Mining License Tax Return Instructions Alaska Department of 2018

What is the Mining License Tax Return Instructions from the Alaska Department Of Revenue?

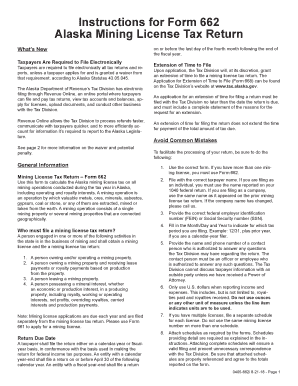

The Mining License Tax Return Instructions provided by the Alaska Department Of Revenue serve as a comprehensive guide for businesses engaged in mining activities within Alaska. This document outlines the necessary steps and requirements for filing the Mining License Tax Return, ensuring compliance with state regulations. It includes detailed information on tax rates, allowable deductions, and the calculation of the tax owed based on the gross value of minerals produced. Understanding these instructions is crucial for accurate reporting and fulfilling tax obligations.

Steps to Complete the Mining License Tax Return Instructions from the Alaska Department Of Revenue

Completing the Mining License Tax Return involves several key steps. First, gather all necessary financial records related to mining operations, including production reports and sales data. Next, refer to the instructions to determine the applicable tax rates and any deductions you may qualify for. Fill out the return form accurately, ensuring all calculations are correct. After completing the form, review it for any errors before submission. Finally, submit the return by the specified deadline to avoid penalties.

Required Documents for the Mining License Tax Return Instructions from the Alaska Department Of Revenue

To successfully file the Mining License Tax Return, certain documents are required. These typically include:

- Production reports detailing the quantity and value of minerals extracted.

- Sales records that document revenue generated from mining activities.

- Any supporting documentation for deductions claimed, such as expenses related to mining operations.

- Previous years' tax returns for reference and consistency in reporting.

Having these documents ready will streamline the filing process and ensure compliance with state regulations.

Filing Deadlines for the Mining License Tax Return Instructions from the Alaska Department Of Revenue

Filing deadlines for the Mining License Tax Return are crucial to avoid penalties. Typically, the return is due on or before March 31 of the year following the tax year. It is important to keep track of these dates and ensure that all necessary documentation is submitted on time. Late submissions may incur additional fees and interest on any unpaid taxes.

Penalties for Non-Compliance with the Mining License Tax Return Instructions from the Alaska Department Of Revenue

Failure to comply with the Mining License Tax Return instructions can result in significant penalties. These may include:

- Monetary fines for late filing or failure to file.

- Interest charges on unpaid taxes, which can accumulate over time.

- Potential legal action for continued non-compliance.

It is essential to adhere to the guidelines to avoid these repercussions and maintain good standing with the Alaska Department Of Revenue.

Legal Use of the Mining License Tax Return Instructions from the Alaska Department Of Revenue

The Mining License Tax Return Instructions are legally binding documents that outline the obligations of mining businesses in Alaska. Compliance with these instructions is necessary to ensure that all tax liabilities are met according to state law. The instructions also provide guidance on how to properly report income and expenses related to mining activities, which is essential for legal and financial accountability.

Quick guide on how to complete mining license tax return instructions alaska department of

Effortlessly Prepare Mining License Tax Return Instructions Alaska Department Of on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without any holdups. Handle Mining License Tax Return Instructions Alaska Department Of on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Efficiently Modify and Electronically Sign Mining License Tax Return Instructions Alaska Department Of with Ease

- Locate Mining License Tax Return Instructions Alaska Department Of and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Mining License Tax Return Instructions Alaska Department Of to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mining license tax return instructions alaska department of

Create this form in 5 minutes!

How to create an eSignature for the mining license tax return instructions alaska department of

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What are the 2018 662i instructions for the 662 license tax return?

The 2018 662i instructions provide detailed guidance on how to complete the 662 license tax return. This includes information on necessary forms, deadlines, and common errors to avoid. Understanding these instructions can help ensure compliance and prevent potential fines.

-

How can I perform a 662 license tax return search?

To perform a 662 license tax return search, you’ll need to visit the appropriate state tax website or utilize specialized search tools that offer tax return information. Make sure to have necessary identifiers, such as your tax ID or business name. This process can help you verify your tax return status or discover outstanding tax obligations.

-

What benefits does airSlate SignNow offer for submitting the 662 license tax return?

AirSlate SignNow streamlines the process of signing and submitting the 662 license tax return by providing an easy-to-use digital platform. This eliminates the need for printing and scanning, making the submission faster and more efficient. With airSlate SignNow, you can ensure your documents are securely signed and sent on time.

-

Is airSlate SignNow suitable for businesses filing 662 license tax returns?

Yes, airSlate SignNow is an excellent choice for businesses filing 662 license tax returns. Its user-friendly interface and robust eSigning capabilities allow for quick document completion. Additionally, businesses can save time and resources by managing their tax returns online.

-

What pricing plans does airSlate SignNow offer?

AirSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan provides essential features for managing documents and eSigning, including custom branding and integrations, making it a cost-effective solution for those needing assistance with the 662 license tax return process.

-

Can I integrate airSlate SignNow with my accounting software for easier tax return processing?

Absolutely, airSlate SignNow integrates seamlessly with many popular accounting software platforms. This allows you to import necessary documents and expedite the 662 license tax return process. Integrating our solution can enhance your workflow and ensure accuracy in your submissions.

-

How secure is airSlate SignNow for handling sensitive tax documents?

AirSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your sensitive tax documents. When dealing with 662 license tax return filings, you can trust that your information is safeguarded against unauthorized access. We prioritize your security and confidentiality.

Get more for Mining License Tax Return Instructions Alaska Department Of

Find out other Mining License Tax Return Instructions Alaska Department Of

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself