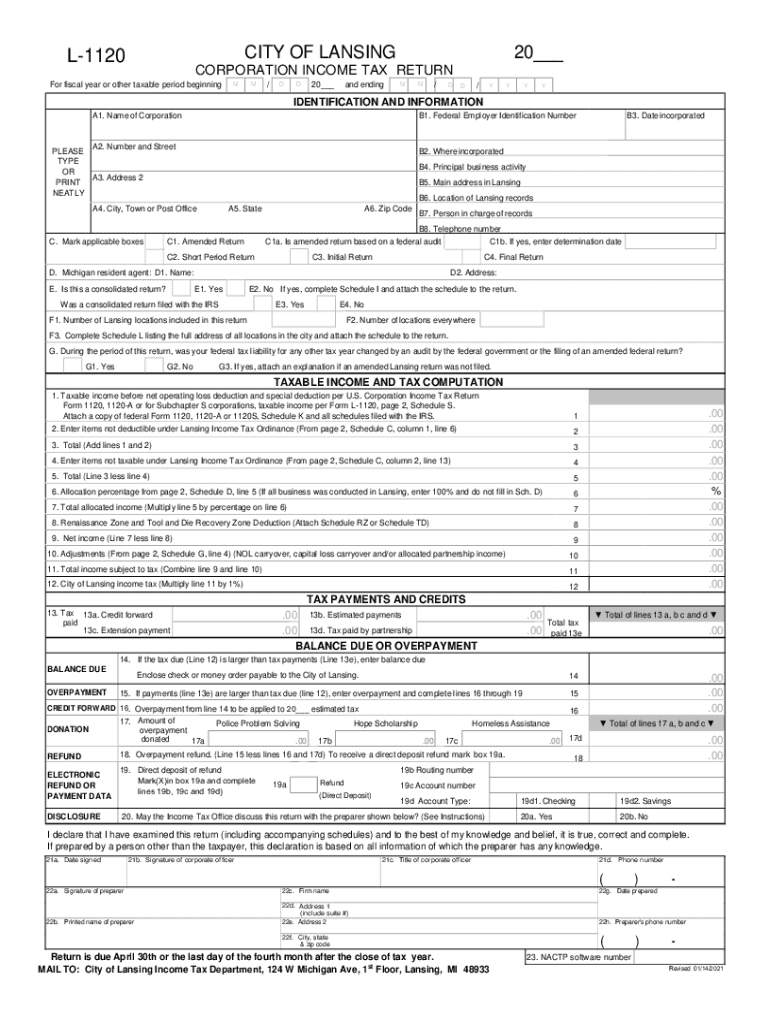

INSTRUCTIONS for FILING FORM L 1120, CORPORATION INCOME 2021-2026

Instructions for filing Arizona Form 122

Arizona Form 122 is essential for corporations in Arizona to report their income and calculate the tax due. The instructions for filing this form outline the necessary steps and requirements. It is important to carefully follow these guidelines to ensure compliance with state tax regulations. The form must be completed accurately, reflecting the corporation's financial activities for the tax year.

Steps to complete Arizona Form 122

Completing Arizona Form 122 involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the form by entering the corporation's income, deductions, and credits as applicable.

- Ensure all calculations are accurate to avoid discrepancies.

- Review the form for completeness and correctness before submission.

- Sign and date the form, ensuring that the authorized representative of the corporation has done so.

Filing deadlines for Arizona Form 122

Timely filing of Arizona Form 122 is crucial to avoid penalties. The due date for filing is typically the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required documents for Arizona Form 122

When filing Arizona Form 122, certain documents are required to support the information provided. These documents include:

- Financial statements, including profit and loss statements and balance sheets.

- Previous year’s tax returns for reference.

- Documentation for any deductions or credits claimed.

- Records of any estimated tax payments made during the year.

Form submission methods for Arizona Form 122

Arizona Form 122 can be submitted through various methods. Corporations have the option to file electronically using approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the Arizona Department of Revenue. It is essential to ensure that the form is sent to the correct address and that it is postmarked by the due date to avoid late filing penalties.

Legal use of Arizona Form 122

Arizona Form 122 is legally binding once it has been completed and submitted according to state regulations. The information provided must be truthful and accurate, as any discrepancies can lead to penalties or audits. Corporations should maintain copies of submitted forms and supporting documents for their records, as these may be required for future reference or in the event of an audit.

Quick guide on how to complete instructions for filing form l 1120 corporation income

Complete INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Manage INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME effortlessly

- Obtain INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME and select Get Form to begin.

- Utilize the features we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for filing form l 1120 corporation income

Create this form in 5 minutes!

How to create an eSignature for the instructions for filing form l 1120 corporation income

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Arizona Form 122?

Arizona Form 122 is a document used for various legal and administrative purposes in the state of Arizona. It is important for businesses and individuals to understand its requirements and how it can be executed efficiently. Using airSlate SignNow, you can easily prepare and eSign Arizona Form 122 online, ensuring compliance and saving time.

-

How can airSlate SignNow help with Arizona Form 122?

airSlate SignNow offers an intuitive platform that simplifies the eSigning and sending process for Arizona Form 122. With features like templates and reusable documents, you can quickly create and manage this form. Moreover, our secure solution ensures that your documents remain confidential and protected throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 122?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing plans to fit various business needs. Our solutions are cost-effective, especially when you consider the time saved in processing Arizona Form 122. Additionally, you can benefit from a free trial to assess whether our platform meets your requirements.

-

What features does airSlate SignNow provide for Arizona Form 122?

AirSlate SignNow offers multiple features specifically designed to streamline the handling of Arizona Form 122. These include easy drag-and-drop fields, automated workflows, and mobile access so you can sign documents from anywhere. These features make it efficient for users to manage their forms while ensuring legal compliance.

-

Can I integrate airSlate SignNow with other tools for Arizona Form 122?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enabling you to streamline workflows for Arizona Form 122. Whether you're using CRM systems, document storage solutions, or project management tools, our integrations enhance the usability of the form and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for Arizona Form 122?

Using airSlate SignNow for Arizona Form 122 simplifies the signing process and enhances convenience. You can track the signing status in real-time, reduce paperwork, and minimize errors, which ultimately speeds up the approval processes. The platform's user-friendly interface makes it accessible for everyone, ensuring a smooth experience.

-

Is it easy to use airSlate SignNow for Arizona Form 122?

Yes, airSlate SignNow is designed to be user-friendly, making the completion of Arizona Form 122 straightforward. Even those without technical expertise can navigate our platform easily. With tutorials and support readily available, users can quickly learn how to eSign and send documents with confidence.

Get more for INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME

- Denali kidcare application form

- Celibacy contract form

- Umpire evaluation form

- Ashland university lesson plan template form

- De 2587 form

- Registration form chattanooga

- Recommendation letters for studentskindergarten recommendation letter 5 samples examples ampamp formatskindergarten

- Application under green trade facility form

Find out other INSTRUCTIONS FOR FILING FORM L 1120, CORPORATION INCOME

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple