California Part Year 2018

What is the California Part Year

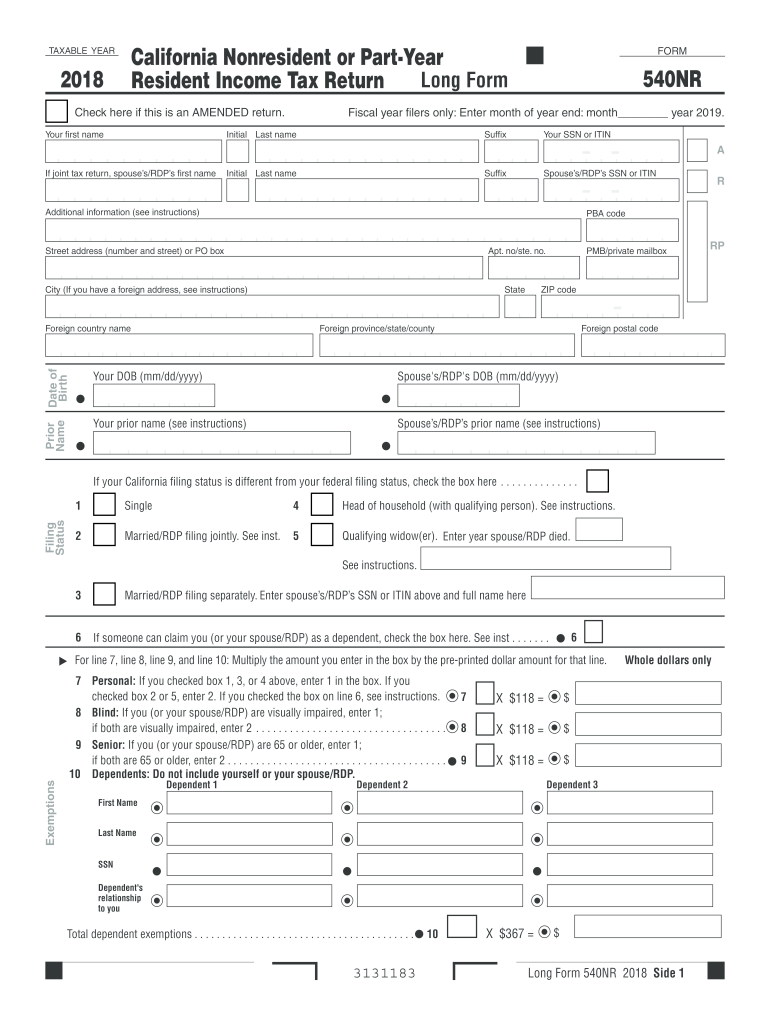

The California Part Year refers to a specific tax status for individuals who reside in California for only part of the year. This status is applicable to those who may have moved into or out of the state during the tax year. It allows taxpayers to report income earned while they were residents of California, ensuring they only pay taxes on income sourced within the state during the time they were living there.

How to use the California Part Year

To utilize the California Part Year status, taxpayers must complete the California Schedule CA 540NR form, which is designed for non-residents and part-year residents. This form enables individuals to accurately report their income, deductions, and credits that apply during their residency period. It is essential to gather all relevant income documentation for the time spent in California to ensure accurate reporting.

Steps to complete the California Part Year

Completing the California Schedule CA 540NR involves several key steps:

- Determine residency status: Confirm the dates of residency in California for the tax year.

- Gather income documents: Collect all W-2s, 1099s, and other income statements for the period of residency.

- Complete the form: Fill out the Schedule CA 540NR, ensuring to report only the income earned during your residency.

- Calculate deductions and credits: Identify any applicable deductions or credits that can be claimed for the time spent in California.

- Review and submit: Double-check all entries for accuracy before submitting the form to the California tax authorities.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the California Schedule CA 540NR. Typically, the deadline for submitting tax returns is April fifteenth of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also keep in mind any potential extensions that may apply, which can provide additional time for filing.

Required Documents

When filing the California Schedule CA 540NR, several documents are necessary to ensure a complete and accurate submission. These include:

- W-2 forms from employers for the period of residency.

- 1099 forms for any freelance or contract work performed.

- Records of any other income sources, such as rental income or investments.

- Documentation for deductions and credits, including receipts and statements.

Penalties for Non-Compliance

Failing to comply with the filing requirements for the California Schedule CA 540NR can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal consequences for fraudulent reporting. It is essential for taxpayers to ensure timely and accurate submissions to avoid these penalties.

Eligibility Criteria

To qualify for the California Part Year status, individuals must meet specific criteria. These include:

- Having a permanent residence in California for part of the tax year.

- Reporting only the income earned during the time of residency in California.

- Providing accurate documentation of residency dates and income sources.

Quick guide on how to complete california part year

Manage California Part Year effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle California Part Year on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and electronically sign California Part Year effortlessly

- Locate California Part Year and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign California Part Year and ensure effective communication during any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california part year

Create this form in 5 minutes!

How to create an eSignature for the california part year

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is 540nr and how does it relate to airSlate SignNow?

540nr is a unique designation for a specific type of document or transaction that can be processed using airSlate SignNow. With our service, users can easily eSign and manage these documents efficiently, streamlining the workflow for businesses.

-

What are the pricing options for using airSlate SignNow for 540nr documents?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes. Depending on your requirements for processing 540nr documents, you can select from monthly or annual subscriptions to find the best fit for your budget.

-

What features does airSlate SignNow provide for managing 540nr transactions?

Our platform includes various features tailored for handling 540nr transactions, such as customizable templates, automated workflows, and secure storage. These features make it easy for businesses to manage documents effectively and maintain compliance.

-

How does airSlate SignNow enhance the efficiency of processing 540nr documents?

By utilizing airSlate SignNow, businesses can drastically reduce the time spent on document processing for 540nr forms. Our intuitive interface and automation capabilities ensure that sending and eSigning documents is quick and hassle-free, improving overall productivity.

-

Can I integrate airSlate SignNow with other tools for managing 540nr documents?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and platforms, allowing you to manage 540nr documents alongside your existing systems. This capability enhances your workflow and ensures that all documents are synchronized for maximum efficiency.

-

What are the security measures in place for 540nr documents using airSlate SignNow?

airSlate SignNow implements advanced security protocols to protect your 540nr documents, including encryption and compliant storage solutions. Our focus on security ensures that your sensitive information remains safe throughout the signing process.

-

Is airSlate SignNow user-friendly for managing 540nr documents?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making it easy for anyone, regardless of technical expertise, to manage 540nr documents. Our straightforward interface empowers users to eSign and send documents without confusion.

Get more for California Part Year

- S1 forma pavyzdys

- Dealers motor vehicle inventory declaration confidential form

- Employee food safety education and training log form

- Form wf 257

- Progressive management application form

- Warrant of execution 60195365 form

- Drb alaska govdocsmaterialssoa verification of student status form please do not

- Claim of exemption lee county clerk of courts leeclerk form

Find out other California Part Year

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document