TREASURY Michigan Income Tax Filing Requirements of Flow 2020

What is the TREASURY Michigan Income Tax Filing Requirements Of Flow

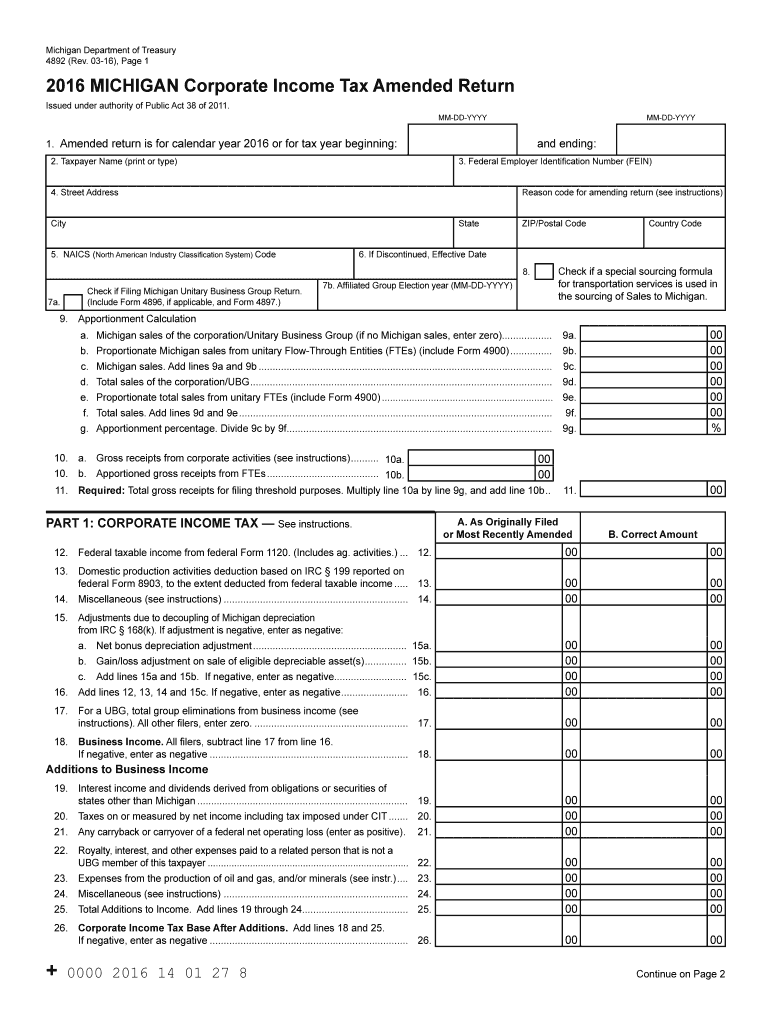

The TREASURY Michigan Income Tax Filing Requirements Of Flow is a specific form used by residents of Michigan to report their income and calculate their state tax obligations. This form is essential for ensuring compliance with Michigan tax laws and is required for individuals, businesses, and other entities that earn income within the state. The form outlines the necessary information that taxpayers must provide, including income sources, deductions, and credits applicable to their situation.

Steps to complete the TREASURY Michigan Income Tax Filing Requirements Of Flow

Completing the TREASURY Michigan Income Tax Filing Requirements Of Flow involves several key steps:

- Gather all necessary documentation, including W-2 forms, 1099 forms, and records of any deductions or credits.

- Fill out the form accurately, ensuring that all income sources are reported and deductions claimed are valid.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the form either electronically or via mail according to the guidelines provided by the Michigan Department of Treasury.

Required Documents

To complete the TREASURY Michigan Income Tax Filing Requirements Of Flow, taxpayers need to prepare several documents:

- W-2 forms from employers showing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions, such as receipts for medical expenses or charitable contributions.

- Previous year’s tax return for reference.

Legal use of the TREASURY Michigan Income Tax Filing Requirements Of Flow

The TREASURY Michigan Income Tax Filing Requirements Of Flow is legally binding when completed and submitted according to state regulations. To ensure its legal standing, it must be filled out truthfully and accurately. Any discrepancies or false information can lead to penalties or legal repercussions. Additionally, the form must be signed by the taxpayer or an authorized representative to validate its authenticity.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when filing the TREASURY Michigan Income Tax Filing Requirements Of Flow. Typically, the deadline for filing is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It's crucial to stay informed about any changes to these dates, as late submissions can incur penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The TREASURY Michigan Income Tax Filing Requirements Of Flow can be submitted through various methods:

- Online submission via the Michigan Department of Treasury's e-filing system.

- Mailing the completed form to the designated address provided by the state.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete treasury michigan income tax filing requirements of flow

Effortlessly Manage TREASURY Michigan Income Tax Filing Requirements Of Flow on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage TREASURY Michigan Income Tax Filing Requirements Of Flow on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign TREASURY Michigan Income Tax Filing Requirements Of Flow with Ease

- Locate TREASURY Michigan Income Tax Filing Requirements Of Flow and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data using tools specifically designed for this by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign TREASURY Michigan Income Tax Filing Requirements Of Flow to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct treasury michigan income tax filing requirements of flow

Create this form in 5 minutes!

How to create an eSignature for the treasury michigan income tax filing requirements of flow

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What are the TREASURY Michigan Income Tax Filing Requirements Of Flow?

The TREASURY Michigan Income Tax Filing Requirements Of Flow include various criteria set by the Michigan Department of Treasury. These requirements typically involve the filing process for individuals and businesses, eligibility for deductions, and deadlines for submissions. It is essential to understand these rules to ensure compliance and avoid penalties.

-

How does airSlate SignNow support compliance with the TREASURY Michigan Income Tax Filing Requirements Of Flow?

airSlate SignNow provides an efficient platform to manage your document workflows, ensuring that all necessary forms are correctly completed. Our solution allows for easy eSigning and document sharing, which can help you meet your TREASURY Michigan Income Tax Filing Requirements Of Flow seamlessly. This minimizes the risk of errors and ensures timely submissions.

-

What features does airSlate SignNow offer for managing tax documents related to TREASURY Michigan Income Tax Filing Requirements Of Flow?

airSlate SignNow offers features such as customizable templates, advanced eSigning capabilities, and secure cloud storage to assist with TREASURY Michigan Income Tax Filing Requirements Of Flow. These functionalities make document management more efficient and reliable for tax filings. Additionally, our integration options facilitate streamlined workflows with other tax-related software.

-

What benefits can businesses expect from using airSlate SignNow for their TREASURY Michigan Income Tax Filing Requirements Of Flow?

Businesses using airSlate SignNow benefit from a simplified document management process that saves time and reduces operational costs. By ensuring compliance with the TREASURY Michigan Income Tax Filing Requirements Of Flow, businesses can minimize the chances of costly mistakes. Furthermore, our user-friendly interface promotes efficiency and enhances overall productivity.

-

Are there any integration options with airSlate SignNow for handling TREASURY Michigan Income Tax Filing Requirements Of Flow?

Yes, airSlate SignNow integrates easily with various accounting and tax software to facilitate the handling of TREASURY Michigan Income Tax Filing Requirements Of Flow. This integration ensures that data flows seamlessly between platforms, reducing redundancy and saving time during the filing process. Our goal is to provide a cohesive experience that meets all your compliance needs.

-

What is the pricing structure for using airSlate SignNow in relation to TREASURY Michigan Income Tax Filing Requirements Of Flow?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring accessibility for managing TREASURY Michigan Income Tax Filing Requirements Of Flow. Our flexible pricing allows businesses to choose plans that align with their document management volume and requirements. Contact our sales team for more information on plans that would best suit your business.

-

Can airSlate SignNow help individuals understand their TREASURY Michigan Income Tax Filing Requirements Of Flow?

Absolutely! airSlate SignNow provides resources and customer support that can guide individuals through the TREASURY Michigan Income Tax Filing Requirements Of Flow. Our platform helps users understand necessary forms and deadlines, ensuring an informed and compliant tax filing experience. We strive to make tax management accessible for all.

Get more for TREASURY Michigan Income Tax Filing Requirements Of Flow

- Minor project permit application adirondack park agency ny gov form

- Click on the application link here local 519 form

- Port st lucie product approval affidavit form

- Background screening renewal form cloudfront net

- Affidavit of domestic partnership miami dade county pdfs dadeschools form

- Scgaa form

- Electrical permit application form

- Community servicevolunteer log sheet walton baseball waltonbaseball form

Find out other TREASURY Michigan Income Tax Filing Requirements Of Flow

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form