Llc 12 Form

What is the statement of information?

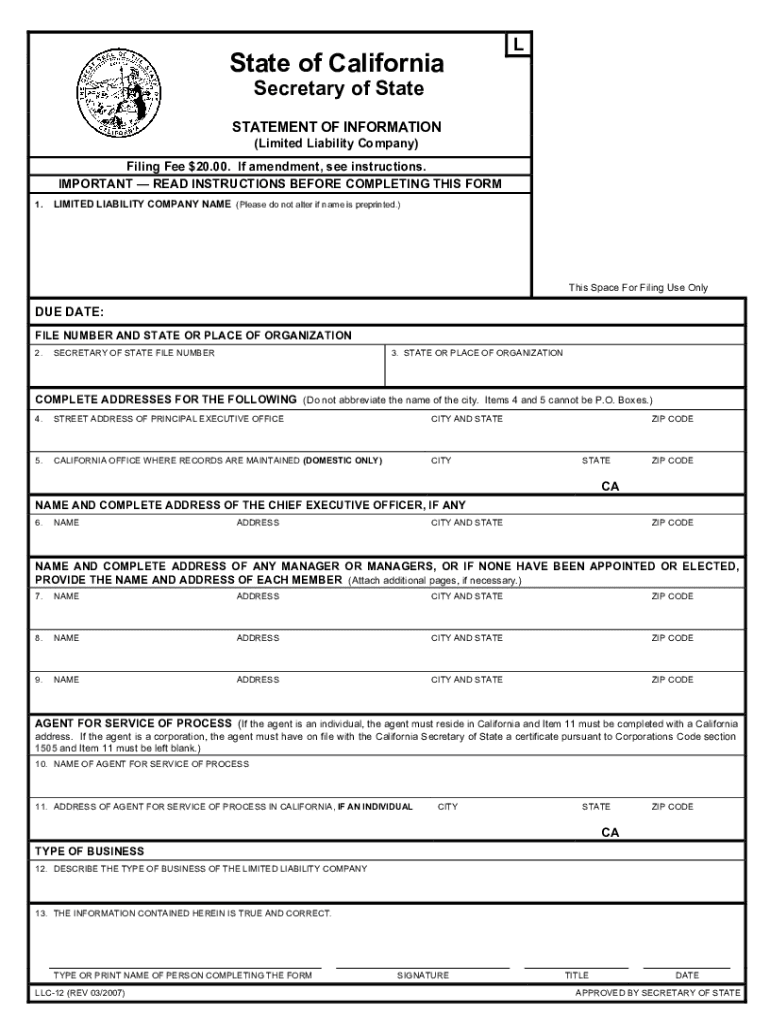

The statement of information is a crucial document that provides essential details about a business entity, such as its name, address, and management structure. In the context of California, the statement of information form is specifically designed for limited liability companies (LLCs) and corporations. This form is typically required to be filed with the Secretary of State to ensure that the state has up-to-date records of the business. Failing to submit this form can lead to penalties, including the suspension of the business entity's rights to operate.

Steps to complete the statement of information form

Completing the statement of information form involves several key steps. First, gather all necessary information about your business, including the entity's name, address, and the names and addresses of its officers or members. Next, access the appropriate form, which can usually be found on the Secretary of State's website. Fill out the form accurately, ensuring that all information is current and correct. Once completed, you can submit the form either online or by mail, depending on your preference. Be mindful of any filing deadlines to avoid late fees.

Legal use of the statement of information

The statement of information serves a legal purpose by ensuring compliance with state regulations. It provides transparency regarding the management and structure of a business entity, which is vital for legal and financial accountability. By filing this document, businesses affirm their legitimacy and commitment to operating within the legal framework established by state law. This legal acknowledgment can be important for securing contracts, loans, and other business opportunities.

Required documents for filing the statement of information

When preparing to file the statement of information, certain documents may be required to support the information provided. Typically, you will need the business's formation documents, such as the Articles of Organization for an LLC or Articles of Incorporation for a corporation. Additionally, having identification documents for the officers or members listed in the form can facilitate the process. It is advisable to review the specific requirements outlined by the state to ensure all necessary documentation is included.

Filing deadlines for the statement of information

Filing deadlines for the statement of information can vary based on the type of business entity and the state in which it operates. In California, for instance, LLCs must file their statement of information within 90 days of formation and then every two years thereafter. Corporations typically have similar requirements, with initial filings due within a specific time frame after incorporation. Keeping track of these deadlines is essential to avoid penalties and maintain good standing with state authorities.

Examples of using the statement of information

Businesses may use the statement of information in various scenarios. For instance, a newly formed LLC must file its statement to establish its existence legally. An existing corporation may need to update its statement to reflect changes in management or address. Additionally, potential investors or partners may request a copy of the statement of information to verify the legitimacy and structure of a business before entering into agreements. This document plays a vital role in fostering trust and transparency in business operations.

Quick guide on how to complete complete the statement of information form llc 12 as follows

Complete Llc 12 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, since you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to generate, alter, and electronically sign your documents swiftly without interruptions. Handle Llc 12 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Llc 12 with ease

- Obtain Llc 12 and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Llc 12 and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

What is the best way to describe type of business in LLC-12 statement of information if you plan on doing multiple businesses under one LLC?

A2A - I’ve no idea what LLC-12 is. Assuming that it is the state mandated articles of organization. That being the case I am going to refuse to answer your question as a favor to you. You are contemplating a potentially extremely complex tax and legal situation. Contact competent legal and tax advisors for their assistance.FYI - I’m a firm believer in the KISS principle - Keep it simple stupid. The nested structure can potentially be pierced if not run properly and thus subject all the underlying LLCs to the same suit ie. a suit against 1 risks all. Additionally, this structure WILL probably increase your accounting and tax work fees almost by a factor of two. You are talking about consolidation work here. Complex. Very complex. Generally. I’d NOT recommend doing it that way. KISS IT.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

Are there any chances to fill out the improvement form for 2019 of the RBSE board for 12 class?

Hari om, you are asking a question as to : “ Are there any chancesto fill out the improvement form for 2019 of the RBSE Board for 12 class?”. Hari om. Hari om.ANSWER :Browse through the following links for further details regarding the answers to your questions on the improvement exam for class 12 of RBSE 2019 :how to give improvement exams in rbse class 12is there a chance to fill rbse improvement form 2019 for a 12th class studentHari om.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the complete the statement of information form llc 12 as follows

How to make an eSignature for your Complete The Statement Of Information Form Llc 12 As Follows online

How to generate an electronic signature for your Complete The Statement Of Information Form Llc 12 As Follows in Google Chrome

How to generate an electronic signature for putting it on the Complete The Statement Of Information Form Llc 12 As Follows in Gmail

How to generate an electronic signature for the Complete The Statement Of Information Form Llc 12 As Follows from your mobile device

How to generate an eSignature for the Complete The Statement Of Information Form Llc 12 As Follows on iOS devices

How to create an electronic signature for the Complete The Statement Of Information Form Llc 12 As Follows on Android OS

People also ask

-

What is a statement of information in the context of airSlate SignNow?

A statement of information is a document that provides essential details about a business, such as ownership and structure. With airSlate SignNow, you can easily create, send, and eSign your statement of information securely, ensuring compliance and accuracy in your business documentation.

-

How does airSlate SignNow handle the security of my statement of information?

Security is a top priority at airSlate SignNow. Your statement of information is protected through advanced encryption methods, ensuring that all data is transmitted securely and accessed only by authorized personnel.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs. You can select a plan based on your expected usage, including features associated with the creation and management of documents like your statement of information.

-

Can I customize my statement of information templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your statement of information templates easily. You can add your branding, adjust fields, and ensure that all necessary information is included to suit your specific business requirements.

-

What are the benefits of eSigning my statement of information with airSlate SignNow?

eSigning your statement of information with airSlate SignNow streamlines the signing process, making it faster and more efficient. You can get documents signed from anywhere, reducing the need for physical meetings and expediting your business operations.

-

Does airSlate SignNow integrate with other tools I use for business?

Yes, airSlate SignNow seamlessly integrates with numerous business applications, enabling you to manage your statement of information and other documents alongside your existing workflows. This integration enhances productivity by minimizing the need for switching between platforms.

-

Is there a mobile app for eSigning my statement of information?

Absolutely! airSlate SignNow offers a mobile app that allows you to eSign your statement of information on-the-go. This feature provides convenience and flexibility, enabling you to manage your documents from anywhere at any time.

Get more for Llc 12

- Instructions colorado department of revenue coloradogov form

- Pdf b o ok colorado department of revenue coloradogov form

- Pdf payment payment colorado department of revenue form

- 2020 form 763s virginia special nonresident claim for individual income tax withheld virginia special nonresident claim for

- 2020 form 760 resident individual income tax booklet form 760 2020 resident individual income tax booklet

- Fillable online fs form 1851 revised june 2020 fax email print

- Dnr wisconsin department of health services form

- 2019 new jersey amended resident income tax return form

Find out other Llc 12

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple