Form 3514 2016

What is the Form 3514

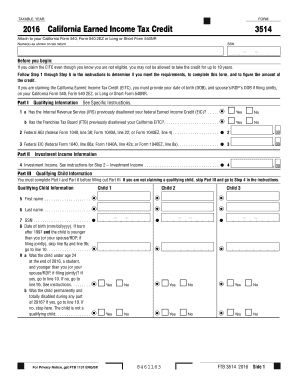

The Form 3514 is a tax form used by residents of California to claim the California Earned Income Tax Credit (CalEITC). This form is designed to help low-income individuals and families receive a tax refund based on their earned income and the number of qualifying children they have. By filing this form, eligible taxpayers can receive financial assistance that can significantly impact their annual tax return.

How to obtain the Form 3514

To obtain the Form 3514, individuals can visit the California Franchise Tax Board (FTB) website, where the form is available for download. Additionally, taxpayers can request a paper copy of the form by contacting the FTB directly. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Steps to complete the Form 3514

Completing the Form 3514 involves several key steps:

- Gather necessary documents, including your federal tax return and information about your qualifying children.

- Fill out personal information, including your name, Social Security number, and filing status.

- Calculate your earned income and determine your eligibility for the CalEITC based on your income and family size.

- Complete the form by following the instructions provided, ensuring all calculations are accurate.

- Review the form for any errors before submitting it.

Legal use of the Form 3514

The legal use of the Form 3514 is governed by California tax laws. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Taxpayers should ensure they meet the eligibility criteria for the CalEITC and retain copies of all documentation submitted with the form. Failure to comply with these regulations may result in penalties or denial of the credit.

Key elements of the Form 3514

Key elements of the Form 3514 include:

- Personal information section, where taxpayers provide their name, address, and Social Security number.

- Earned income calculation, which determines the taxpayer's eligibility for the credit.

- Information about qualifying children, including their names and Social Security numbers.

- Signature section, where the taxpayer certifies the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3514 typically align with the federal tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential for taxpayers to be aware of these dates to avoid late filing penalties.

Quick guide on how to complete form 3514 396663226

Accomplish Form 3514 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed paperwork, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 3514 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form 3514 with ease

- Find Form 3514 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all information and then click on the Done button to save your updates.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and electronically sign Form 3514 and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3514 396663226

Create this form in 5 minutes!

People also ask

-

What is form 3514 and how can airSlate SignNow assist with it?

Form 3514 is a specific document that can be essential for various administrative processes. airSlate SignNow offers you a streamlined way to create, send, and eSign form 3514, ensuring compliance and efficiency in your workflow.

-

Can I customize form 3514 templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize form 3514 templates to suit your organization's needs. You can easily modify fields, add your branding, and integrate specific requirements to enhance the document's functionality.

-

What are the costs associated with using form 3514 in airSlate SignNow?

airSlate SignNow provides a range of pricing plans to accommodate different business sizes. You can utilize form 3514 within our plans to benefit from cost-effective solutions, making electronic signing and document management affordable.

-

How does airSlate SignNow enhance the security of form 3514?

airSlate SignNow implements top-notch security protocols for form 3514 and other documents, including encryption and secure cloud storage. This ensures that your sensitive information remains protected throughout the signing process.

-

Can I integrate form 3514 with my existing applications?

Absolutely! airSlate SignNow offers integrations with various applications, enabling you to incorporate form 3514 into your existing systems seamlessly. This flexibility enhances workflow efficiency and streamlines your document management processes.

-

What features does airSlate SignNow offer for managing form 3514?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking for form 3514. These functionalities simplify the eSigning process, allowing you to manage document approvals efficiently.

-

What benefits can I expect from using airSlate SignNow for form 3514?

By using airSlate SignNow for form 3514, you gain benefits such as improved turnaround times, enhanced collaboration, and reduced paper usage. This eco-friendly solution supports your business in becoming more efficient and sustainable.

Get more for Form 3514

- New mexico dnr order form

- New mexico hipaa release form

- Nevada check up providers form

- Hipaa permits disclosure to health care professionals form

- Bcbs of ohio prior authorization form

- Bcbs of ohio prior authorization 11197182 form

- Hospital referral form nyc gov nyc

- Pdf health home incident reporting form new york state department

Find out other Form 3514

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement