Form 565 Franchise Tax Board CA Gov 2018

What is the Form 565 Franchise Tax Board CA gov

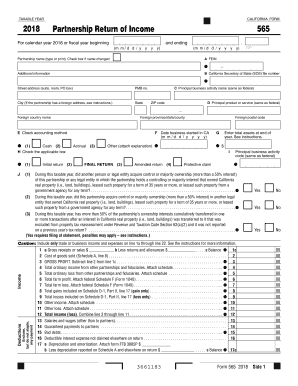

The Form 565 is a California state tax form used by partnerships to report income, deductions, and credits. This form is essential for partnerships operating within California, as it ensures compliance with state tax regulations. It provides the Franchise Tax Board with necessary details about the partnership's financial activities, enabling accurate tax assessments and ensuring that all partners fulfill their tax obligations.

How to use the Form 565 Franchise Tax Board CA gov

To effectively use the Form 565, partnerships must gather relevant financial data, including income, expenses, and partner information. The form requires specific details about each partner's share of income and deductions. Once completed, the form must be submitted to the Franchise Tax Board by the designated deadline. Utilizing a digital signing platform can streamline the process, allowing for secure and efficient submission.

Steps to complete the Form 565 Franchise Tax Board CA gov

Completing the Form 565 involves several key steps:

- Gather financial information for the partnership, including income statements and expense reports.

- Fill out the partnership's basic information, including name, address, and tax identification number.

- Report income and deductions accurately, ensuring all figures are supported by documentation.

- Detail each partner's share of income and deductions in the appropriate sections.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail to the Franchise Tax Board.

Legal use of the Form 565 Franchise Tax Board CA gov

The legal use of the Form 565 is governed by California tax laws. It must be completed accurately and submitted on time to avoid penalties. The form serves as a legal declaration of the partnership's financial activities and is essential for compliance with state regulations. E-signatures on the form are legally binding when executed through a compliant electronic signature solution.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 565. Generally, the form is due on the fifteenth day of the third month after the close of the partnership's fiscal year. For partnerships operating on a calendar year, this typically means a deadline of March 15. It is crucial to stay informed about any changes to these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit the Form 565 through various methods. The preferred method is electronic submission, which allows for faster processing and confirmation. Alternatively, the form can be mailed to the Franchise Tax Board or submitted in person at designated locations. Each submission method has its own requirements and timelines, making it important to choose the most efficient option for your partnership.

Penalties for Non-Compliance

Failure to file the Form 565 on time or inaccuracies in the form can result in significant penalties. The Franchise Tax Board may impose fines for late submissions, and incorrect information can lead to audits or additional tax liabilities. Partnerships should ensure that all information is accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete 2018 form 565 franchise tax board cagov

Effortlessly Complete Form 565 Franchise Tax Board CA gov on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 565 Franchise Tax Board CA gov on any device using the airSlate SignNow Android or iOS applications and enhance your document-driven processes today.

How to Modify and Electronically Sign Form 565 Franchise Tax Board CA gov with Ease

- Obtain Form 565 Franchise Tax Board CA gov and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 565 Franchise Tax Board CA gov and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 565 franchise tax board cagov

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 565 franchise tax board cagov

How to generate an electronic signature for the 2018 Form 565 Franchise Tax Board Cagov in the online mode

How to make an eSignature for your 2018 Form 565 Franchise Tax Board Cagov in Google Chrome

How to make an eSignature for signing the 2018 Form 565 Franchise Tax Board Cagov in Gmail

How to generate an electronic signature for the 2018 Form 565 Franchise Tax Board Cagov from your mobile device

How to make an eSignature for the 2018 Form 565 Franchise Tax Board Cagov on iOS

How to create an electronic signature for the 2018 Form 565 Franchise Tax Board Cagov on Android

People also ask

-

What is Form 565 for the Franchise Tax Board in California?

Form 565 is a tax document required by the Franchise Tax Board (FTB) in California for partnerships and limited liability companies. This form reports income, deductions, and other pertinent information regarding the partnership. Understanding how to properly fill out Form 565 is essential for compliance with California tax laws.

-

How can airSlate SignNow assist with Form 565 submissions?

airSlate SignNow streamlines the process of preparing and submitting Form 565 to the Franchise Tax Board. Our platform allows users to electronically sign documents and easily collaborate with partners, ensuring all necessary signatures are obtained efficiently. With our solution, you can expedite your submission process while staying compliant with CA tax regulations.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs. You can choose from monthly or yearly subscriptions, with costs varying based on the features required. Each plan includes essential tools to help manage forms like the Form 565 for the Franchise Tax Board CA gov effectively.

-

What features of airSlate SignNow help with compliance for Form 565?

The features of airSlate SignNow include secure eSigning, document tracking, and user authentication, all designed to help maintain compliance when submitting Form 565 to the Franchise Tax Board. Our platform provides templates and guidance tailored to California’s tax requirements, ensuring you never miss a step in the filing process.

-

Is airSlate SignNow user-friendly for those filing Form 565?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible even for those who may not be tech-savvy. Our intuitive interface allows users to easily upload, edit, and sign documents like Form 565 for the Franchise Tax Board CA gov with minimal training required. You'll be able to navigate the platform effortlessly.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely, airSlate SignNow offers integrations with various business applications that facilitate tax management, enhancing your workflow. Whether you need to sync with accounting software or collaborate with team members, our platform can integrate seamlessly to enhance your experience when dealing with Form 565 submissions to the Franchise Tax Board.

-

What benefits does eSigning offer for Form 565 submissions?

eSigning with airSlate SignNow for Form 565 submissions provides signNow benefits, including time efficiency and enhanced security. You can obtain signatures faster without the need for physical documentation, while ensuring that sensitive information remains protected. This modern approach simplifies compliance with California's Franchise Tax Board requirements.

Get more for Form 565 Franchise Tax Board CA gov

- 6251 form 2014

- Small estate affidavit affidavit for collection of personal property small estate affidavit affidavit for collection of form

- Bcal 3305 2015 2019 form

- Dd 2760 form

- G 325 a form

- Civ 243 declaration of default re stipulated agreement and sdcourt ca form

- Cpp 1 installment payment plan request illinois department of tax illinois form

- De 1080cz form

Find out other Form 565 Franchise Tax Board CA gov

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later