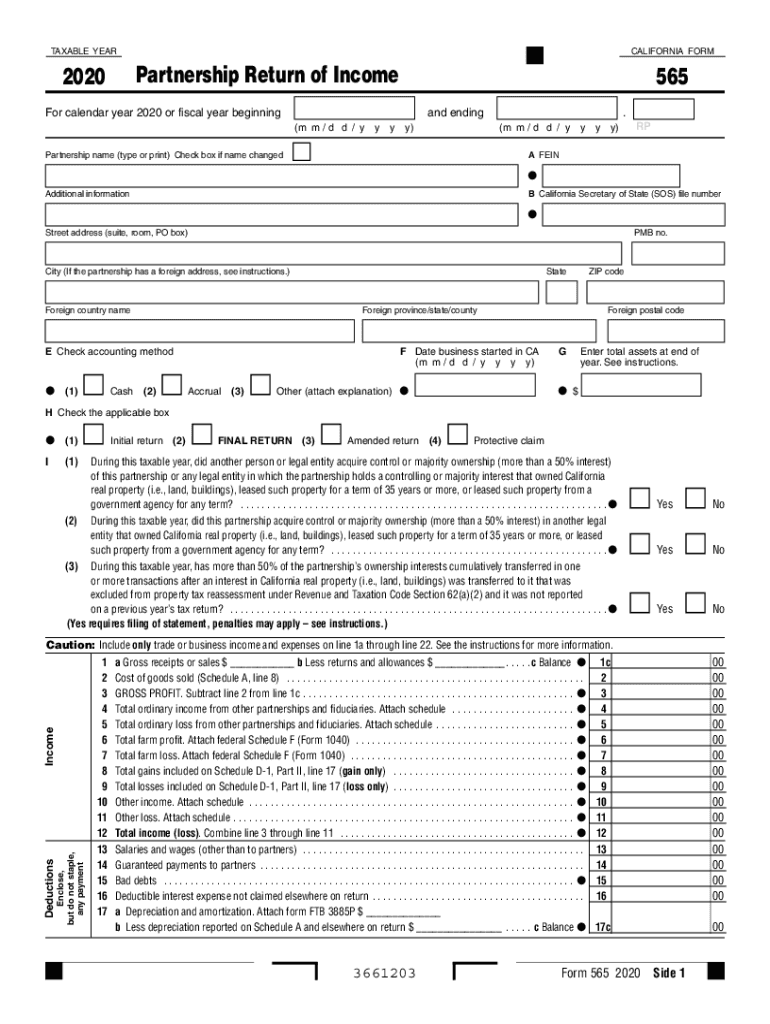

California Form 565 Partnership Return of Income California Form 565 Partnership Return of Income 2020

What is the California Form 565 Partnership Return Of Income

The California Form 565 is a tax document used by partnerships to report income, deductions, and other tax-related information to the California Franchise Tax Board. This form is essential for partnerships operating within California, as it ensures compliance with state tax laws. The form captures key financial details about the partnership, including the income earned, losses incurred, and distributions made to partners. Completing this form accurately is crucial for the partnership’s tax obligations and for the partners’ individual tax filings.

Steps to complete the California Form 565 Partnership Return Of Income

Completing the California Form 565 involves several important steps. First, gather all necessary financial documents, including income statements, expense reports, and partner information. Next, fill out the form by entering the partnership's total income and deductions. Ensure that you provide accurate information for each partner, including their share of income and losses. After completing the form, review it for any errors or omissions. Finally, submit the form to the California Franchise Tax Board by the designated deadline, either electronically or via mail.

Legal use of the California Form 565 Partnership Return Of Income

The California Form 565 is legally binding when completed and submitted according to state regulations. It must be signed by an authorized partner or representative of the partnership. The form serves as an official declaration of the partnership's financial activities for the tax year. Compliance with the filing requirements ensures that the partnership meets its legal obligations and avoids potential penalties. It is important to keep copies of the filed form and any supporting documentation for future reference.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the California Form 565. Typically, the form is due on the 15th day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is essential to be aware of these deadlines to avoid late fees and penalties.

Required Documents

To complete the California Form 565, certain documents are required. These include financial statements that detail the partnership's income and expenses, partner agreements outlining each partner's share of profits and losses, and any prior year tax returns if applicable. Additionally, documentation supporting deductions claimed on the form, such as receipts and invoices, should be organized and ready for submission. Having these documents prepared in advance can streamline the filing process.

Penalties for Non-Compliance

Failure to file the California Form 565 by the deadline can result in significant penalties. The California Franchise Tax Board imposes late filing fees, which can accumulate over time. Additionally, if the form is filed inaccurately or with incomplete information, the partnership may face further penalties. It is crucial for partnerships to ensure timely and accurate filing to avoid these financial repercussions and maintain compliance with state tax laws.

Who Issues the Form

The California Form 565 is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California’s income tax laws, including the collection of taxes from partnerships and other business entities. The FTB provides guidelines and resources to assist partnerships in completing the form accurately. Understanding the role of the FTB in the filing process can help partnerships navigate their tax obligations effectively.

Quick guide on how to complete 2020 california form 565 partnership return of income 2020 california form 565 partnership return of income

Complete California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents since you can obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income without hassle

- Obtain California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income to ensure seamless communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 california form 565 partnership return of income 2020 california form 565 partnership return of income

Create this form in 5 minutes!

How to create an eSignature for the 2020 california form 565 partnership return of income 2020 california form 565 partnership return of income

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What are the CA Form 565 instructions for 2021?

The CA Form 565 instructions for 2021 provide guidance on filing the organization's income, deductions, credits, and other important information required by the California Franchise Tax Board. Make sure to follow these instructions closely to ensure proper compliance and avoid penalties.

-

How can airSlate SignNow help with filling out the CA Form 565 for 2021?

airSlate SignNow facilitates the easy management and eSigning of documents, including the CA Form 565 for 2021. By using our platform, users can streamline their submission process, ensuring an efficient and organized approach to handling tax-related documents.

-

Is there a cost associated with using airSlate SignNow for CA Form 565 instructions in 2021?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans provide access to tools that help users effectively manage their CA Form 565 instructions for 2021 without breaking the bank.

-

Are there any features specifically designed for tax document management in airSlate SignNow?

Absolutely! airSlate SignNow includes features such as templates, automated reminders, and secure storage that specifically aid in managing tax documents like the CA Form 565 instructions for 2021. These tools help optimize workflow and keep users on track with their deadlines.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software. This capability allows users to seamlessly incorporate the CA Form 565 instructions for 2021 into their existing workflows, enhancing efficiency during tax season.

-

What benefits does airSlate SignNow provide for businesses dealing with CA Form 565 instructions in 2021?

Businesses benefit from airSlate SignNow's user-friendly interface, which simplifies the process of managing and signing the CA Form 565 instructions for 2021. Additionally, the platform ensures that documents are securely stored and easily accessible whenever needed.

-

How does airSlate SignNow ensure compliance with CA Form 565 instructions for 2021?

airSlate SignNow is committed to compliance, providing users with up-to-date information and templates that reflect the CA Form 565 instructions for 2021. This ensures that all electronic signatures and document handling meet the necessary legal standards.

Get more for California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income

Find out other California Form 565 Partnership Return Of Income California Form 565 Partnership Return Of Income

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure