Form 391 2014

What is the Form 391

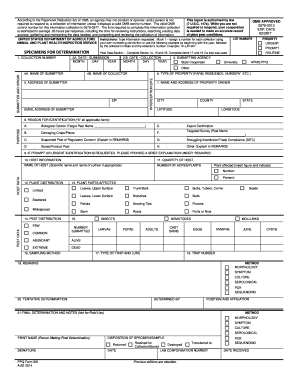

The Form 391, also known as the PPQ Form 391, is a document used primarily for specific administrative purposes within various sectors. It often serves as a formal request or declaration that may be required by governmental or regulatory bodies. Understanding its purpose is essential for ensuring compliance and proper documentation in your business or personal affairs.

How to obtain the Form 391

Obtaining the Form 391 is straightforward. Typically, it can be accessed through the official website of the relevant agency or organization that requires it. In some cases, local offices may also provide physical copies. Ensure that you are downloading the most recent version to avoid any issues with outdated information.

Steps to complete the Form 391

Completing the Form 391 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details and any relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions before submission. Finally, submit the form according to the guidelines provided, whether online, by mail, or in person.

Legal use of the Form 391

The legal validity of the Form 391 hinges on proper completion and adherence to the regulations governing its use. When filled out correctly, it can serve as a legally binding document. It is important to ensure that all signatures and required fields are completed, as failure to do so may lead to complications or disputes. Utilizing a reliable eSigning platform can enhance the legal standing of the form by providing necessary verification and compliance with eSignature laws.

Key elements of the Form 391

Understanding the key elements of the Form 391 is crucial for effective completion. Essential components typically include personal identification information, the purpose of the form, and any required supporting documentation. Additionally, there may be specific instructions regarding signatures and submission methods. Familiarizing yourself with these elements can streamline the process and reduce the likelihood of errors.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form 391 can result in various penalties. These may include fines, delays in processing, or even legal repercussions depending on the context in which the form is used. It is vital to understand the implications of non-compliance and to ensure that all submissions are accurate and timely to avoid potential issues.

Digital vs. Paper Version

When considering the Form 391, you may choose between a digital version or a traditional paper format. The digital version offers convenience and efficiency, allowing for quicker completion and submission. It also often includes features such as eSigning capabilities, which enhance security and compliance. Conversely, the paper version may be preferred in certain situations where a physical signature is required. Understanding the advantages and limitations of each format can help you make an informed decision based on your specific needs.

Quick guide on how to complete form 391

Complete Form 391 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage Form 391 on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 391 without stress

- Locate Form 391 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal weight as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from a device of your choice. Edit and eSign Form 391 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 391

Create this form in 5 minutes!

How to create an eSignature for the form 391

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is form 391 and how does it work with airSlate SignNow?

Form 391 is a crucial document used for various governmental filings. With airSlate SignNow, you can easily create, send, and eSign form 391, ensuring that your submissions are legally binding and securely handled. Our platform streamlines the entire process, making it efficient for users to manage their documentation.

-

What features does airSlate SignNow offer for form 391?

airSlate SignNow provides a range of features specifically designed for handling form 391. These include advanced eSigning capabilities, document templates, and real-time tracking. You can also customize reminders and notifications to ensure you never miss an important deadline.

-

How much does it cost to use airSlate SignNow for form 391?

Pricing for airSlate SignNow is competitive, with various plans that cater to different needs. For users focused on form 391, our basic plan offers all the essential features at an affordable rate. You can also access premium options that provide additional functionalities for larger teams or more frequent use.

-

Can I integrate airSlate SignNow with other software for form 391 management?

Yes, airSlate SignNow offers integrations with numerous popular software applications, which can enhance your management of form 391. Whether you use CRMs, document storage solutions, or project management tools, you can seamlessly integrate them to create a more efficient workflow. This ensures that all your documents are easily accessible in one place.

-

Is airSlate SignNow secure for handling sensitive information in form 391?

Absolutely! airSlate SignNow prioritizes the security of your documents, including form 391. We utilize industry-standard encryption and compliance measures to protect sensitive data throughout the signing process, ensuring your information remains confidential and secure.

-

How can I get started with airSlate SignNow for form 391?

Getting started with airSlate SignNow for form 391 is simple. Just sign up for a free trial on our website, where you can explore the platform and its features. Once you're familiar with the system, you can begin creating and managing your form 391 documents in no time.

-

What are the benefits of using airSlate SignNow for form 391 over traditional methods?

Using airSlate SignNow for form 391 offers numerous benefits compared to traditional methods. Our platform enhances efficiency by eliminating the need for paper documents, reducing the time needed for signature collection, and minimizing errors. This leads to more streamlined operations and faster turnaround times for your submissions.

Get more for Form 391

- Form vtr 271 2012

- Lf601 contract 04 13 form

- Renew my over axle over gross weight tolerance permit form

- Functional ability evaluation form 2008

- Utah dmv mvr form

- Functional ability evaluation medical report 2009 form

- Dld60b utah department of public safety publicsafety utah form

- Driver license hearing request form utah dui

Find out other Form 391

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free