Form 8849

What is the Form 8849

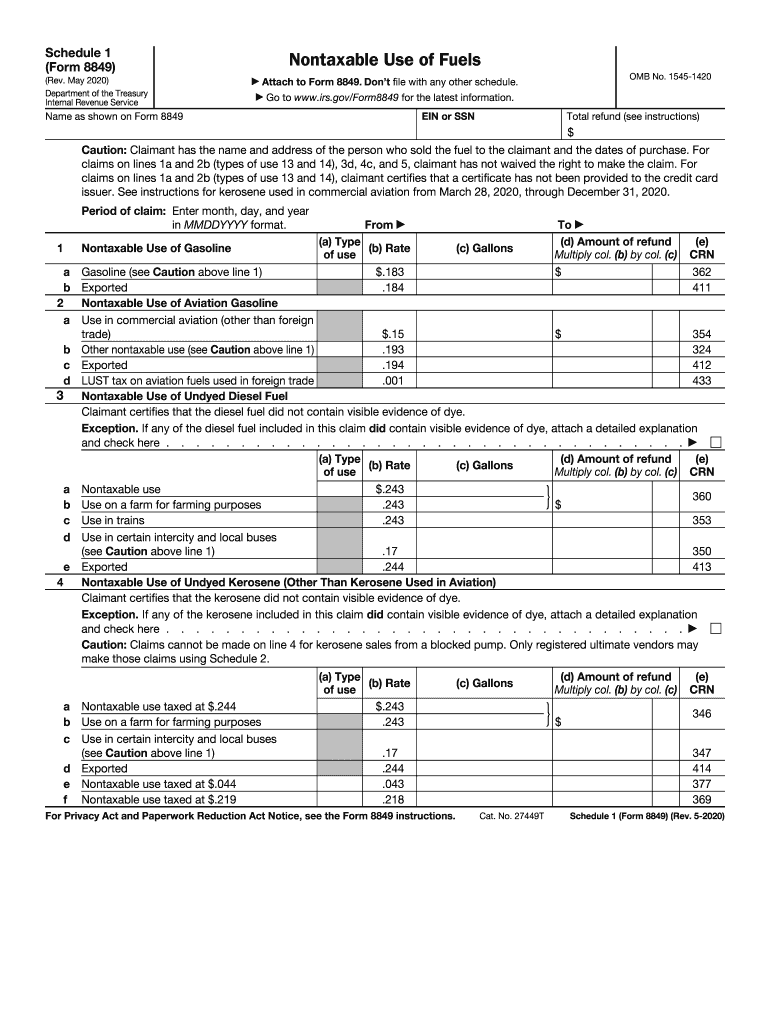

The Form 8849, officially known as the "Claim for Refund of Excise Taxes," is a tax form used by businesses and individuals in the United States to claim refunds for certain excise taxes. This form is particularly relevant for those who have paid excise taxes on fuel that is used for nontaxable purposes. The IRS uses this form to process claims for refunds related to fuel taxes, making it an essential document for taxpayers who qualify for such refunds.

How to use the Form 8849

Using the Form 8849 involves several key steps. First, you must determine your eligibility to claim a refund for excise taxes paid. Next, gather all necessary documentation that supports your claim, such as receipts and records of fuel purchases. Complete the form by accurately filling in the required information, including your name, address, and details of the excise taxes you are claiming. After completing the form, you can submit it either electronically or by mail, depending on your preference and the IRS guidelines.

Steps to complete the Form 8849

Completing the Form 8849 requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the latest version of the Form 8849 from the IRS website.

- Review the instructions accompanying the form to understand the requirements.

- Fill in your personal information, including your taxpayer identification number.

- Specify the type of excise tax you are claiming a refund for, such as nontaxable use of fuel.

- Provide the amounts and calculations related to the excise taxes paid.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 8849

The legal use of the Form 8849 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their excise tax payments and adhere to the guidelines outlined by the IRS. The form serves as a formal request for a refund, and any inaccuracies or fraudulent claims can result in penalties. It is crucial to keep detailed records of all transactions related to the claim, as the IRS may request supporting documentation during the review process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8849 can vary based on the type of refund being claimed. Generally, taxpayers must file the form within three years from the date the tax was paid. It is essential to stay informed about specific deadlines to avoid missing the opportunity to claim a refund. Mark your calendar for any relevant dates, and consider setting reminders to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 8849. The form can be filed electronically through the IRS e-file system, which is a convenient method that allows for faster processing. Alternatively, you may choose to print the completed form and mail it to the appropriate IRS address. In-person submissions are generally not available for this form, making electronic and mail submissions the primary methods for filing.

Quick guide on how to complete form 8849

Easy completion of Form 8849 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8849 on any device using the airSlate SignNow apps available for Android or iOS and streamline any document-related procedure today.

Effortless editing and eSigning of Form 8849

- Find Form 8849 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important portions of the documents or obscure sensitive information using the tools that airSlate SignNow has specifically prepared for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign Form 8849 while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8849

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is form 8849 used for?

Form 8849 is used to claim refunds for various taxes paid on fuel. Businesses that have overpaid fuel taxes can use form 8849 to recover these costs, making it an essential document for tax reporting and compliance.

-

How can airSlate SignNow assist with form 8849?

AirSlate SignNow streamlines the signing process for form 8849, enabling users to eSign and send the document quickly. This ensures that your refund claims are filed accurately and without unnecessary delays, simplifying tax management for your business.

-

Is there a cost associated with using airSlate SignNow for form 8849?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet various business needs. These plans are designed to provide cost-effective solutions for managing and eSigning important documents like form 8849.

-

Can I store my completed form 8849 in airSlate SignNow?

Absolutely! AirSlate SignNow not only allows you to eSign form 8849, but it also offers secure cloud storage for all your completed documents. This feature ensures easy access to your important tax documents whenever needed.

-

What features does airSlate SignNow provide for form 8849?

AirSlate SignNow includes features such as customizable templates, automated reminders, and secure workflows that enhance the management of form 8849. These tools help ensure that your form is completed and submitted on time, reducing the risk of errors.

-

Are there integrations available for airSlate SignNow when handling form 8849?

Yes, airSlate SignNow integrates with several popular business tools and software, which can enhance your ability to manage form 8849 effortlessly. This includes platforms like Google Drive, Dropbox, and various CRM systems that improve workflow efficiency.

-

What are the benefits of using airSlate SignNow for form 8849?

Using airSlate SignNow for form 8849 offers numerous benefits, including increased efficiency, reduced paperwork, and a faster turnaround time for tax refunds. Its user-friendly interface allows for easy collaboration among team members.

Get more for Form 8849

- Espresso evaluation form

- Undertaking indemnity bond format

- The latte factor book pdf form

- Employer of record sample completed i 9 form employer of record sample completed i 9 form dwd wisconsin

- United india insurance policy download pdf form

- Birmingham board of realtors form

- Form 8814 parents election to report childs interest and dividends

- Form irs 1094 b fill online printable fillable blank

Find out other Form 8849

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free