California Form 565 Partnership Return of Income , California Form 565, Partnership Return of Income 2021

Understanding the California Form 565 Partnership Return of Income

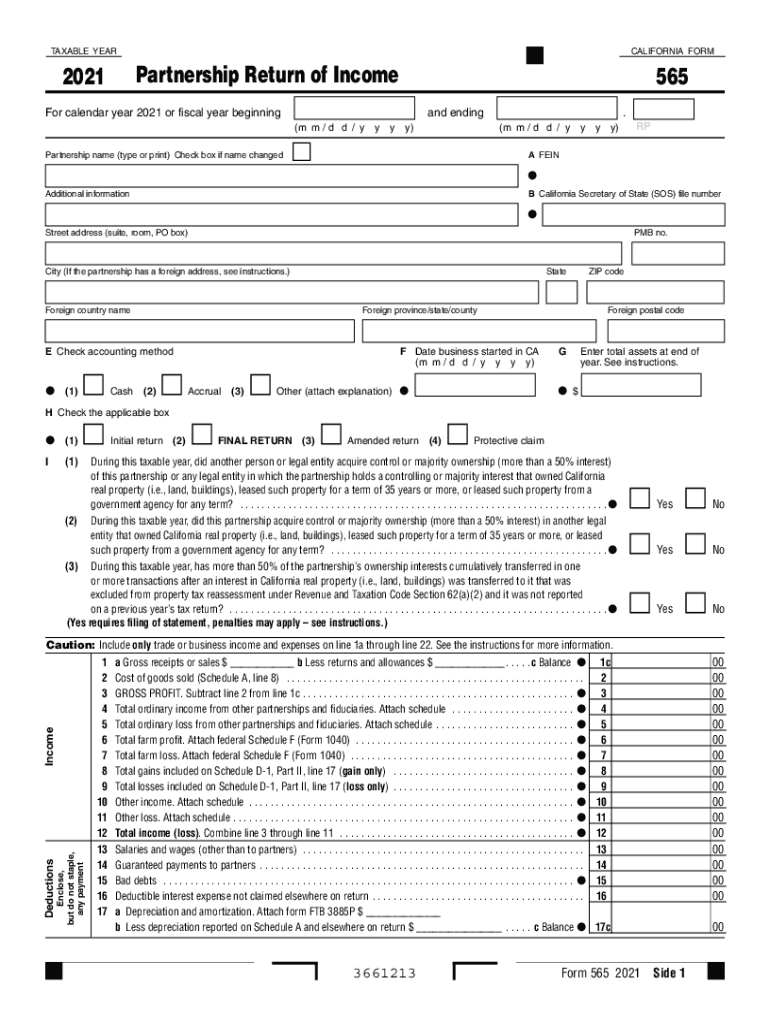

The California Form 565 is a crucial document for partnerships operating within the state. This form is used to report the income, deductions, and credits of partnerships, ensuring compliance with California tax laws. It is essential for partnerships to file this form annually to accurately reflect their financial activities. The California Franchise Tax Board (FTB) requires this form to be submitted by partnerships that are doing business in California, even if they do not owe any tax. Understanding the purpose and requirements of Form 565 is vital for maintaining good standing with tax authorities.

Steps to Complete the California Form 565

Filling out the California Form 565 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense reports, and any relevant tax documents. Follow these steps:

- Provide the partnership's identifying information, such as the name, address, and federal employer identification number (EIN).

- Report total income and deductions, ensuring all figures are accurate and supported by documentation.

- Complete the partner's information section, detailing each partner's share of income, deductions, and credits.

- Review the completed form for errors and ensure all required signatures are included.

- Submit the form by the designated deadline to avoid penalties.

Obtaining the California Form 565

The California Form 565 can be obtained through the California Franchise Tax Board's official website. It is available in a downloadable PDF format, allowing for easy access and printing. Additionally, partnerships can request physical copies of the form by contacting the FTB directly. It is advisable to ensure you have the most current version of the form, as updates may occur annually.

Legal Use of the California Form 565

The California Form 565 serves as a legally binding document when completed and submitted in accordance with state regulations. It is essential for partnerships to ensure that all information provided is accurate and truthful, as discrepancies can lead to audits or penalties. The form must be signed by an authorized partner, affirming the accuracy of the information reported. Compliance with the legal requirements surrounding Form 565 is critical for maintaining the partnership's good standing with tax authorities.

Filing Deadlines for the California Form 565

Partnerships must be aware of the filing deadlines for the California Form 565 to avoid penalties. Generally, the form is due on the 15th day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships should also consider any extensions that may apply, as these can provide additional time for filing.

Key Elements of the California Form 565

Several key elements must be included in the California Form 565 to ensure it is complete and compliant. These include:

- Partnership identification details, including name and EIN.

- Income and deduction summaries, detailing all financial activities.

- Information on each partner's share of income, losses, and credits.

- Signature of an authorized partner, certifying the accuracy of the information.

Ensuring that all these elements are accurately reported will help facilitate a smooth filing process and reduce the risk of issues with tax authorities.

Quick guide on how to complete 2021 california form 565 partnership return of income 2021 california form 565 partnership return of income

Prepare California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Manage California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income on any platform with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to modify and electronically sign California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income effortlessly

- Find California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income and click on Get Form to commence.

- Utilize the features we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and carries the same legal significance as a standard ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Modify and electronically sign California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 california form 565 partnership return of income 2021 california form 565 partnership return of income

Create this form in 5 minutes!

People also ask

-

What is the CA Form 565 and why is it important?

The CA Form 565 is a tax form used for reporting income and deductions by partnerships in California. It's crucial for compliance with state tax regulations, helping ensure accurate filing and avoiding penalties.

-

How can airSlate SignNow assist with completing CA Form 565?

airSlate SignNow simplifies the process of completing the CA Form 565 by allowing users to fill out and eSign documents digitally. This streamlines the workflow, making it easier to manage tax documentation and promote timely submissions.

-

Is there a cost associated with using airSlate SignNow to file CA Form 565?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. This cost-effective solution includes features that make it easy to handle forms like CA Form 565, ensuring you have everything needed without breaking the bank.

-

What features does airSlate SignNow provide for managing CA Form 565?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time collaboration, all tailored to efficiently complete and manage CA Form 565. These tools help streamline the overall documentation process.

-

Can I integrate airSlate SignNow with other software for CA Form 565 management?

Absolutely! airSlate SignNow can seamlessly integrate with various business applications, allowing for a smooth workflow when managing CA Form 565. This enhances productivity by enabling centralized access to related documents.

-

What benefits does eSigning with airSlate SignNow offer for CA Form 565?

Using airSlate SignNow for eSigning CA Form 565 provides increased security, faster turnaround times, and improved tracking of document status. This helps businesses stay compliant while ensuring documents are processed efficiently.

-

How does airSlate SignNow ensure the security of my CA Form 565?

airSlate SignNow prioritizes security with end-to-end encryption, secure access protocols, and comprehensive audit trails for documents like CA Form 565. This guarantees that your sensitive information remains protected throughout the signing process.

Get more for California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income

- Letter from landlord to tenant about time of intent to enter premises ohio form

- Letter landlord notice sample form

- Letter from tenant to landlord about sexual harassment ohio form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children ohio form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure ohio form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497322273 form

- Oh tenant landlord 497322274 form

- Oh letter landlord form

Find out other California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors