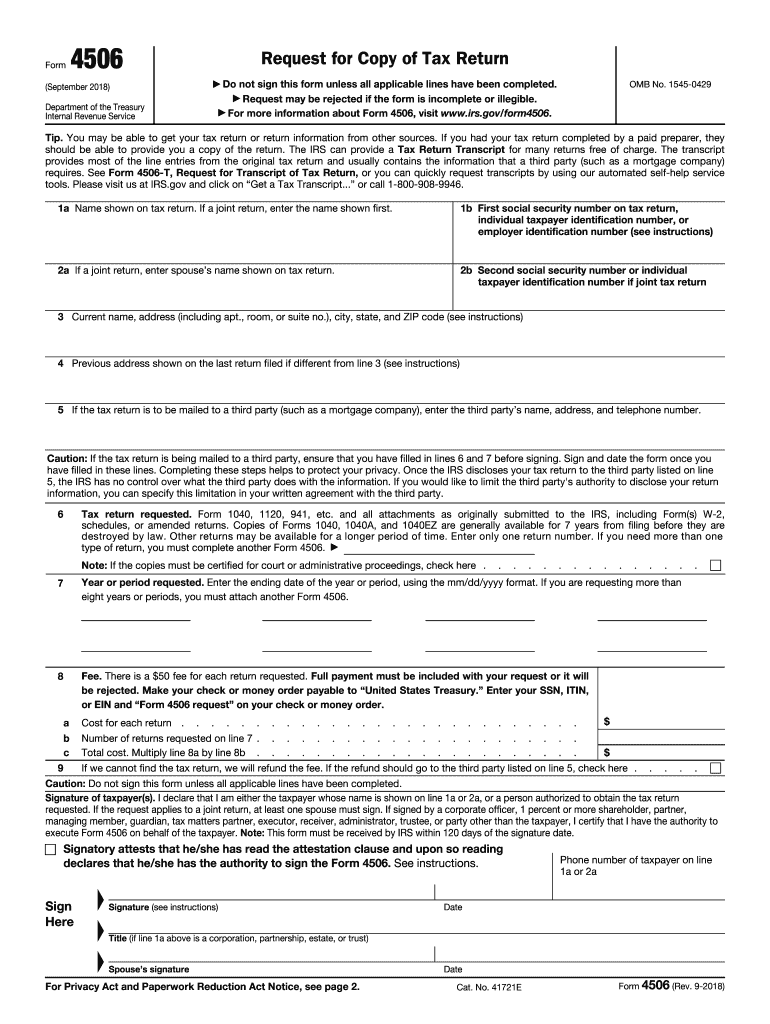

Irs Form 4506 for 2018

What is the IRS Form 4506?

The IRS Form 4506 is a request for a copy of your tax return. This form is essential for individuals who need to obtain copies of their past tax returns for various reasons, such as applying for loans, verifying income, or resolving tax issues. By submitting this form, taxpayers can request copies of their federal tax returns, including any attachments, for specific years, including 2017. Understanding this form's purpose is crucial for ensuring that you have the necessary documentation for your financial needs.

How to Use the IRS Form 4506

To use the IRS Form 4506 effectively, you must complete it accurately. Start by filling in your personal information, including your name, address, and Social Security number. Specify the tax years for which you need copies, such as 2017. You can also indicate whether you want the copies sent directly to you or to a third party. After completing the form, sign and date it to validate your request. Be mindful of any fees that may apply for processing your request. Submitting the form correctly is essential for obtaining your tax return copies without delays.

Steps to Complete the IRS Form 4506

Completing the IRS Form 4506 involves several straightforward steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your personal details in the designated sections.

- Clearly indicate the years for which you are requesting copies, including 2017.

- Decide whether the copies should be sent to you or a third party.

- Sign and date the form to confirm your identity and request.

- Submit the completed form to the IRS address specified in the instructions.

Form Submission Methods

You can submit the IRS Form 4506 through various methods. The most common options include:

- By Mail: Send the completed form to the address provided in the instructions. Ensure you use the correct address based on your location and the tax years requested.

- Online: While the IRS does not allow direct online submissions of Form 4506, you can use IRS e-services to access your tax information if you have an online account.

- In-Person: Visit your local IRS office to submit the form in person, although this may require an appointment.

Required Documents

When requesting a copy of your 2017 tax return using Form 4506, you may need to provide additional documentation to verify your identity. This can include:

- A copy of your driver's license or state ID.

- Proof of your Social Security number, such as your Social Security card.

- Any other documents that may be required based on your specific situation, such as a power of attorney if you are requesting for someone else.

IRS Guidelines

The IRS has specific guidelines for submitting Form 4506. It is important to follow these to ensure your request is processed smoothly. Key points include:

- Ensure that all information is accurate and complete to avoid delays.

- Be aware of any applicable fees for obtaining copies of your tax returns.

- Check the processing times, as requests can take several weeks to fulfill.

Quick guide on how to complete copy of tax return 2018 2019 form

Discover the easiest method to complete and sign your Irs Form 4506 For

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow provides a superior way to finalize and endorse your Irs Form 4506 For and associated forms for public services. Our intelligent electronic signature platform equips you with all the tools necessary to manage paperwork efficiently and in compliance with legal standards - comprehensive PDF editing, organizing, securing, signing, and sharing capabilities are all available within a user-friendly interface.

Only a few steps are needed to fill out and endorse your Irs Form 4506 For:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to include in your Irs Form 4506 For.

- Navigate between the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the toolbar above.

- Emphasize essential sections or Blackout those that are no longer relevant.

- Hit Sign to generate a legally binding electronic signature using your preferred method.

- Include the Date next to your signature and finish your task with the Done button.

Store your completed Irs Form 4506 For in the Documents folder of your account, download it, or send it to your preferred cloud storage. Our platform also offers versatile file sharing options. There’s no need to print your templates when submitting them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct copy of tax return 2018 2019 form

FAQs

-

What is ITR Form 7?

The Income Tax Department of India issues Form ITR 7 forms for Trusts to file their income tax returns. Persons including companies, who are required to furnish return under section 139(4A) or section 139(4B) or section 139(4D) or section 139(4E) or section 139(4F) can use the Form ITR-7 to file their tax return.Watch this video to know more about the same topic-Or you can read it here in detail about this topic:https://www.hrblock.in/guides/it...About H&R Block IndiaH&R Block, is the world's largest Tax Service provider company with over 720 Million tax returns filed worldwide annually. It is the largest tax services provider for individuals and businesses in India with a strong focus on client satisfaction.H&R Block provides services of Individual Income Tax Filing, U.S. Expat Tax Filing, Business Tax preparation and GST Managed Services.Apart from this H&R Block also provide tax tools like Income Tax Calculator, Advance tax calculator and a downloadable Income tax ready Reckoner for quick reference.You can follow H&R Block on YouTube at http://bit.ly/SubHIMUGet in touch with H&R Block on Quora at https://www.quora.com/profile/HR...

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

How the new Form 16 will change income tax return filing this FY 2018-19 (AY 2019-20)?

The new format of the Form 16 and the ITR for AY 2019–20 will allow the tax department to view a detailed break up of the salary and tax exemptions claimed by an employee. Any discrepancy in the Form 16 versus the ITR filed by the person will be easily traced by the tax department.Hence, the salary part of the ITR will need to be carefully filed to provide all details such that there is no mismatch with the Form 16 and the Form 26AS. Any discrepancy could result in a notice situation.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

Create this form in 5 minutes!

How to create an eSignature for the copy of tax return 2018 2019 form

How to make an eSignature for the Copy Of Tax Return 2018 2019 Form in the online mode

How to make an eSignature for the Copy Of Tax Return 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the Copy Of Tax Return 2018 2019 Form in Gmail

How to make an electronic signature for the Copy Of Tax Return 2018 2019 Form right from your smartphone

How to make an eSignature for the Copy Of Tax Return 2018 2019 Form on iOS devices

How to generate an eSignature for the Copy Of Tax Return 2018 2019 Form on Android

People also ask

-

What is the easiest way to get a copy of my 2017 tax return?

The easiest way to get a copy of your 2017 tax return is to use the IRS online tools or request a transcript through the mail. For a quick option, you can visit the IRS website and utilize their online 'Get Transcript' feature. This ensures you obtain the documentation you need efficiently.

-

Can airSlate SignNow help me with documents related to my 2017 tax return?

Yes, airSlate SignNow can help you manage documents related to your 2017 tax return by allowing you to eSign and send forms securely and quickly. Its user-friendly interface simplifies document handling, making it easier for you to stay organized while retrieving your tax documents.

-

How much does it cost to retrieve a copy of my 2017 tax return?

Retrieving a copy of your 2017 tax return from the IRS generally does not have a fee for a transcript. However, if you request a copy of the actual return, there might be a nominal fee. Utilizing airSlate SignNow can save you time and costs in managing and signing any required documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers several features for document management, including eSigning, custom workflows, and secure document storage. These features help streamline the process of managing your tax returns and other important paperwork, making it easier to retrieve your documents, like your 2017 tax return.

-

Is airSlate SignNow compliant with tax document regulations?

Yes, airSlate SignNow is compliant with various document regulations, ensuring that your tax documents, including your 2017 tax return, are handled securely. This compliance protects your sensitive information while allowing for efficient eSigning and document management.

-

How does airSlate SignNow integrate with other software I might use?

airSlate SignNow integrates seamlessly with a variety of software, including popular accounting and project management tools. This means you can easily incorporate your workflows, including handling your 2017 tax return documents, into your existing systems without disruption.

-

What benefits can I expect by using airSlate SignNow for my tax documents?

By using airSlate SignNow, you can expect benefits such as faster document turnaround, enhanced security, and cost savings. Managing your tax returns, including how to get a copy of your 2017 tax return, becomes simpler through our user-friendly platform tailored for efficient document handling.

Get more for Irs Form 4506 For

Find out other Irs Form 4506 For

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien