, Form or 20, Oregon Corporation Excise Tax Return, 150 102 020 2020

What is the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

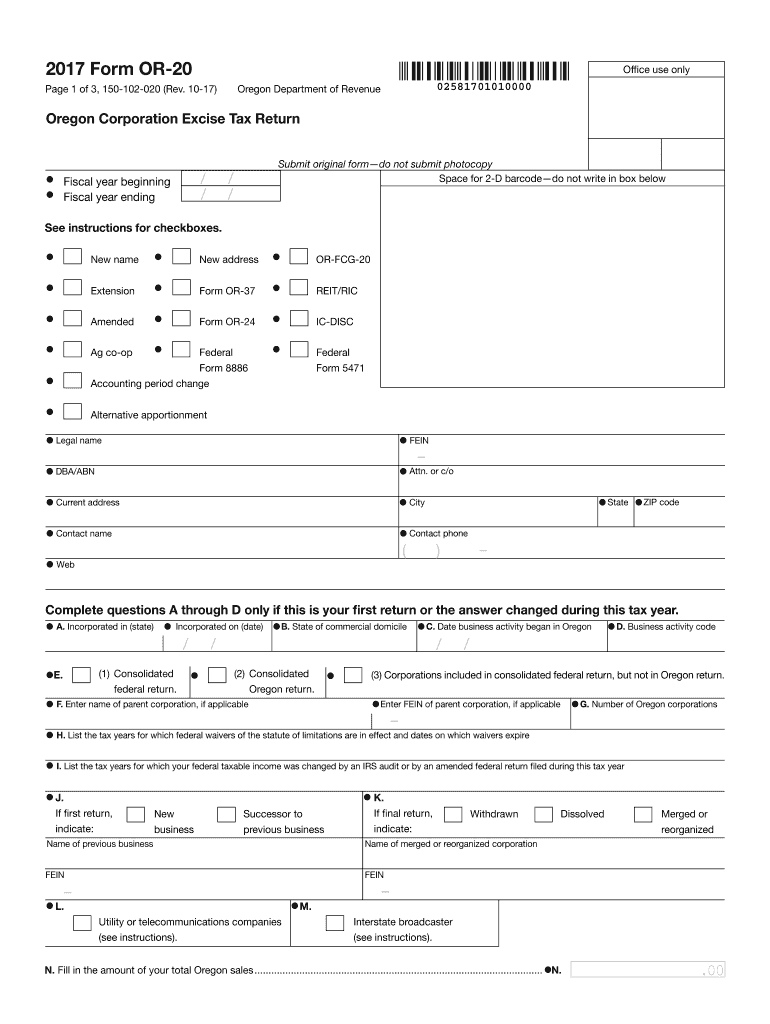

The Form OR 20, Oregon Corporation Excise Tax Return, is a tax document that corporations operating in Oregon must file annually. This form is used to report the corporation's income, deductions, and tax liability to the Oregon Department of Revenue. It is essential for ensuring compliance with state tax laws and for calculating the excise tax owed by the corporation based on its net income.

How to use the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

Using the Form OR 20 involves several steps. First, gather all necessary financial information, including income statements, balance sheets, and any relevant deductions. Next, download the form from the Oregon Department of Revenue website or obtain a physical copy. Fill out the form accurately, ensuring all financial data is complete and correct. After completing the form, review it for accuracy before submitting it to the state.

Steps to complete the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

Completing the Form OR 20 requires careful attention to detail. Follow these steps:

- Gather financial documents, including profit and loss statements and balance sheets.

- Download the Form OR 20 from the Oregon Department of Revenue website.

- Fill in the corporation's name, address, and federal employer identification number (EIN).

- Report total income, including all sources of revenue.

- Detail allowable deductions, such as business expenses and losses.

- Calculate the net income and the corresponding excise tax owed.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form OR 20. Generally, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, the deadline is April 15. It is crucial to file on time to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the Form OR 20 on time can result in significant penalties. The Oregon Department of Revenue may impose a late filing penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest will accrue on any unpaid taxes from the due date until payment is made. Corporations should ensure timely submission to avoid these financial repercussions.

Digital vs. Paper Version

Corporations have the option to submit the Form OR 20 either digitally or via paper. The digital version allows for quicker processing and may reduce the risk of errors. Filing electronically typically provides immediate confirmation of receipt. Conversely, paper submissions may take longer to process and can be subject to mailing delays. Corporations should consider their preferences and capabilities when choosing the submission method.

Quick guide on how to complete 2017 form or 20 oregon corporation excise tax return 150 102 020

Finish , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 effortlessly on any gadget

Digital document management has become favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without holdups. Handle , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The simplest method to alter and electronically sign , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 without hassle

- Find , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 and click on Obtain Form to initiate.

- Utilize the tools we offer to finish your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Completed button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Modify and electronically sign , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form or 20 oregon corporation excise tax return 150 102 020

Create this form in 5 minutes!

How to create an eSignature for the 2017 form or 20 oregon corporation excise tax return 150 102 020

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

The Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 is a tax document that corporations in Oregon must file to report their income and calculate their excise tax. This form is essential for compliance with Oregon tax laws, helping businesses accurately report their earnings to the state. Understanding this form is crucial for any corporation operating in Oregon.

-

How can airSlate SignNow help with the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

airSlate SignNow simplifies the process of preparing and submitting the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020. With our eSignature solution, businesses can easily send and sign the necessary documents online, ensuring a smoother filing process without the hassle of paperwork. This efficiency can save valuable time for corporations during tax season.

-

Are there any pricing options for using airSlate SignNow to handle the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our pricing is competitive, providing an affordable solution for eSigning and document management, including the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020. You can choose a plan that suits your requirements and budget.

-

What features does airSlate SignNow offer that assist with tax documents like Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

airSlate SignNow provides features such as eSignature capabilities, secure document storage, and automated workflows, which are essential for managing tax documents like the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020. These tools enhance productivity and decrease the likelihood of errors during tax preparation and submission.

-

Can airSlate SignNow integrate with accounting software for filing the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enabling users to streamline their workflow while preparing the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020. This integration ensures that all relevant financial data is easily accessible and organized, making tax filings more efficient.

-

What are the benefits of using airSlate SignNow for the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

Using airSlate SignNow offers numerous benefits such as time savings, increased accuracy, and enhanced compliance when preparing the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020. Its user-friendly platform allows for quick eSigning and document management, ensuring your filings are handled with care and efficiency.

-

Is airSlate SignNow secure for handling sensitive tax documents like Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020?

Yes, airSlate SignNow prioritizes security, ensuring that all sensitive tax documents, including the Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020, are protected. We employ advanced encryption and secure data storage practices to keep your information safe and comply with regulatory requirements.

Get more for , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

- This form is for use in nominating or requesting determinationamp39 5 5 5l 1amp39 nationalregister sc

- Soccer coach contract template 787755433 form

- Soccer football player contract template form

- Social contract template form

- Social classroom contract template form

- Soccer player contract template 787755436 form

- Social for middle school contract template form

- Social media agency contract template form

Find out other , Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself