GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS and 2018

What is the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND

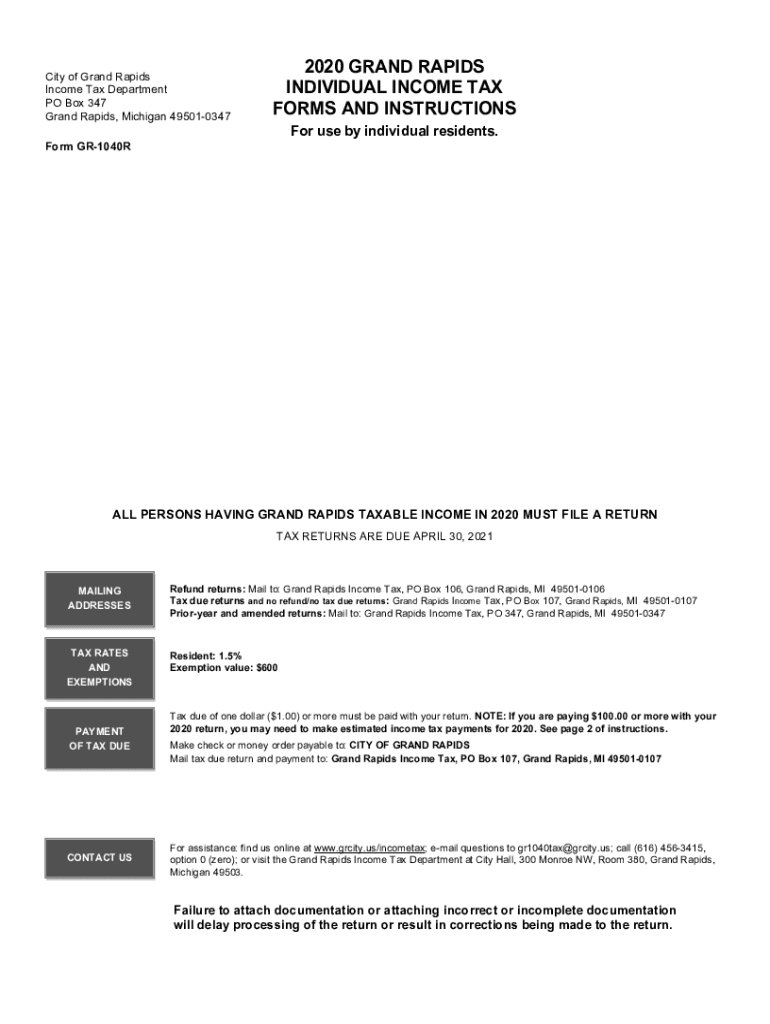

The GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND are essential documents required for residents of Grand Rapids, Michigan, to report their income and calculate their tax obligations. These forms are designed to ensure compliance with state tax laws and facilitate the accurate assessment of individual income taxes. They typically include various sections where taxpayers must provide personal information, income details, deductions, and credits applicable to their financial situation. Understanding these forms is crucial for effective tax filing and avoiding potential penalties.

Steps to complete the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND

Completing the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, review the form instructions carefully to understand the required sections. Fill out the personal information section, followed by income details, deductions, and applicable credits. After completing the form, review it for errors and ensure all calculations are correct. Finally, sign and date the form before submitting it electronically or by mail.

How to obtain the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND

Obtaining the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND is a straightforward process. Residents can access these forms online through the official Grand Rapids city website or the Michigan Department of Treasury website. Alternatively, physical copies may be available at local government offices or public libraries. It is advisable to ensure that you are using the most current version of the forms to avoid issues during the filing process.

Legal use of the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND

The legal use of the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND is governed by state tax laws. These forms must be completed accurately and submitted by the designated filing deadline to avoid penalties. Electronic submission of these forms is permitted and considered legally binding, provided that the submission complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations. Ensuring that all information is truthful and complete is essential to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND typically align with federal tax deadlines. For most individuals, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to be aware of these dates to ensure timely filing and avoid late fees. Additionally, extensions may be available, but they must be requested before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

Residents have multiple options for submitting the GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND. Forms can be filed online through the appropriate state tax portal, which often allows for faster processing and confirmation of receipt. Alternatively, taxpayers may choose to mail their completed forms to the designated tax office or submit them in person at local government offices. Each method has its own advantages, such as convenience with online filing and personal interaction with in-person submissions.

Quick guide on how to complete 2020 grand rapids individual income tax forms and

Effortlessly Prepare GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without delays. Handle GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND with Ease

- Find GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal value as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating searches for forms, or errors that require printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Modify and electronically sign GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 grand rapids individual income tax forms and

Create this form in 5 minutes!

How to create an eSignature for the 2020 grand rapids individual income tax forms and

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What are GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND available through airSlate SignNow?

airSlate SignNow provides an easy way to access and eSign GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND. Users can upload their tax documents, invite others to sign, and securely store completed forms. The platform ensures compliance with local regulations and offers a streamlined approach to tax preparation.

-

How does airSlate SignNow simplify the process of filling out GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND?

With airSlate SignNow, filling out GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND is made straightforward via intuitive templates that guide users through each step. The platform supports auto-fill features, reducing manual entry effort and helping users avoid errors. This enhances efficiency and speeds up the tax filing process.

-

What pricing options are available for using GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different user needs, including individual users and businesses that require GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND. Monthly and annual subscriptions provide flexibility, while features like bulk sending and advanced analytics are available based on the chosen plan. This allows users to select the package that best fits their requirements.

-

Can airSlate SignNow integrate with other software for managing GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND?

Yes, airSlate SignNow easily integrates with a variety of software platforms including accounting and tax preparation tools. This allows users to manage GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND seamlessly alongside their existing workflows. Popular integrations enhance data connectivity, reduce redundancy, and increase overall productivity.

-

What are the key benefits of using airSlate SignNow for GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND?

Using airSlate SignNow for GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND offers numerous benefits, including time savings, enhanced security, and increased compliance. The platform’s electronic signature capability ensures documents are signed promptly while maintaining a high level of security. Furthermore, users can track document statuses in real-time, minimizing the potential for delays.

-

Is airSlate SignNow secure for handling GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND?

Absolutely, airSlate SignNow prioritizes security for GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND transactions. The platform employs advanced encryption protocols and complies with strict industry standards to protect personal and financial information. Users can trust that their sensitive tax documents are safe and secured throughout the signing process.

-

How can I get support while using airSlate SignNow for GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND?

airSlate SignNow provides comprehensive support for users handling GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND. The help center includes articles, tutorials, and FAQs to assist with common queries. Additionally, customers can access live chat and email support to resolve more complex issues quickly and effectively.

Get more for GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND

Find out other GRAND RAPIDS INDIVIDUAL INCOME TAX FORMS AND

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure