liability, and determine any refunds or payments due. Understanding the purpose and requirements of these forms is crucial for compliance and financial planning.

How to Obtain Kettering OH Tax Forms

Kettering OH tax forms, including the KR-1040, can be obtained through several channels. The Ohio Department of Taxation provides downloadable versions of these forms on its official website. Additionally, local tax offices in Kettering may offer physical copies for residents who prefer in-person assistance. It is also common for tax preparation services to provide these forms as part of their service offerings, ensuring that taxpayers have access to the necessary documentation for filing.

Steps to Complete Kettering OH Tax Forms

Completing Kettering OH tax forms, such as the KR-1040, involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section accurately, ensuring that names and addresses are correct.

- Report all sources of income, including wages, dividends, and interest.

- Claim deductions and credits applicable to your situation, which may reduce your taxable income.

- Calculate the total tax owed or refund due using the provided tables and instructions.

- Review the completed form for accuracy before submission.

Legal Use of Kettering OH Tax Forms

The legal use of Kettering OH tax forms, including the KR-1040, is governed by both state and federal tax laws. These forms must be completed truthfully and submitted by the designated deadlines to avoid penalties. Electronic filing is permitted and often encouraged, as it can streamline the process and provide immediate confirmation of receipt. Compliance with these legal requirements ensures that taxpayers fulfill their obligations and avoid issues with tax authorities.

Filing Deadlines and Important Dates

Filing deadlines for Kettering OH tax forms, particularly the KR-1040, typically align with federal tax deadlines. Generally, individual income tax returns are due by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to deadlines and to plan accordingly to ensure timely submission of their forms.

Form Submission Methods

Kettering OH tax forms can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file electronically using approved software, which can simplify the process and provide instant confirmation. Alternatively, forms can be mailed to the appropriate tax authority, or submitted in person at local tax offices. Each method has its own set of guidelines, so it is important to follow the instructions provided with the forms to ensure successful submission.

Quick guide on how to complete kr 1040 forms

Manage Kr 1040 Forms effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the essentials to create, edit, and electronically sign your documents swiftly without delays. Handle Kr 1040 Forms across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Kr 1040 Forms stress-free

- Obtain Kr 1040 Forms and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Decide how you want to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and electronically sign Kr 1040 Forms and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kr 1040 forms

Create this form in 5 minutes!

How to create an eSignature for the kr 1040 forms

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What are Kettering OH tax forms?

Kettering OH tax forms refer to the specific documents required for filing taxes in Kettering, Ohio. These forms include personal income tax returns, business tax forms, and other related documents. Using airSlate SignNow, you can easily access, fill out, and eSign these Kettering OH tax forms efficiently.

-

How can airSlate SignNow help me with Kettering OH tax forms?

airSlate SignNow provides a streamlined solution for preparing and submitting Kettering OH tax forms. Our platform allows you to create, modify, and eSign all necessary tax documents with ease. This saves time and ensures that your forms are completed accurately and submitted on time.

-

What is the pricing structure for airSlate SignNow related to Kettering OH tax forms?

airSlate SignNow offers competitive pricing plans tailored to meet your business needs, including those related to Kettering OH tax forms. Our plans are designed to be cost-effective, ensuring access to features that simplify document management and eSigning. You can choose a plan that fits your budget, providing value as you manage your tax forms.

-

Are there any integrations with airSlate SignNow for Kettering OH tax forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software commonly used for handling Kettering OH tax forms. This connectivity allows you to pull in data automatically and streamline your workflow. As a result, you can efficiently manage your tax documents without the need for manual data entry.

-

What features does airSlate SignNow offer for Kettering OH tax forms?

airSlate SignNow includes several key features that are beneficial for managing Kettering OH tax forms, such as customizable templates, secure eSigning, and cloud storage. These tools enable users to create forms quickly, sign documents electronically, and store them safely. This functionality enhances the overall efficiency of your tax preparation process.

-

Is airSlate SignNow secure for handling Kettering OH tax forms?

Absolutely! airSlate SignNow prioritizes your security and compliance when handling Kettering OH tax forms. We utilize high-level encryption, secure servers, and established privacy protocols to ensure your data remains confidential and protected throughout the eSigning process.

-

Can I access my Kettering OH tax forms on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access your Kettering OH tax forms on any device. You can fill out, sign, and send documents from your smartphone or tablet, offering the flexibility to manage your taxes wherever you are. This feature ensures you never miss a deadline, even on the go.

Get more for Kr 1040 Forms

Find out other Kr 1040 Forms

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement