Duplicate Wage and Tax Statement 2021-2026

What is the Duplicate Wage And Tax Statement

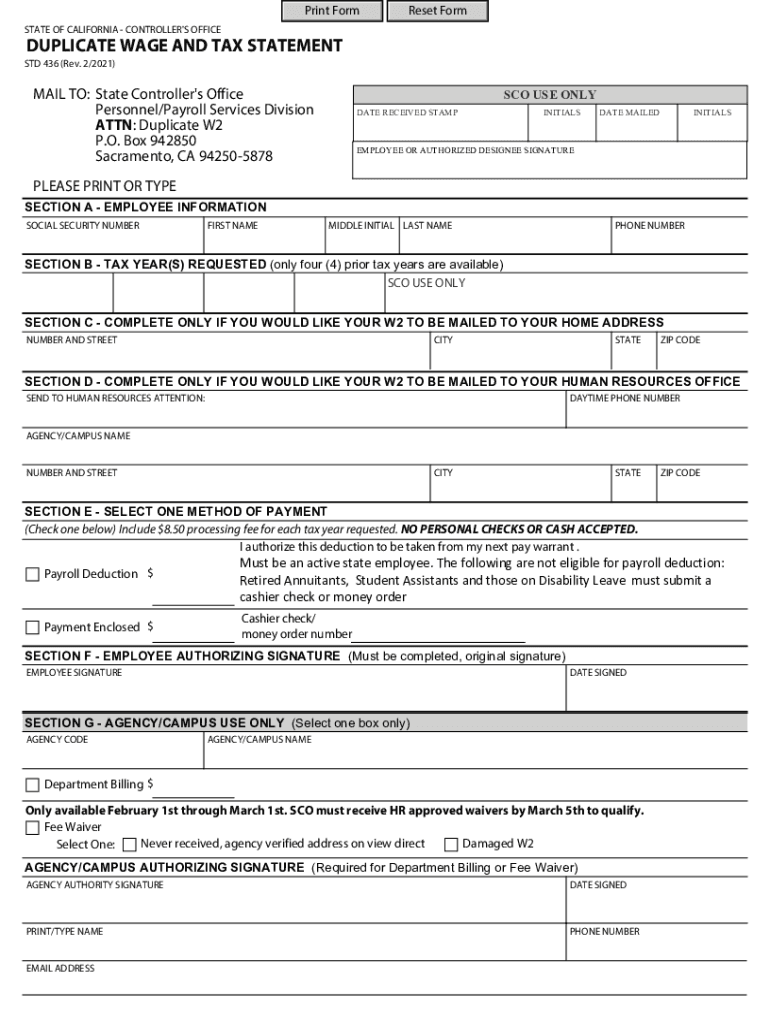

The Duplicate Wage And Tax Statement, often referred to as the standard form 436, is a document that provides a summary of an employee's earnings and the taxes withheld from those earnings during a specific tax year. This form is essential for both employees and employers, as it serves as a record for tax filing purposes. The information contained in the form includes wages, tips, and other compensation, as well as federal income tax withheld, Social Security tax, and Medicare tax. Understanding this form is crucial for ensuring accurate tax reporting and compliance.

How to use the Duplicate Wage And Tax Statement

To effectively use the Duplicate Wage And Tax Statement, individuals should first ensure that all information is accurate and complete. Employees can use the details from this form when preparing their tax returns, as it provides a comprehensive overview of their taxable income for the year. Employers may also use this form to verify employee earnings and tax withholdings. It is important to keep this document secure, as it contains sensitive personal information that could be misused if it falls into the wrong hands.

Steps to complete the Duplicate Wage And Tax Statement

Completing the Duplicate Wage And Tax Statement involves several key steps. First, gather all necessary information, including the employee's name, Social Security number, and total earnings for the year. Next, accurately fill in the amounts for federal income tax withheld, Social Security tax, and Medicare tax. Once the form is completed, review it for any errors or omissions. Finally, provide copies to the employee and retain a copy for your records. Ensuring accuracy at each step is essential to avoid complications during tax filing.

Legal use of the Duplicate Wage And Tax Statement

The legal use of the Duplicate Wage And Tax Statement is governed by federal and state tax regulations. This form must be issued to employees by their employers to ensure compliance with tax laws. It serves as an official record of earnings and tax withholdings, which can be requested by the Internal Revenue Service (IRS) during audits or investigations. Properly maintaining and distributing this form helps both employers and employees fulfill their legal obligations regarding tax reporting.

Key elements of the Duplicate Wage And Tax Statement

Key elements of the Duplicate Wage And Tax Statement include the employee's personal information, such as name and Social Security number, as well as the employer's details. The form outlines total wages earned, tips received, and other forms of compensation. Additionally, it specifies the total federal income tax withheld, Social Security tax, and Medicare tax. Each of these components is crucial for accurate tax reporting and provides a clear financial picture for both parties involved.

Filing Deadlines / Important Dates

Filing deadlines for the Duplicate Wage And Tax Statement are typically aligned with the tax filing season. Employers are required to provide this form to employees by January 31 of the following year. Employees must then use the information to file their tax returns by the April 15 deadline. It is essential for both employers and employees to be aware of these dates to ensure compliance and avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Duplicate Wage And Tax Statement can be submitted through various methods, depending on the preferences of the employer and the requirements of the employee. Employers may choose to provide the form electronically, allowing for easier access and storage. Alternatively, they can mail physical copies to employees or deliver them in person. Each method has its advantages, and employers should select the one that best suits their operational needs while ensuring that employees receive their forms promptly.

Quick guide on how to complete duplicate wage and tax statement 552179712

Complete Duplicate Wage And Tax Statement seamlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Duplicate Wage And Tax Statement on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Duplicate Wage And Tax Statement effortlessly

- Find Duplicate Wage And Tax Statement and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Duplicate Wage And Tax Statement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct duplicate wage and tax statement 552179712

Create this form in 5 minutes!

How to create an eSignature for the duplicate wage and tax statement 552179712

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the std 436 form and how do I use it?

The std 436 form is a standardized document used for a variety of purposes, including official reporting and record-keeping. To utilize it effectively, users can fill it out digitally and eSign using airSlate SignNow's platform, enabling seamless submission and documentation.

-

How does airSlate SignNow support the completion of the std 436 form?

airSlate SignNow simplifies the completion of the std 436 form by allowing users to fill out the fields directly within the application. The platform streamlines editing, sharing, and eSigning processes, ensuring that your documents are completed efficiently.

-

Is there a cost associated with using airSlate SignNow for the std 436 form?

Yes, airSlate SignNow offers a variety of pricing plans for individuals and businesses looking to utilize the std 436 form. The plans are designed to be cost-effective while providing robust features for document management and eSigning.

-

What features does airSlate SignNow offer for managing the std 436 form?

With airSlate SignNow, users can take advantage of features such as customizable templates, secure storage, and automated workflows specifically for the std 436 form. This enhances efficiency, reduces document processing time, and ensures compliance.

-

Can I integrate airSlate SignNow with other applications to manage the std 436 form?

Yes, airSlate SignNow integrates seamlessly with a variety of apps, allowing you to manage the std 436 form within your existing workflow. Popular integrations include Google Drive, Salesforce, and Microsoft Office, enhancing your document management capabilities.

-

What are the benefits of using airSlate SignNow for the std 436 form?

Using airSlate SignNow for the std 436 form offers numerous benefits, including time savings, enhanced security, and improved document tracking. The platform enables easy collaboration and ensures that your forms are accurately completed and quickly processed.

-

How secure is my information when using airSlate SignNow for the std 436 form?

Your information is highly secure when using airSlate SignNow for the std 436 form, as the platform employs top-level encryption and security protocols. This ensures that sensitive data remains protected throughout the entire signing and document management process.

Get more for Duplicate Wage And Tax Statement

Find out other Duplicate Wage And Tax Statement

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free