Application for Extension of Time to File IRS Gov Form

What is the Application for Extension of Time to File IRS gov

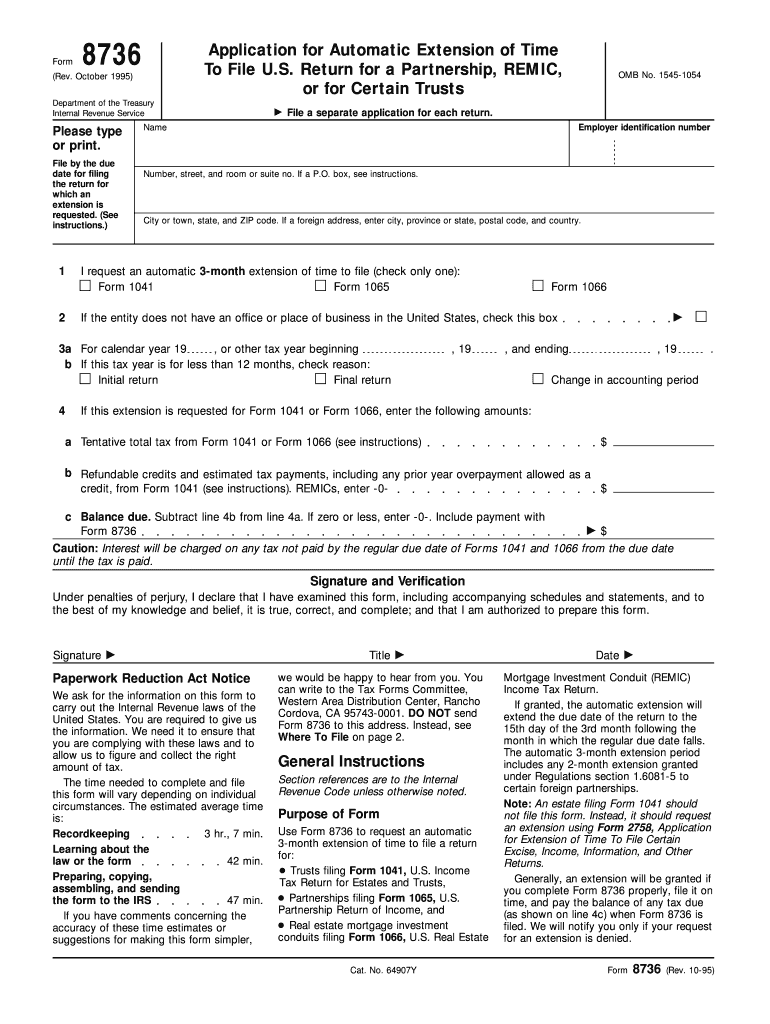

The Application for Extension of Time to File is a crucial document for taxpayers who need additional time to submit their federal tax returns. This application allows individuals and businesses to request an extension, typically for six months, to file their tax returns without incurring penalties for late submission. It is important to note that while this extension provides more time to file, it does not extend the deadline for payment of any taxes owed. Taxpayers must still estimate and pay any owed taxes by the original due date to avoid interest and penalties.

How to Use the Application for Extension of Time to File IRS gov

Using the Application for Extension of Time to File is straightforward. Taxpayers can complete the form electronically through the IRS website or by downloading a paper version. When filling out the form, it is essential to provide accurate information, including your name, address, and Social Security number or Employer Identification Number (EIN). After completing the form, submit it electronically or mail it to the appropriate IRS address. Filing electronically is often faster and provides immediate confirmation of receipt.

Steps to Complete the Application for Extension of Time to File IRS gov

Completing the Application for Extension of Time to File involves several key steps:

- Obtain the correct form from the IRS website or your tax software.

- Fill in your personal information, including your name and identification number.

- Estimate your tax liability and enter the amount you plan to pay.

- Sign and date the form, confirming that the information provided is accurate.

- Submit the form electronically or by mail before the original tax return due date.

Legal Use of the Application for Extension of Time to File IRS gov

The Application for Extension of Time to File is legally recognized, provided it is completed and submitted according to IRS guidelines. It is essential to understand that this application does not absolve taxpayers from their obligation to pay any taxes owed by the original deadline. Failure to pay taxes on time can result in penalties and interest. Therefore, ensuring compliance with all IRS regulations when using this form is critical for maintaining legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Application for Extension of Time to File are typically aligned with the original due dates for tax returns. For most individual taxpayers, the deadline is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to submit the extension application before this date to avoid penalties. Additionally, keep in mind that the extended filing deadline will usually be October 15.

Who Issues the Form

The Application for Extension of Time to File is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides all necessary forms and instructions on its official website, ensuring that taxpayers have access to the most current information regarding tax filing and extensions.

Quick guide on how to complete october 1995 department of the treasury internal revenue service application for automatic extension of time to file u

Complete Application For Extension Of Time To File IRS gov effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Application For Extension Of Time To File IRS gov on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The simplest way to modify and eSign Application For Extension Of Time To File IRS gov without hassle

- Locate Application For Extension Of Time To File IRS gov and click Get Form to initiate the process.

- Utilize the tools we provide to finish your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Application For Extension Of Time To File IRS gov and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How long is the waiting time for the issuance of an immigrant visa (Form I-130) of a petition approved in 2014 by the U.S. Citizenship and Immigration Services then sent to the Department of State National Visa Center for consular action?

The same length as a piece of string!Seriously though, you have not given enough information.See Forums online showing typical processing times I-130 Tracker. Petition for Alien Relative Tracker. Family Based Immigration TrackerIt would depend upon many things:What was the priority dateHave you had biometrics processedWhich ConsulateWhat is/are the citizenship(s) of the applicant and of his family?What category has the sponsor applied for?Are there likely to be security clearance issues - this is especially the case with applicants from India, Pakistan, Middle East and Asia where many have similar names and local government bureaucracy is technologically outdated - especially from countries considered by DOS to be high risk of terrorism.If your case is outside the typical wait times and you are sure you have the correct priority date and all approvals then either you or your sponsor should seek help from the office of the Congressman where they reside or in whose district you will be residing.

Create this form in 5 minutes!

How to create an eSignature for the october 1995 department of the treasury internal revenue service application for automatic extension of time to file u

How to make an electronic signature for your October 1995 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U online

How to generate an electronic signature for the October 1995 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U in Chrome

How to make an eSignature for putting it on the October 1995 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U in Gmail

How to create an eSignature for the October 1995 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U straight from your mobile device

How to make an eSignature for the October 1995 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U on iOS

How to generate an eSignature for the October 1995 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U on Android OS

People also ask

-

What is the Application For Extension Of Time To File IRS gov?

The Application For Extension Of Time To File IRS gov is a form that allows taxpayers to request additional time to file their tax returns. By submitting this application, you can avoid penalties for late filing while ensuring you have sufficient time to prepare your documents accurately.

-

How can airSlate SignNow help with the Application For Extension Of Time To File IRS gov?

airSlate SignNow simplifies the process of completing and submitting the Application For Extension Of Time To File IRS gov by providing a user-friendly platform for document preparation and e-signatures. Our solution enables you to quickly fill out the form, add necessary signatures, and send it securely to the IRS.

-

Is there a cost associated with using airSlate SignNow for the Application For Extension Of Time To File IRS gov?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. We provide a cost-effective solution that allows you to manage your documents efficiently, including the Application For Extension Of Time To File IRS gov, without breaking the bank.

-

What features does airSlate SignNow offer for the Application For Extension Of Time To File IRS gov?

Our platform includes features like customizable templates, easy document sharing, and secure e-signatures to streamline the Application For Extension Of Time To File IRS gov process. Additionally, our intuitive user interface makes it simple for anyone to navigate the filing process.

-

Can I integrate airSlate SignNow with other applications for tax filing?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your experience when filing the Application For Extension Of Time To File IRS gov. You can connect with popular accounting software and document management tools to streamline your workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Application For Extension Of Time To File IRS gov, offers several benefits such as enhanced security, reduced turnaround time, and improved document accuracy. Our platform ensures that your sensitive information is protected while making the filing process efficient.

-

How does airSlate SignNow ensure the security of my Application For Extension Of Time To File IRS gov?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and authentication measures. When you submit your Application For Extension Of Time To File IRS gov, you can rest assured that your data is safeguarded against unauthorized access.

Get more for Application For Extension Of Time To File IRS gov

Find out other Application For Extension Of Time To File IRS gov

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim