Income Tax Revenue Service Adjusts Monthly, Annual, 2024-2026

Understanding California Form 565

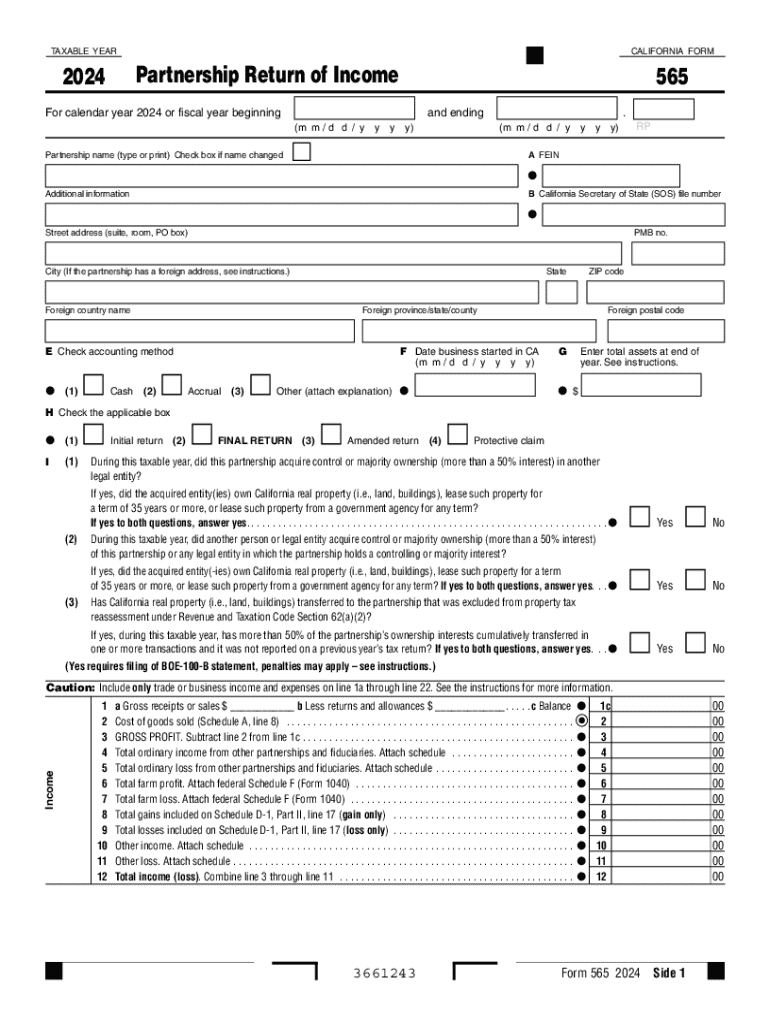

California Form 565 is the partnership return form used for reporting income, deductions, and credits for partnerships operating in California. This form is essential for partnerships to fulfill their state tax obligations. It captures the partnership's financial information and ensures compliance with California tax laws. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their personal tax returns.

Steps to Complete California Form 565

Completing California Form 565 involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the partnership information section, including the partnership's name, address, and federal employer identification number (EIN).

- Report total income and deductions on the form, ensuring all calculations are accurate and supported by documentation.

- Complete the Schedule K-1 for each partner, detailing their share of income and deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines for California Form 565

The filing deadline for California Form 565 typically aligns with the federal partnership return deadline. Generally, partnerships must file by the 15th day of the third month after the end of their tax year. For partnerships operating on a calendar year, this means the due date is March 15. If additional time is needed, partnerships can request an automatic six-month extension, which extends the filing deadline to September 15.

Required Documents for Filing

When preparing to file California Form 565, it is important to gather the following documents:

- Income statements that detail all sources of revenue.

- Expense reports that outline all deductible expenses incurred by the partnership.

- Prior year tax returns to ensure consistency and accuracy in reporting.

- Partner information, including Social Security numbers or EINs for all partners.

Penalties for Non-Compliance

Failure to file California Form 565 on time can result in significant penalties. The California Franchise Tax Board (FTB) imposes a late filing penalty, which is typically a percentage of the unpaid tax amount. Additionally, partnerships may face interest charges on any unpaid taxes. It is crucial for partnerships to adhere to filing deadlines to avoid these financial repercussions.

Form Submission Methods

California Form 565 can be submitted in various ways to accommodate different preferences:

- Online: Partnerships can file electronically using approved e-filing software, which often simplifies the process and reduces errors.

- Mail: The form can be printed and mailed to the appropriate address provided by the California FTB.

- In-Person: Partnerships may also choose to deliver the form directly to a local FTB office, though this option may require an appointment.

Create this form in 5 minutes or less

Find and fill out the correct income tax revenue service adjusts monthly annual

Create this form in 5 minutes!

How to create an eSignature for the income tax revenue service adjusts monthly annual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing California Form 565 instructions 2024?

airSlate SignNow offers a user-friendly interface that simplifies the process of managing California Form 565 instructions 2024. Key features include customizable templates, automated workflows, and secure eSigning capabilities, ensuring that your documents are handled efficiently and securely.

-

How can airSlate SignNow help with the completion of California Form 565 instructions 2024?

With airSlate SignNow, you can easily fill out and eSign California Form 565 instructions 2024 online. The platform allows you to collaborate with team members in real-time, ensuring that all necessary information is accurately captured and submitted on time.

-

Is there a cost associated with using airSlate SignNow for California Form 565 instructions 2024?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that can assist with California Form 565 instructions 2024, making it a cost-effective solution for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for California Form 565 instructions 2024?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow for California Form 565 instructions 2024. Popular integrations include CRM systems, cloud storage services, and productivity tools, enhancing your overall efficiency.

-

What benefits does airSlate SignNow provide for businesses handling California Form 565 instructions 2024?

Using airSlate SignNow for California Form 565 instructions 2024 offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. The platform's automation features help minimize errors and ensure compliance with state regulations.

-

How secure is airSlate SignNow when dealing with California Form 565 instructions 2024?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents. When handling California Form 565 instructions 2024, you can trust that your sensitive information is safeguarded against unauthorized access.

-

What support options are available for users of airSlate SignNow regarding California Form 565 instructions 2024?

airSlate SignNow provides comprehensive support options, including a knowledge base, live chat, and email assistance. Whether you have questions about California Form 565 instructions 2024 or need help with the platform, their support team is ready to assist you.

Get more for Income Tax Revenue Service Adjusts Monthly, Annual,

Find out other Income Tax Revenue Service Adjusts Monthly, Annual,

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast