Solved Complete the Tax Return on Form 540NR and 2023

Understanding the FTB 3514 Form

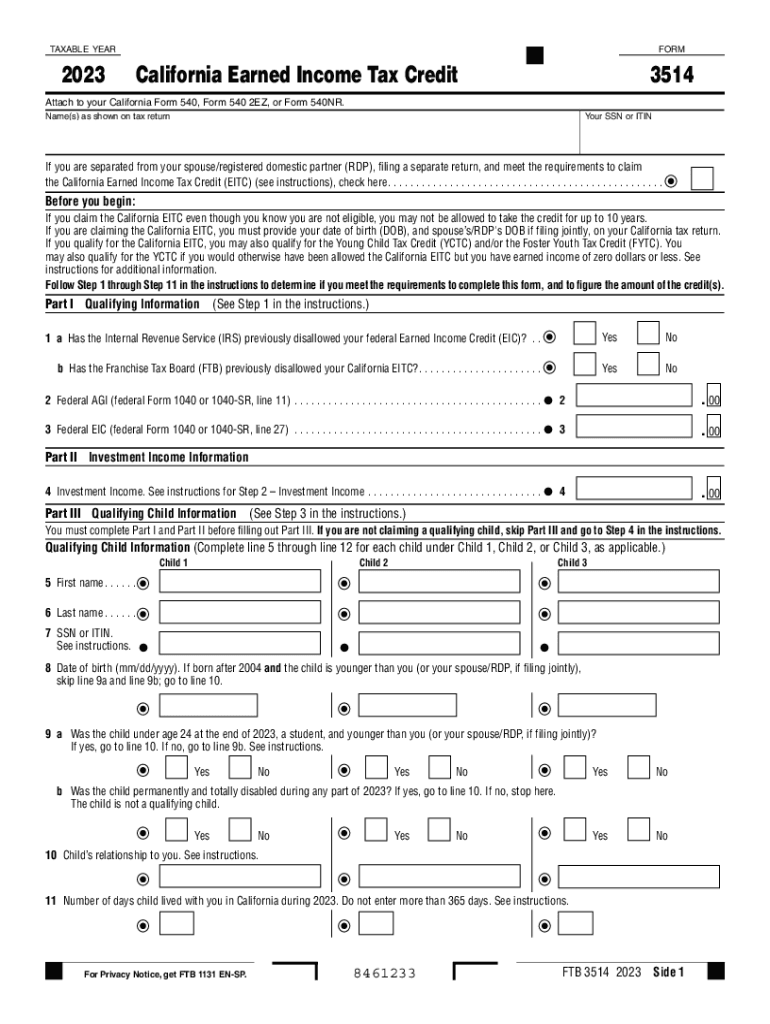

The FTB 3514 form, also known as the California Earned Income Credit (EIC) form, is essential for qualifying individuals to claim tax credits on their California tax returns. This form is specifically designed for residents who meet certain income thresholds and have qualifying children or dependents. Completing the FTB 3514 form accurately can lead to significant tax savings, making it a crucial component of the California tax filing process.

Eligibility Criteria for the FTB 3514 Form

To qualify for the California Earned Income Credit using the FTB 3514 form, taxpayers must meet specific eligibility requirements. These include:

- Filing status: Must be single, married filing jointly, head of household, or qualifying widow(er).

- Income limits: Must have earned income below the specified thresholds, which vary based on the number of qualifying children.

- Residency: Must be a California resident for at least half of the tax year.

- Social Security Number: Must have a valid Social Security Number or Individual Taxpayer Identification Number.

Steps to Complete the FTB 3514 Form

Filling out the FTB 3514 form involves several key steps to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary documents, including income statements, Social Security Numbers for dependents, and previous tax returns.

- Download the FTB 3514 form from the California Franchise Tax Board website or access it through tax preparation software.

- Complete the personal information section, including your name, address, and filing status.

- Enter your earned income and any other relevant financial information as prompted on the form.

- Calculate your credit amount based on the instructions provided, ensuring all figures are accurate.

- Review the completed form for any errors or omissions before submission.

Required Documents for Filing the FTB 3514 Form

When preparing to file the FTB 3514 form, it is essential to have the following documents on hand:

- W-2 forms from all employers to report earned income.

- Form 1099 for any additional income sources.

- Social Security cards for you and any qualifying children.

- Proof of residency, such as utility bills or lease agreements.

Form Submission Methods for the FTB 3514 Form

Taxpayers have several options for submitting the FTB 3514 form. These methods include:

- Online submission through the California Franchise Tax Board's e-file system, which is the fastest option.

- Mailing a paper copy of the completed form to the appropriate address provided in the filing instructions.

- In-person submission at designated California tax offices, although this option may require an appointment.

Penalties for Non-Compliance with the FTB 3514 Form

Failing to comply with the requirements of the FTB 3514 form can result in penalties. These may include:

- Loss of the earned income credit if the form is not filed correctly or on time.

- Potential fines for inaccuracies or fraudulent claims.

- Interest on any unpaid taxes resulting from errors in the filing process.

Create this form in 5 minutes or less

Find and fill out the correct solved complete the tax return on form 540nr and

Create this form in 5 minutes!

How to create an eSignature for the solved complete the tax return on form 540nr and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 3514 form?

The ftb 3514 form is a California tax form used for claiming the California Earned Income Tax Credit. It helps eligible taxpayers receive a refund based on their income level and family size. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the ftb 3514 form?

airSlate SignNow streamlines the process of completing and eSigning the ftb 3514 form. Our platform allows you to fill out the form digitally, ensuring accuracy and saving time. You can easily send it to others for signatures, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the ftb 3514 form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution provides access to features that simplify the completion and signing of the ftb 3514 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the ftb 3514 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the ftb 3514 form. These tools enhance efficiency and ensure that your documents are handled securely. You can also integrate with other applications for a seamless workflow.

-

Can I integrate airSlate SignNow with other software for the ftb 3514 form?

Absolutely! airSlate SignNow integrates with various software applications, allowing you to manage the ftb 3514 form alongside your existing tools. This integration helps streamline your workflow and enhances productivity, making it easier to handle tax documents.

-

What are the benefits of using airSlate SignNow for the ftb 3514 form?

Using airSlate SignNow for the ftb 3514 form offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform simplifies the eSigning process, ensuring that you can complete your tax documents efficiently. Additionally, you can access your forms anytime, anywhere.

-

How secure is airSlate SignNow when handling the ftb 3514 form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your data while handling the ftb 3514 form. You can trust that your sensitive information is safe and compliant with industry standards.

Get more for Solved Complete The Tax Return On Form 540NR And

- Complaint discharge form

- Lease mobile home agreement form

- Discharge bankruptcy court form

- Proposed public opinion survey to determine economic feasibility of revised product form

- Proposed sales survey to determine effectiveness of planned advertising campaign for new product form

- Agreement product form

- Adverse action notice form

- Real property form 497329598

Find out other Solved Complete The Tax Return On Form 540NR And

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney