3d Print Employee Tax Summary for the Calendar Year 2023

Understanding California Form 565

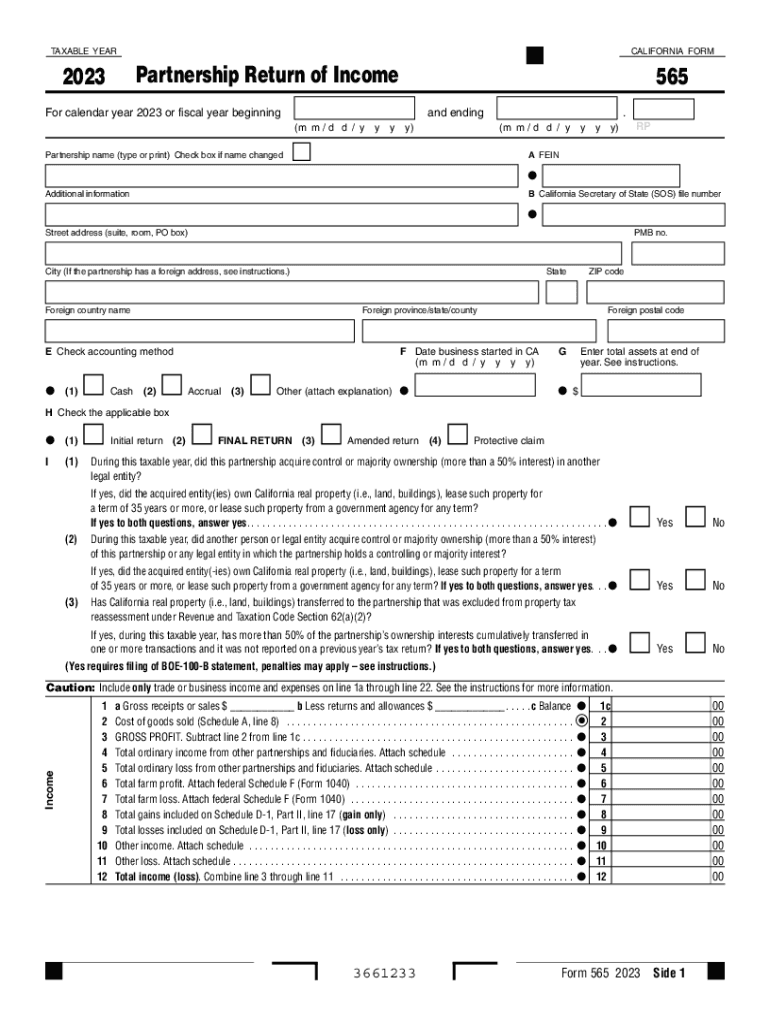

California Form 565 is a tax form used by partnerships to report income, deductions, and other tax-related information to the California Franchise Tax Board. This form is essential for partnerships operating in California, as it ensures compliance with state tax regulations. The form includes various sections that require detailed information about the partnership's financial activities, including income earned, expenses incurred, and distributions made to partners.

Key Elements of California Form 565

The key elements of California Form 565 include the partnership's name, address, and federal employer identification number (EIN). Additionally, the form requires a breakdown of income, deductions, and credits. Partnerships must also provide information about each partner, including their share of income and losses. Accurate reporting is crucial to avoid penalties and ensure that all partners receive the correct tax treatment.

Steps to Complete California Form 565

Completing California Form 565 involves several steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the partnership information section, including the name and EIN.

- Report total income, deductions, and credits on the appropriate lines.

- Detail each partner's share of income and losses in the designated section.

- Review the completed form for accuracy before submission.

Filing Deadlines for California Form 565

The filing deadline for California Form 565 is generally the 15th day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Timely filing is essential to avoid late fees and penalties.

Form Submission Methods for California Form 565

California Form 565 can be submitted through various methods:

- Online: Partnerships can file electronically using the California Franchise Tax Board's e-file system.

- Mail: The completed form can be mailed to the appropriate address provided by the Franchise Tax Board.

- In-Person: Partnerships may also deliver the form in person at designated Franchise Tax Board offices.

Penalties for Non-Compliance with California Form 565

Failure to file California Form 565 on time or inaccuracies in the form can result in penalties. The Franchise Tax Board may impose a late filing penalty, which can be a percentage of the unpaid tax amount. Additionally, partners may face individual penalties if their income is not reported correctly. It is crucial for partnerships to ensure compliance to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct 3d print employee tax summary for the calendar year

Create this form in 5 minutes!

How to create an eSignature for the 3d print employee tax summary for the calendar year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the California Form 565 instructions for 2024?

The California Form 565 instructions for 2024 provide detailed guidelines on how to complete the form for partnerships. These instructions include information on required schedules, filing deadlines, and specific line item explanations to ensure compliance with California tax regulations.

-

How can airSlate SignNow help with California Form 565 submissions?

airSlate SignNow simplifies the process of submitting California Form 565 by allowing users to electronically sign and send documents securely. This streamlines the workflow, ensuring that all necessary forms, including the California Form 565 instructions for 2024, are completed accurately and submitted on time.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, making it easy to manage tax documents like the California Form 565. These features enhance efficiency and ensure that users can access the California Form 565 instructions for 2024 whenever needed.

-

Is airSlate SignNow cost-effective for small businesses handling California Form 565?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing California Form 565 submissions. With affordable pricing plans, businesses can utilize the platform to streamline their document processes without incurring high costs, making it an ideal choice for handling the California Form 565 instructions for 2024.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, allowing users to seamlessly incorporate the California Form 565 instructions for 2024 into their existing workflows. This integration enhances productivity and ensures that all necessary documents are readily available.

-

What are the benefits of using airSlate SignNow for eSigning California Form 565?

Using airSlate SignNow for eSigning California Form 565 offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. By following the California Form 565 instructions for 2024 digitally, users can expedite the signing process and maintain compliance with state regulations.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure cloud storage. This ensures that sensitive information, including details related to the California Form 565 instructions for 2024, is protected from unauthorized access.

Get more for 3d Print Employee Tax Summary For The Calendar Year

Find out other 3d Print Employee Tax Summary For The Calendar Year

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast