Desktop Form 3514 California Earned Income Tax Credit 2022

What is the Desktop Form 3514 California Earned Income Tax Credit

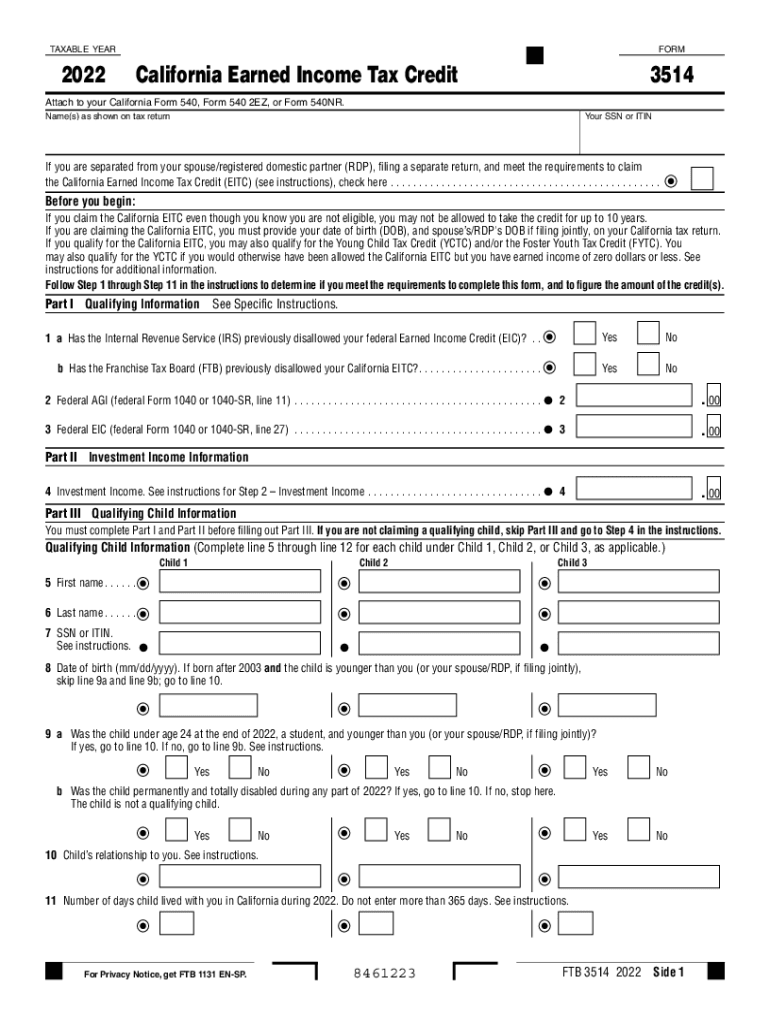

The Desktop Form 3514 is an essential document used by California taxpayers to claim the California Earned Income Tax Credit (CalEITC). This form is designed to assist low-income individuals and families in receiving a tax credit that can significantly reduce their tax liability. The CalEITC aims to provide financial relief and encourage work among eligible taxpayers. Understanding the purpose and benefits of this form is crucial for those looking to maximize their tax returns.

Eligibility Criteria for the Desktop Form 3514

To qualify for the California Earned Income Tax Credit using the Desktop Form 3514, taxpayers must meet specific eligibility requirements. These include:

- Filing status: Taxpayers must file as single, married filing jointly, head of household, or qualifying widow(er).

- Income limits: The taxpayer's earned income must fall below certain thresholds, which vary based on the number of qualifying children.

- Residency: The taxpayer must be a resident of California for the entire tax year.

- Social Security Number: All qualifying individuals must have a valid Social Security Number or Individual Taxpayer Identification Number.

Steps to Complete the Desktop Form 3514 California Earned Income Tax Credit

Filling out the Desktop Form 3514 involves several steps to ensure accurate information is provided. Here’s a simplified process:

- Gather necessary documents, including income statements and Social Security Numbers for all qualifying children.

- Access the form through the California Franchise Tax Board's website or tax software.

- Complete personal information, including name, address, and filing status.

- Report earned income and any other relevant income sources in the designated sections.

- Indicate the number of qualifying children and provide their information.

- Calculate the credit amount based on the provided income and number of children.

- Review the form for accuracy before submission.

Form Submission Methods for the Desktop Form 3514

Taxpayers have various options for submitting the Desktop Form 3514. These methods include:

- Online Submission: Use tax preparation software that supports e-filing to submit the form electronically.

- Mail: Print the completed form and send it to the California Franchise Tax Board via postal service.

- In-Person: Visit a local tax office to submit the form directly, though this option may vary based on location and availability.

Key Elements of the Desktop Form 3514 California Earned Income Tax Credit

The Desktop Form 3514 includes several key elements that are essential for accurately claiming the CalEITC. These elements consist of:

- Personal Information: Taxpayer's name, address, and filing status.

- Income Reporting: Sections dedicated to reporting earned income and other income sources.

- Qualifying Children: Information about each qualifying child, including their Social Security Number and relationship to the taxpayer.

- Credit Calculation: A section where the taxpayer calculates the total credit based on income and number of children.

Legal Use of the Desktop Form 3514 California Earned Income Tax Credit

The legal use of the Desktop Form 3514 is governed by California state tax laws. To ensure compliance, taxpayers must accurately report their income and provide valid information regarding their eligibility. Misrepresentation or errors can lead to penalties or disqualification from receiving the credit. It is advisable to keep copies of all submitted documents and any supporting materials for future reference or audits.

Quick guide on how to complete desktop form 3514 california earned income tax credit

Complete Desktop Form 3514 California Earned Income Tax Credit effortlessly on any platform

Web-based document management has become increasingly popular among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Desktop Form 3514 California Earned Income Tax Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest way to edit and electronically sign Desktop Form 3514 California Earned Income Tax Credit with ease

- Obtain Desktop Form 3514 California Earned Income Tax Credit and then click Get Form to embark on the process.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Desktop Form 3514 California Earned Income Tax Credit and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct desktop form 3514 california earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the desktop form 3514 california earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3514 business code?

The form 3514 business code is a classification used for various business types in tax filings. Understanding this code helps businesses ensure compliance with regulatory requirements. airSlate SignNow can assist you in managing forms effectively while using the form 3514 business code.

-

How can I use airSlate SignNow with the form 3514 business code?

airSlate SignNow simplifies the process of filling out and eSigning documents related to the form 3514 business code. Our platform provides an intuitive interface that allows users to input necessary data quickly. By utilizing our solution, businesses can ensure their form 3514 submissions are accurate and timely.

-

Is there a cost associated with using airSlate SignNow for the form 3514 business code?

Yes, airSlate SignNow operates on a subscription-based pricing model that offers various plans to fit different business needs. Each plan provides full access to features like eSigning, document storage, and more, including those required for form 3514 submissions. Choose the plan that best suits your business scale and budget.

-

What features does airSlate SignNow offer for handling form 3514 business code?

airSlate SignNow offers multiple features like customizable templates, automated workflows, and secure storage specifically designed to handle documents related to the form 3514 business code. These features streamline the documentation process, improve efficiency, and reduce the chances of errors. Additionally, our mobile app allows you to manage these forms on the go.

-

Can airSlate SignNow integrate with other software to manage form 3514 business code?

Absolutely! airSlate SignNow supports integration with various applications and software that can aid in managing the form 3514 business code. This allows businesses to sync their data and workflows seamlessly, ensuring your documents are organized and accessible wherever needed.

-

What are the benefits of using airSlate SignNow for form 3514 business code?

Using airSlate SignNow for the form 3514 business code provides numerous benefits including increased accuracy, reduced processing time, and enhanced collaboration among team members. Our eSigning feature also ensures that your documents are signed and returned faster, facilitating quicker business operations and compliance.

-

How secure is airSlate SignNow when handling documents for the form 3514 business code?

airSlate SignNow prioritizes security, employing robust encryption methods to protect your documents related to the form 3514 business code. All transactions are secured to prevent unauthorized access and to ensure the integrity of sensitive information. You can confidently manage your documentation without worrying about data bsignNowes.

Get more for Desktop Form 3514 California Earned Income Tax Credit

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497326346 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497326347 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497326348 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497326349 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497326350 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497326351 form

- South dakota corporation 497326352 form

- Living trust for husband and wife with no children south dakota form

Find out other Desktop Form 3514 California Earned Income Tax Credit

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online