Form 8814 Parents' Election to Report Child's Interest and Dividends 2024

What is the Form 8814 Parents' Election To Report Child's Interest And Dividends

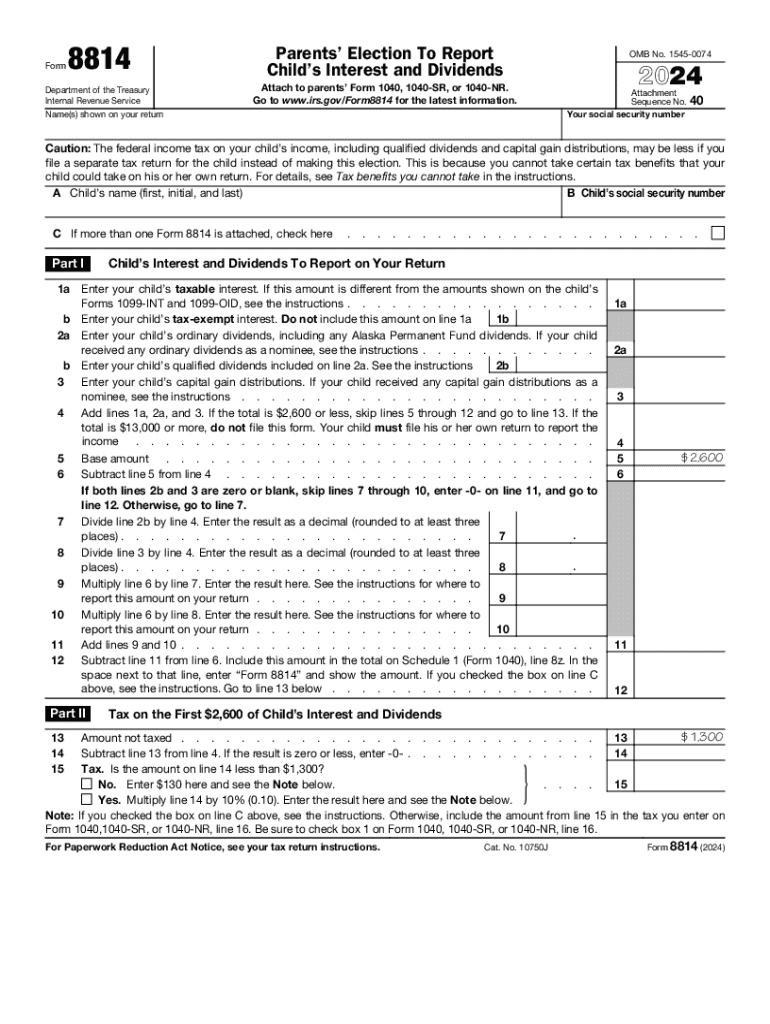

The Form 8814, officially known as the Parents' Election To Report Child's Interest And Dividends, is a federal tax form used by parents to report their child's unearned income, such as interest and dividends, on their own tax return. This option is available for children under the age of 19, or under 24 if they are full-time students and do not provide more than half of their own support. By electing to report this income, parents can simplify the tax process and potentially benefit from lower tax rates, depending on their overall income level.

How to use the Form 8814 Parents' Election To Report Child's Interest And Dividends

To use Form 8814, parents must first determine whether their child meets the eligibility criteria. If eligible, they can include the child's interest and dividends on their own tax return using this form. The total amount of the child's unearned income must be less than $11,000 for the tax year. Parents should carefully fill out the form, reporting the income accurately to avoid any issues with the IRS. This form must be attached to the parent's tax return when filing.

Steps to complete the Form 8814 Parents' Election To Report Child's Interest And Dividends

Completing Form 8814 involves several key steps:

- Gather necessary information about the child's unearned income, including interest and dividends.

- Ensure the child's total income is below the $11,000 threshold.

- Fill out the form accurately, entering the child's income in the designated sections.

- Attach the completed Form 8814 to your federal tax return.

- Submit your tax return by the filing deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8814. Parents should refer to the IRS instructions for the form to ensure compliance with current tax laws. Key guidelines include eligibility requirements, income thresholds, and the proper way to report the child's income. It's important for parents to stay updated on any changes to tax regulations that may affect their use of this form.

Filing Deadlines / Important Dates

Form 8814 must be filed along with the parent’s federal tax return, which is typically due on April fifteenth. If this date falls on a weekend or holiday, the deadline may shift to the next business day. Parents should also be aware of any extensions that may apply to their tax filing to ensure they submit the form on time.

Eligibility Criteria

To qualify for using Form 8814, certain criteria must be met. The child must be under the age of 19 or under 24 if they are a full-time student. Additionally, the child's total unearned income must not exceed $11,000 for the tax year. Parents should also ensure they provide more than half of the child's support during the year to be eligible to report the income on their tax return.

Create this form in 5 minutes or less

Find and fill out the correct form 8814 parents election to report childs interest and dividends

Create this form in 5 minutes!

How to create an eSignature for the form 8814 parents election to report childs interest and dividends

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8814 and how can airSlate SignNow help with it?

Form 8814 is used to report a child's unearned income on a parent's tax return. airSlate SignNow simplifies the process of filling out and eSigning Form 8814, ensuring that you can complete your tax documents quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for Form 8814?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have the tools necessary to manage Form 8814 efficiently.

-

What features does airSlate SignNow offer for managing Form 8814?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage Form 8814 and ensure that all parties can sign and submit the document seamlessly.

-

Can I integrate airSlate SignNow with other applications for Form 8814?

Absolutely! airSlate SignNow integrates with various applications, including CRM and accounting software. This allows you to streamline your workflow when handling Form 8814 and other important documents.

-

How does airSlate SignNow ensure the security of Form 8814 documents?

Security is a top priority for airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Form 8814 documents, ensuring that your sensitive information remains confidential.

-

Can I access Form 8814 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage Form 8814 from your smartphone or tablet. This flexibility ensures that you can complete your documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for Form 8814?

Using airSlate SignNow for Form 8814 offers numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. Our platform makes it easy to eSign and share documents, improving your overall efficiency.

Get more for Form 8814 Parents' Election To Report Child's Interest And Dividends

- Da form 5840

- Backflow prevention form city of round rock roundrocktexas

- 5e lesson plan sample pdf form

- Weaving calculation excel sheet form

- Kendriya vidyalaya worksheets for class 3 evs form

- 16comheif recordbook template docx goliad agrilife form

- Ushering agency registration form 275681439

- Daughters of utah pioneers minutes date form

Find out other Form 8814 Parents' Election To Report Child's Interest And Dividends

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word