Nydof Betax Dof B E 2015

What is the Nydof Betax Dof B E

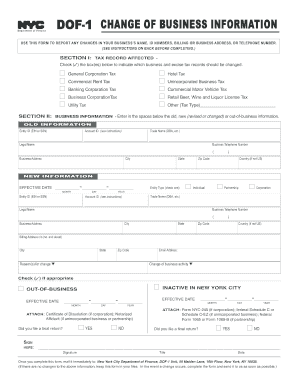

The Nydof Betax Dof B E is a specific form utilized by businesses in New York for tax purposes. This form is essential for reporting business-related financial information to the New York City Department of Finance. It serves as a declaration of business activities and is critical for ensuring compliance with local tax regulations. Understanding this form is crucial for any business operating within the state, as it impacts tax obligations and potential liabilities.

Steps to Complete the Nydof Betax Dof B E

Completing the Nydof Betax Dof B E involves several key steps to ensure accuracy and compliance. Begin by gathering necessary financial documents, including income statements and expense reports. Next, fill out the form with precise information regarding your business activities, including revenue and deductions. It is important to double-check all entries for accuracy. Finally, sign and date the form before submission to the appropriate department.

Legal Use of the Nydof Betax Dof B E

The Nydof Betax Dof B E must be used in accordance with New York City tax laws to be considered legally binding. This means that all information provided must be truthful and complete. Falsifying information on this form can lead to penalties, including fines or legal action. Businesses should ensure they are aware of the legal implications of their submissions and maintain accurate records to support their claims.

Required Documents for the Nydof Betax Dof B E

To successfully complete the Nydof Betax Dof B E, certain documents are required. These typically include:

- Financial statements, such as profit and loss statements

- Records of business expenses

- Tax identification numbers

- Any previous tax filings relevant to the current year

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Filing Deadlines for the Nydof Betax Dof B E

It is crucial for businesses to be aware of the filing deadlines associated with the Nydof Betax Dof B E. Typically, forms must be submitted by specific dates each year, which can vary based on the business's fiscal year. Missing these deadlines may result in penalties or interest on unpaid taxes. Businesses should consult the New York City Department of Finance for the most current deadlines to ensure timely compliance.

Examples of Using the Nydof Betax Dof B E

Businesses may encounter various scenarios when utilizing the Nydof Betax Dof B E. For instance, a small business owner may use this form to report annual income and expenses, while a partnership might need to disclose shared revenue and deductions. Each example highlights the importance of accurately reporting financial data to avoid discrepancies with tax authorities.

Quick guide on how to complete nydof betax dof b e

Prepare Nydof Betax Dof B E effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Nydof Betax Dof B E on any device with the airSlate SignNow Android or iOS apps and simplify any document-related process today.

The easiest way to modify and eSign Nydof Betax Dof B E with ease

- Locate Nydof Betax Dof B E and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Nydof Betax Dof B E and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nydof betax dof b e

Create this form in 5 minutes!

How to create an eSignature for the nydof betax dof b e

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is nydof betax and how does it relate to airSlate SignNow?

Nydof betax refers to the seamless integration of document signing and management within airSlate SignNow. This solution enhances the efficiency of eSigning documents, allowing businesses to streamline their workflow and reduce time spent on paperwork. With nydof betax, users can experience a simplified, yet powerful approach to managing documents online.

-

How does pricing for nydof betax work with airSlate SignNow?

The pricing for nydof betax within airSlate SignNow is competitive and designed to suit various business needs. Customers can choose from different pricing tiers based on their document signing volume and feature requirements. This makes it a cost-effective solution for businesses wanting to adopt eSignatures without breaking the bank.

-

What features are included with nydof betax?

Nydof betax offers a variety of features including customizable templates, automated workflows, and secure document storage. These features empower businesses to signNowly enhance their document handling processes. Additionally, the user-friendly interface ensures that all team members can adopt these functionalities with ease.

-

What are the benefits of using nydof betax for eSigning documents?

Utilizing nydof betax with airSlate SignNow provides numerous benefits, such as improved efficiency, reduced turnaround times, and enhanced document security. By integrating eSigning into business practices, companies can save time and resources, allowing them to focus on core activities. Furthermore, the ability to track document status in real time ensures transparency and accountability.

-

Can nydof betax integrate with other software applications?

Yes, nydof betax allows for seamless integration with various software applications, enhancing its functionality. Popular integrations include CRM systems, cloud storage services, and productivity tools. This flexibility ensures that users can incorporate airSlate SignNow into their existing workflows without any disruptions.

-

Is nydof betax secure for sensitive documents?

Absolutely, nydof betax prioritizes security and compliance when handling sensitive documents. airSlate SignNow employs industry-leading encryption protocols and adheres to legal standards for eSignature validation. This multi-layered approach to security helps protect business information from unauthorized access.

-

How can businesses get started with nydof betax?

Getting started with nydof betax is simple. Businesses can visit the airSlate SignNow website, where they can sign up for a free trial or choose a suitable pricing plan. The onboarding process is straightforward, and customer support is available to help with any questions or setup requirements.

Get more for Nydof Betax Dof B E

- Hm 9171 form

- Lifeguard checklist form

- Application for certificate of compliance tlma rctlma form

- Sign installation request form city of oakland

- Socalgas claims form

- City of vacaville alarm permit application first alarm form

- F160 application for visiting privileges kern county sheriffamp39s form

- Hbuhsd work permit 2010 form

Find out other Nydof Betax Dof B E

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity

- How To Use Electronic signature in Construction

- How To Implement Electronic signature in Charity

- How To Set Up Electronic signature in Construction

- How To Integrate Electronic signature in Doctors

- How To Use Electronic signature in Doctors

- How To Install Electronic signature in Doctors

- How To Add Electronic signature in Doctors