Sa100 2020

What is the SA100?

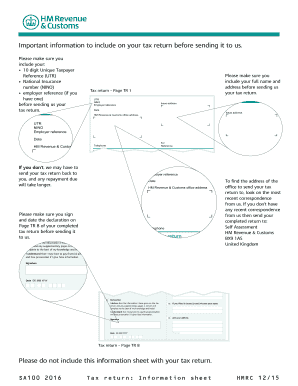

The SA100 is a self-assessment tax return form used by individuals in the United Kingdom to report their income and capital gains to HM Revenue and Customs (HMRC). It is primarily for those who are self-employed, have income from property, or receive other taxable income not covered by PAYE (Pay As You Earn). The SA100 form must be completed annually to ensure that individuals pay the correct amount of tax based on their earnings.

How to Obtain the SA100

To obtain the SA100 form, individuals can visit the HMRC website, where they can download the form in PDF format. Alternatively, the form can be requested by contacting HMRC directly. It is advisable to obtain the form well in advance of the filing deadline to allow sufficient time for completion and submission.

Steps to Complete the SA100

Completing the SA100 involves several steps:

- Gather all necessary financial documents, including income statements, bank statements, and receipts for expenses.

- Fill out personal information, including name, address, and National Insurance number.

- Report all sources of income, including self-employment earnings, rental income, and any other taxable income.

- Calculate allowable expenses to reduce taxable income.

- Review the completed form for accuracy before submission.

Legal Use of the SA100

The SA100 form is legally binding and must be completed accurately to comply with UK tax laws. Failure to submit the form or providing incorrect information may result in penalties from HMRC. It is essential to ensure that all income and expenses are reported truthfully to avoid legal repercussions.

Filing Deadlines / Important Dates

For the SA100, the key deadlines are:

- Paper returns must be submitted by October 31 following the end of the tax year.

- Online submissions must be completed by January 31 following the end of the tax year.

It is crucial to meet these deadlines to avoid late filing penalties and interest on any unpaid taxes.

Required Documents

When completing the SA100, individuals should have the following documents ready:

- P60 or P45 forms from employers, if applicable.

- Bank statements showing interest earned.

- Invoices and receipts for self-employment income and expenses.

- Records of any rental income and associated costs.

Form Submission Methods

The SA100 can be submitted through various methods:

- Online via the HMRC self-assessment portal, which is the most efficient method.

- By post, sending a completed paper form to the appropriate HMRC address.

- In-person at designated HMRC offices, though this method is less common.

Quick guide on how to complete sa100 2016

Effortlessly Prepare Sa100 on Any Device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without waiting. Handle Sa100 on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Edit and Electronically Sign Sa100 with Ease

- Locate Sa100 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and electronically sign Sa100 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa100 2016

Create this form in 5 minutes!

How to create an eSignature for the sa100 2016

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the SA100 2016 form?

The SA100 2016 is the self-assessment tax return form for individuals in the UK. It captures essential income information and is used to calculate your tax obligations. Completing this form accurately is crucial for ensuring compliance with HMRC regulations.

-

How can airSlate SignNow assist with SA100 2016 submissions?

airSlate SignNow streamlines the process of signing and submitting your SA100 2016 form. With its eSignature capabilities, you can easily gather signatures, making the submission process faster and more efficient. This helps you meet tax deadlines without the hassle of paper forms.

-

What are the pricing options for using airSlate SignNow for SA100 2016 submissions?

airSlate SignNow offers flexible pricing plans to suit businesses of all sizes, allowing you to choose a plan that fits your needs. Each plan includes features that facilitate the signing of important documents like the SA100 2016 form. Check our website for specific pricing details and any current promotions.

-

Are there any specific features of airSlate SignNow that cater to SA100 2016 form users?

Yes, airSlate SignNow provides features such as reusable templates and advanced tracking for documents like the SA100 2016 form. These features enhance user efficiency by allowing you to prepare and send the document quickly. Additionally, you can monitor the signing process in real time.

-

What benefits does airSlate SignNow offer for handling SA100 2016 forms?

Using airSlate SignNow to handle your SA100 2016 forms can save you time and reduce errors. The digital format allows for easy editing, sharing, and signing, which streamlines the process. Furthermore, the solution is cost-effective, which is beneficial for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other tax software for my SA100 2016 submissions?

Absolutely! airSlate SignNow offers seamless integrations with a variety of accounting and tax software tools. This compatibility makes it easy to manage your SA100 2016 submissions alongside your other financial documents, providing an efficient workflow.

-

Is airSlate SignNow secure for handling sensitive information like SA100 2016 forms?

Yes, airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your data. This ensures that sensitive information contained in your SA100 2016 forms remains confidential. You can trust that your documents are handled with the utmost care.

Get more for Sa100

Find out other Sa100

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online