Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank

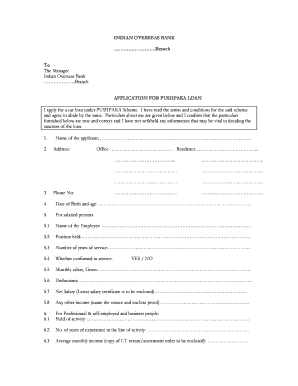

What is the Indian Overseas Bank Pushpaka Loan Scheme Application Form?

The Indian Overseas Bank Pushpaka Loan Scheme Application Form is a crucial document for individuals seeking financial assistance through this specific loan program. This scheme is designed to support various personal and business needs, providing eligible applicants with access to funds at competitive interest rates. The form collects essential information about the applicant, including personal details, financial status, and the purpose of the loan. Completing this application accurately is vital for a smooth approval process.

Steps to Complete the Indian Overseas Bank Pushpaka Loan Scheme Application Form

Filling out the Pushpaka Loan Scheme Application Form requires careful attention to detail. Follow these steps to ensure your application is complete:

- Gather necessary documents, such as identification proof, income statements, and any relevant financial records.

- Begin by filling in your personal information, including your name, address, and contact details.

- Provide details about your financial situation, including income sources and existing debts.

- Clearly state the purpose of the loan and the amount you wish to borrow.

- Review the completed form for accuracy and completeness before submission.

Eligibility Criteria for the Indian Overseas Bank Pushpaka Loan Scheme

To qualify for the Pushpaka Loan Scheme, applicants must meet specific eligibility requirements. These typically include:

- Age: Applicants should be at least eighteen years old.

- Citizenship: Only Indian citizens can apply for this scheme.

- Income: A stable income source is necessary to demonstrate repayment capability.

- Credit History: A good credit score may be required to secure favorable loan terms.

How to Obtain the Indian Overseas Bank Pushpaka Loan Scheme Application Form

The application form for the Pushpaka Loan Scheme can be obtained through several channels. Applicants can:

- Visit the nearest Indian Overseas Bank branch to request a physical copy of the form.

- Download the form from the official Indian Overseas Bank website if available.

- Contact the bank's customer service for assistance in obtaining the form.

Legal Use of the Indian Overseas Bank Pushpaka Loan Scheme Application Form

The Pushpaka Loan Scheme Application Form is legally binding once submitted. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions or denial of the loan application. Additionally, the use of electronic signatures can enhance the legal validity of the application, provided that the signing process complies with relevant eSignature laws.

Form Submission Methods for the Indian Overseas Bank Pushpaka Loan Scheme

Applicants have various options for submitting the Pushpaka Loan Scheme Application Form. These methods include:

- Online submission through the Indian Overseas Bank's official website, if available.

- Mailing the completed form to the designated loan processing center.

- In-person submission at any Indian Overseas Bank branch.

Quick guide on how to complete pushpaka bloanb scheme bapplicationb form indian overseas bank

Finish Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank effortlessly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank easily

- Find Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, lengthy form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank and ensure smooth communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pushpaka bloanb scheme bapplicationb form indian overseas bank

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is the Indian Overseas Bank scheme?

The Indian Overseas Bank scheme offers a variety of financial services tailored to meet the needs of customers. This includes loans, savings accounts, and investment products designed to assist individuals and businesses. By understanding the specifics of the Indian Overseas Bank scheme, customers can choose the best options available for their financial goals.

-

What are the key features of the Indian Overseas Bank scheme?

The Indian Overseas Bank scheme includes features like competitive interest rates, flexible repayment options, and diverse product offerings. Customers also benefit from online banking facilities that simplify managing their accounts. These features make the Indian Overseas Bank scheme appealing for both personal and commercial use.

-

How can the Indian Overseas Bank scheme benefit businesses?

Businesses can leverage the Indian Overseas Bank scheme for better cash flow management and funding opportunities. With various loan products and operational accounts, companies can optimize their financial strategies. This support makes the Indian Overseas Bank scheme an essential partner for business growth.

-

What are the pricing options associated with the Indian Overseas Bank scheme?

Pricing for the Indian Overseas Bank scheme varies depending on the type of financial product selected, such as loans or accounts. Generally, the scheme offers competitive pricing with minimal fees, ensuring that clients can maximize their returns. Prospective customers should review the specific terms related to each product to understand the pricing structure better.

-

Are there any required documents to apply for the Indian Overseas Bank scheme?

To apply for the Indian Overseas Bank scheme, applicants typically need to provide identification documents, income proof, and any relevant financial statements. These requirements may vary based on the type of service requested. It's advisable to check with the bank for a detailed list of documentation needed for a smooth application process.

-

Can I integrate airSlate SignNow with the Indian Overseas Bank scheme?

Yes, integrating airSlate SignNow with the Indian Overseas Bank scheme can streamline your document signing process. This integration allows users to eSign essential documents related to banking and finance without leaving the platform. By using airSlate SignNow, customers can enhance their experience with the Indian Overseas Bank scheme.

-

How does the Indian Overseas Bank scheme compare with other banking services?

The Indian Overseas Bank scheme stands out because of its comprehensive offerings tailored to various customer needs. Compared to other banks, this scheme provides competitive rates and personalized services that cater to both personal and commercial sectors. Evaluating these features helps customers determine the best fit for their financial requirements.

Get more for Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank

- California notary public application form wikiform

- Diary of two motorcycle hobos form

- Citizenship application form online spore citizenship

- Mesa gateway badging office form

- Environmental assessment worksheet city of st cloud mn form

- Transcript request form bishop kearney

- Fish health certificate 129579 form

- Town of clarkstown alarm permit form

Find out other Pushpaka BLoanb Scheme BApplicationb Form Indian Overseas Bank

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe