Ca Ftb Income 2019

What is the California FTB Income?

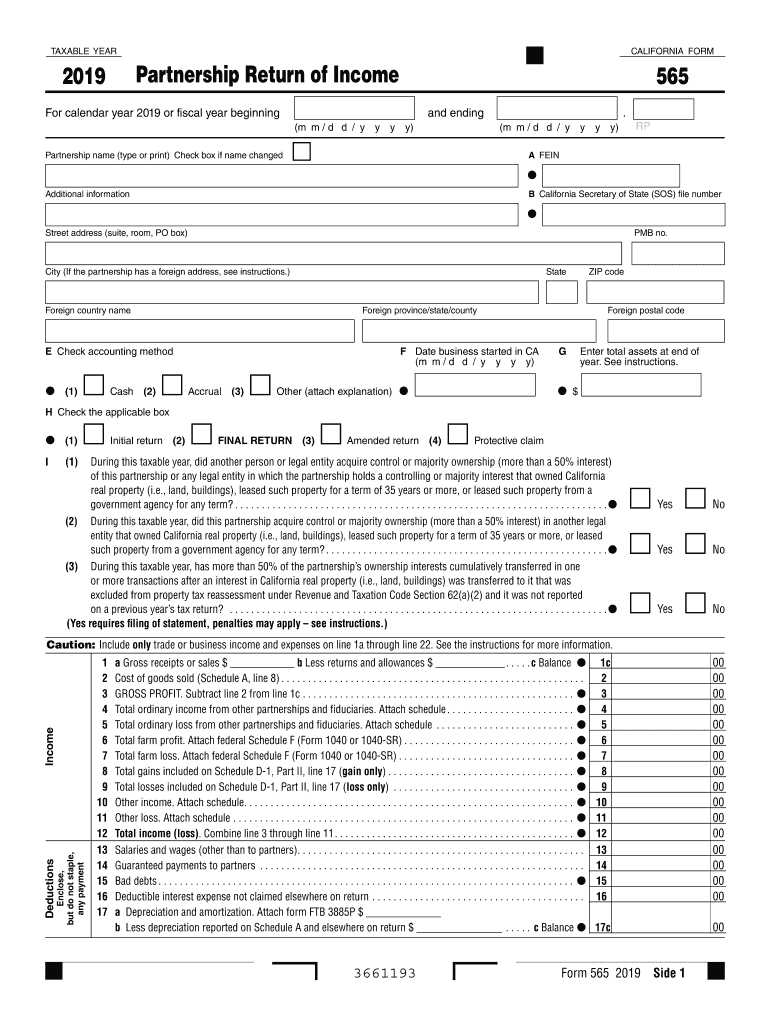

The California FTB Income refers to the income that is subject to taxation under California state law, as reported on the California FTB Form 565. This form is specifically designed for partnerships to report their income, deductions, and credits. It is essential for ensuring that all income generated by partnerships in California is accurately reported to the Franchise Tax Board (FTB). Understanding what constitutes California FTB Income is crucial for compliance and accurate tax reporting.

Steps to Complete the California FTB Form 565

Filling out the California FTB Form 565 involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Complete the identification section, providing details about the partnership, such as its name, address, and federal Employer Identification Number (EIN).

- Report the partnership's income, including gross receipts and other income sources.

- Detail any deductions the partnership may claim, such as business expenses and contributions.

- Calculate the partnership's taxable income by subtracting deductions from total income.

- Ensure all required signatures are obtained from partners before submission.

Required Documents for California FTB Form 565

To complete the California FTB Form 565, several documents are necessary:

- Partnership financial statements, including profit and loss statements.

- Federal tax returns for the partnership.

- Documentation of any deductions or credits claimed.

- Prior year FTB Form 565, if applicable, for reference.

- Any additional forms specific to the partnership's income sources or deductions.

Form Submission Methods for California FTB Form 565

The California FTB Form 565 can be submitted using various methods:

- Online: Partnerships can file electronically through the California FTB website.

- Mail: Completed forms can be sent to the appropriate FTB address based on the partnership's location.

- In-Person: Partnerships may also choose to deliver the form directly to a local FTB office.

Penalties for Non-Compliance with California FTB Form 565

Non-compliance with the requirements of the California FTB Form 565 can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time if the form is not submitted by the deadline.

- Interest on any unpaid taxes, which can increase the total amount owed.

- Potential audits or additional scrutiny from the FTB, leading to further complications.

Eligibility Criteria for Filing California FTB Form 565

To be eligible to file the California FTB Form 565, a partnership must meet specific criteria:

- It must be classified as a partnership under federal tax law.

- It must have income derived from California sources or have California resident partners.

- The partnership must comply with all California tax regulations and requirements.

Quick guide on how to complete instructions for form 540 2ez california franchise tax board

Complete Ca Ftb Income effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to develop, amend, and eSign your documents swiftly without obstacles. Manage Ca Ftb Income on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to edit and eSign Ca Ftb Income effortlessly

- Locate Ca Ftb Income and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or black out sensitive details with tools that airSlate SignNow has specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Bid farewell to lost or misplaced files, tedious form hunting, or errors that necessitate printing fresh document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign Ca Ftb Income and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 540 2ez california franchise tax board

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 540 2ez california franchise tax board

How to generate an electronic signature for your Instructions For Form 540 2ez California Franchise Tax Board in the online mode

How to generate an eSignature for your Instructions For Form 540 2ez California Franchise Tax Board in Chrome

How to create an electronic signature for putting it on the Instructions For Form 540 2ez California Franchise Tax Board in Gmail

How to generate an electronic signature for the Instructions For Form 540 2ez California Franchise Tax Board from your smart phone

How to generate an eSignature for the Instructions For Form 540 2ez California Franchise Tax Board on iOS devices

How to create an electronic signature for the Instructions For Form 540 2ez California Franchise Tax Board on Android devices

People also ask

-

What is the California FTB Form 565?

The California FTB Form 565 is used for partnership tax reporting in California. It is essential for partnerships to accurately report their income, deductions, and credits to ensure compliance with state tax laws. Utilizing airSlate SignNow can simplify the eSigning process of this important document.

-

How can airSlate SignNow help with filing the California FTB Form 565?

airSlate SignNow allows businesses to send, receive, and eSign the California FTB Form 565 electronically. The platform ensures that all signatures are legally binding and securely stored, streamlining the submission process. This efficiency saves time and reduces errors in tax filings.

-

What are the pricing options for using airSlate SignNow for the California FTB Form 565?

airSlate SignNow offers various pricing plans to suit different business needs, including options for individuals and teams. Pricing is designed to be cost-effective, ensuring access to features that support the electronic signing of the California FTB Form 565 without breaking the bank. Users can choose a plan that best fits their volume and frequency of document signing.

-

What features does airSlate SignNow offer for managing the California FTB Form 565?

airSlate SignNow provides features such as document templates, automatic reminders, and a secure signing workflow that makes managing the California FTB Form 565 easy. Users can track the status of their documents in real-time, ensuring timely completion and submission. These features enhance productivity and ensure compliance with tax regulations.

-

Is airSlate SignNow compliant with legal and tax regulations for the California FTB Form 565?

Yes, airSlate SignNow is fully compliant with state and federal regulations regarding electronic signatures, making it a reliable tool for the California FTB Form 565. The platform uses advanced security measures to protect sensitive information while ensuring that all signed documents meet legal standards. This compliance gives users peace of mind when submitting important tax documents.

-

Can I integrate airSlate SignNow with other accounting software for the California FTB Form 565?

airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the workflow for completing the California FTB Form 565. Users can easily connect their preferred tools, streamlining the process of preparing and submitting partnership tax returns. This integration boosts efficiency and minimizes the need for double data entry.

-

What are the benefits of using airSlate SignNow for the California FTB Form 565 compared to traditional methods?

Using airSlate SignNow for the California FTB Form 565 offers numerous benefits over traditional paper methods, including increased speed, reduced errors, and enhanced security. The electronic signing process is not only faster but also allows for easier collaboration among partners. Additionally, all signed forms are stored securely online, making retrieval and references much simpler.

Get more for Ca Ftb Income

- Calcasieu urgent care application for employment form

- Downloadable pre printed puppy registered form

- Sellers mandatory disclosure statement form

- Cheer tyme sponsorship form

- Tr 1 form

- Ccw application cms sbcounty form

- Sbsd tow service agreement cms sbcounty form

- Personal property insurance plan notice of loss form adams50

Find out other Ca Ftb Income

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors