a Complete Tax Exemption Certificate Form 721 C 2020

What is the A Complete Tax Exemption Certificate Form 721 C

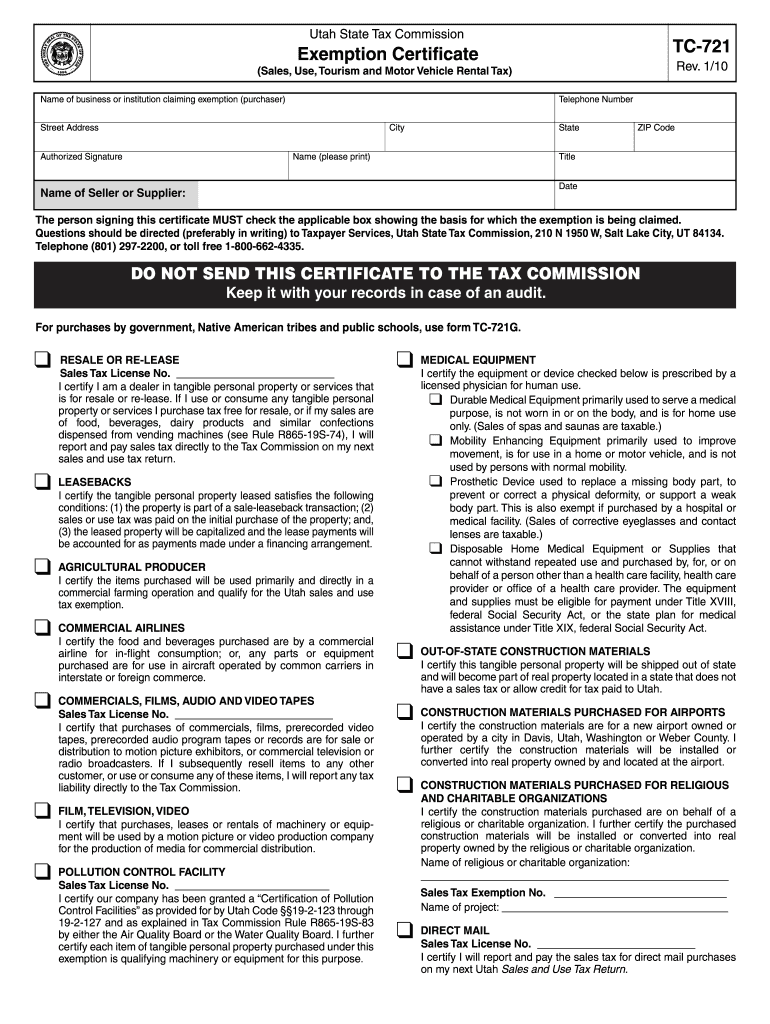

The A Complete Tax Exemption Certificate Form 721 C is a crucial document used in the United States for claiming tax exemption on certain transactions. This form is primarily utilized by organizations that qualify for tax-exempt status, allowing them to make purchases without incurring sales tax. The form serves as proof of the entity's tax-exempt status and is essential for compliance with state tax regulations.

How to use the A Complete Tax Exemption Certificate Form 721 C

To effectively use the A Complete Tax Exemption Certificate Form 721 C, individuals or organizations must fill it out accurately and present it to vendors when making tax-exempt purchases. It is important to ensure that all required information is provided, including the name of the exempt organization, the type of exemption, and the signature of an authorized representative. This form must be presented at the time of purchase to avoid sales tax charges.

Steps to complete the A Complete Tax Exemption Certificate Form 721 C

Completing the A Complete Tax Exemption Certificate Form 721 C involves several key steps:

- Obtain the form from a reliable source or download it from the appropriate state tax authority website.

- Fill in the name and address of the exempt organization accurately.

- Indicate the type of exemption being claimed, ensuring it aligns with the organization's status.

- Provide the signature of an authorized representative, along with their title and date.

- Review the completed form for accuracy before submission.

Key elements of the A Complete Tax Exemption Certificate Form 721 C

The A Complete Tax Exemption Certificate Form 721 C contains several key elements that must be included for it to be valid:

- Organization Name: The legal name of the tax-exempt organization.

- Address: The physical address of the organization.

- Exemption Type: A clear indication of the type of exemption being claimed.

- Authorized Signature: The signature of a person authorized to act on behalf of the organization.

- Date: The date the form is completed and signed.

Legal use of the A Complete Tax Exemption Certificate Form 721 C

The legal use of the A Complete Tax Exemption Certificate Form 721 C is essential for organizations seeking to make tax-exempt purchases. This form must be used in accordance with state laws governing tax exemptions. Failure to comply with these regulations can result in penalties or the denial of tax-exempt status. It is crucial for organizations to maintain accurate records of all transactions involving this form to ensure legal compliance.

Eligibility Criteria

Eligibility to use the A Complete Tax Exemption Certificate Form 721 C typically requires that the organization be recognized as tax-exempt under applicable federal or state laws. Common qualifying entities include non-profit organizations, educational institutions, and government agencies. Each state may have specific criteria regarding the types of organizations that can claim tax exemption, so it is important to verify eligibility based on local regulations.

Quick guide on how to complete a complete tax exemption certificate form 721 c

Handle A Complete Tax Exemption Certificate Form 721 C seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage A Complete Tax Exemption Certificate Form 721 C on any device with airSlate SignNow's Android or iOS apps and streamline any document-related process today.

How to edit and eSign A Complete Tax Exemption Certificate Form 721 C effortlessly

- Obtain A Complete Tax Exemption Certificate Form 721 C and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign A Complete Tax Exemption Certificate Form 721 C and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a complete tax exemption certificate form 721 c

Create this form in 5 minutes!

How to create an eSignature for the a complete tax exemption certificate form 721 c

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

At what age do you stop paying property taxes in California?

Senior Tax Exemptions in California The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

-

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

-

How long is a Colorado sales tax exemption certificate good for?

No fee is required for this exemption certificate and it does not expire.

-

How do I claim my senior property tax exemption in California?

Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office. Once the exemption has been granted, it remains effective until a change in eligibility occurs, such as selling or moving out of the home. Annual filing is not required.

-

What is the property tax loophole in California?

19 would narrow California's property tax inheritance loophole, which offers Californians who inherit certain properties a signNow tax break by allowing them to pay property taxes based on the property's value when it was originally purchased rather than its value upon inheritance.

-

How do I become exempt from property taxes in California?

The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.

-

How do you qualify for property tax exemption in California?

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

-

How to get a tax exemption certificate in the Philippines?

Certification of Low Income/No Income signed by the Barangay Chairman of the place where the applicant resides; Duly signNowd Affidavit of Low Income/No Income from the Notary Public; Request Letter; Photocopy of Identification Card with three (3) specimen signature; Payment of Certification Fee (P100.

Get more for A Complete Tax Exemption Certificate Form 721 C

- Arkansas state vehicle safety program authorizatio form

- Last six digits of vin form

- South florida regional transportation authority form

- State of florida department of transportationweldi form

- To download pdf version alaska trailer rentals anchorage ak form

- Multi purpose affidavit pinellas county tax collector form

- To download pdf driver39s safety performance form gasrt com

- Offices locations minnesota department of public safety form

Find out other A Complete Tax Exemption Certificate Form 721 C

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares