Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit 2020

What is the Form 3514 California Earned Income Tax Credit

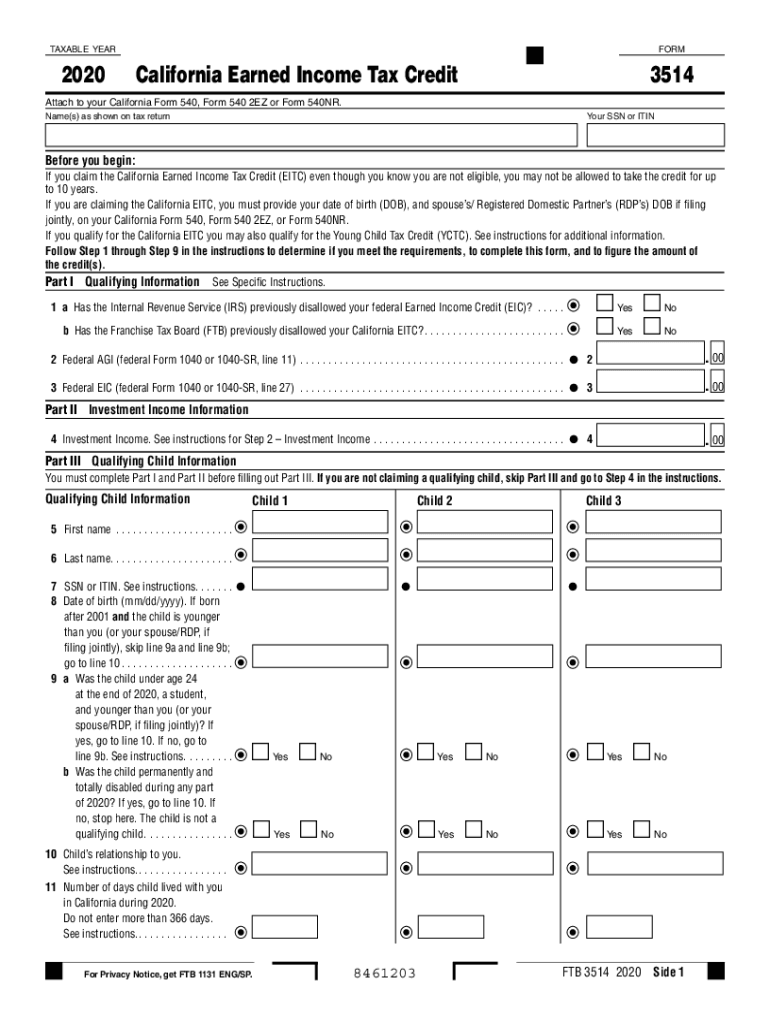

The Form 3514 is the California Earned Income Tax Credit (EITC) application form, designed to assist low-income working individuals and families in California. This credit aims to reduce poverty and incentivize work by providing a refundable tax credit that can significantly lower tax liabilities or result in a refund. The form is particularly relevant for those who meet specific income thresholds and have qualifying children, as well as for certain individuals without children.

Key elements of the Form 3514 California Earned Income Tax Credit

Understanding the key elements of the Form 3514 is essential for successful completion. The form includes sections for personal information, income details, and information regarding qualifying children. Important details such as filing status, Social Security numbers, and income types must be accurately reported. Additionally, taxpayers must provide documentation supporting their eligibility for the credit, which may include pay stubs or tax returns from previous years.

Steps to complete the Form 3514 California Earned Income Tax Credit

Completing the Form 3514 involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including income statements and identification numbers. Next, fill out the personal information section, ensuring all names and numbers are correct. Then, report your income and any qualifying children in the appropriate sections. Finally, review the form for any errors before submitting it to the California Franchise Tax Board (FTB).

How to obtain the Form 3514 California Earned Income Tax Credit

The Form 3514 can be obtained through several channels. It is available for download in PDF format from the California Franchise Tax Board's website. Additionally, taxpayers can request a physical copy by contacting the FTB directly. Many tax preparation software programs also include the form, allowing users to fill it out electronically as part of their tax filing process.

Eligibility Criteria for the Form 3514 California Earned Income Tax Credit

To qualify for the California Earned Income Tax Credit using Form 3514, individuals must meet specific eligibility criteria. These include having earned income below a certain threshold, which varies based on filing status and the number of qualifying children. Additionally, applicants must be residents of California for at least half the year and possess a valid Social Security number. It is important to review the latest guidelines from the FTB to ensure compliance with all requirements.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 3514 can be done through various methods. Taxpayers have the option to file electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, the form can be mailed directly to the California Franchise Tax Board. For those who prefer in-person assistance, local FTB offices may provide support for filling out and submitting the form. Each method has its own processing times, so it is advisable to choose the one that best fits individual needs.

Legal use of the Form 3514 California Earned Income Tax Credit

The legal use of the Form 3514 is governed by California tax laws and regulations. To ensure that the form is legally binding, taxpayers must provide accurate information and comply with all filing requirements. Electronic submissions are considered valid under the ESIGN Act, provided that they meet specific criteria for electronic signatures and documentation. It is crucial to retain copies of submitted forms and any supporting documents for future reference and potential audits.

Quick guide on how to complete 2020 form 3514 california earned income tax credit 2020 form 3514 california earned income tax credit

Complete Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit effortlessly on any device

Online document administration has gained signNow traction among organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents efficiently without delays. Manage Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit seamlessly

- Obtain Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 3514 california earned income tax credit 2020 form 3514 california earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 3514 california earned income tax credit 2020 form 3514 california earned income tax credit

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the form 3514 business code?

The form 3514 business code is a crucial classification used for tax purposes that helps businesses identify their specific operations. This code streamlines processes for businesses, ensuring compliance with regulations. By incorporating the form 3514 business code, businesses can better define their financial activities and reporting requirements.

-

How does airSlate SignNow support the completion of the form 3514 business code?

airSlate SignNow offers various features for completing essential documents like the form 3514 business code. Users can easily eSign and send documents, ensuring they are filled out accurately and efficiently. The platform simplifies the documentation process, making it easier for businesses to manage their tax filings.

-

What are the pricing options for airSlate SignNow regarding the form 3514 business code?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes. These plans are designed to accommodate the needs of companies utilizing the form 3514 business code, offering cost-effective solutions without compromising quality. By selecting the right plan, users can ensure they have the necessary tools to manage their documentation effectively.

-

Can I integrate airSlate SignNow with other software to manage my form 3514 business code?

Yes, airSlate SignNow offers seamless integrations with various software solutions that enhance the management of the form 3514 business code. These integrations support CRM systems and accounting software, allowing for streamlined document workflows. By leveraging these tools, you can maintain accurate records and ensure compliance.

-

What benefits does airSlate SignNow offer for businesses dealing with the form 3514 business code?

Using airSlate SignNow provides numerous benefits for businesses addressing the form 3514 business code. The platform enhances efficiency, reduces paperwork, and helps ensure documents are signed in a timely manner. Additionally, it improves record-keeping and compliance, making tax-related tasks easier for businesses.

-

How secure is airSlate SignNow when handling documents related to the form 3514 business code?

airSlate SignNow prioritizes security and employs top-tier encryption protocols for all documents related to the form 3514 business code. This ensures that sensitive business information remains protected throughout the signing and storage process. Users can trust that their data is safe and compliant with industry standards.

-

Is there customer support available for questions regarding the form 3514 business code?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions related to the form 3514 business code. The support team is knowledgeable and can provide guidance on how to effectively use the platform for your documentation needs. Customers can signNow out via multiple channels for timely assistance.

Get more for Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit

Find out other Form 3514 California Earned Income Tax Credit Form 3514 California Earned Income Tax Credit

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free