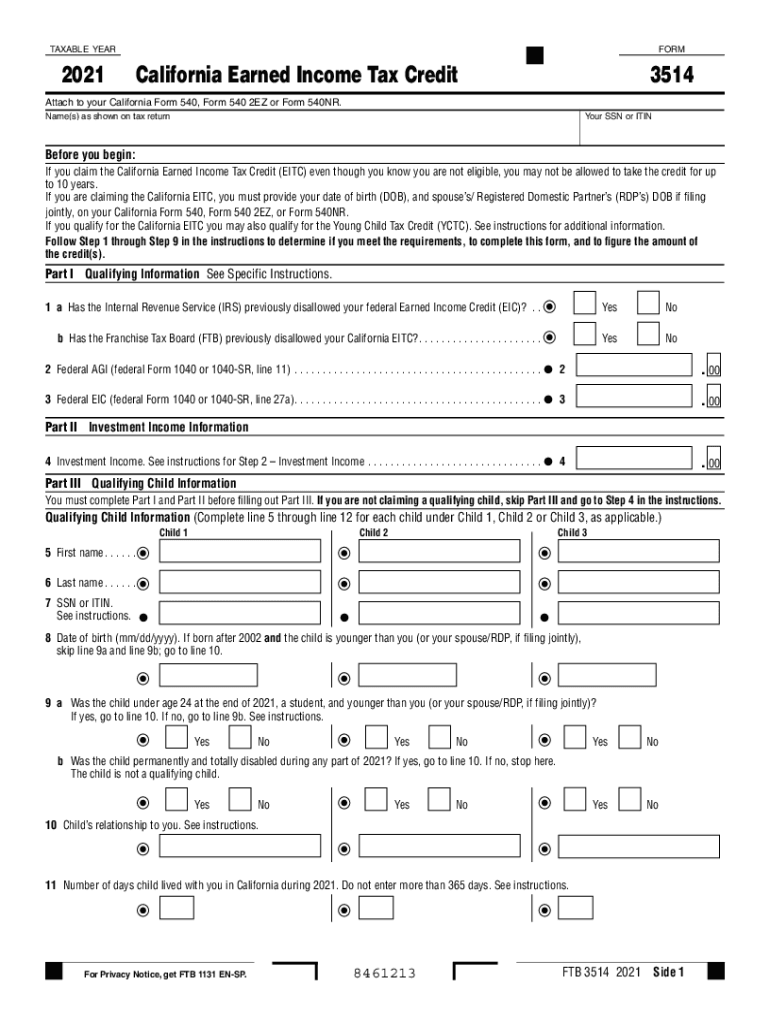

California Form 3514 California Earned Income Tax Credit 2021

What is the California Form 3514 California Earned Income Tax Credit

The California Form 3514 is a tax form used to claim the California Earned Income Tax Credit (CalEITC). This credit is designed to assist low-income working individuals and families by reducing their tax liability and potentially providing a refund. The CalEITC is a vital financial resource that aims to alleviate poverty and promote economic stability among eligible residents of California.

Eligibility Criteria

To qualify for the California Earned Income Tax Credit, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and the number of qualifying children.

- Being a resident of California for more than half the year.

- Filing a California tax return, even if no tax is owed.

Understanding these criteria is essential for determining eligibility and maximizing potential tax benefits.

Steps to complete the California Form 3514 California Earned Income Tax Credit

Completing the California Form 3514 involves several straightforward steps:

- Gather necessary documents, including proof of income and any relevant tax documents.

- Fill out the personal information section, including your name, address, and Social Security number.

- Indicate your filing status and the number of qualifying children, if applicable.

- Calculate your earned income and follow the instructions to determine your credit amount.

- Review the form for accuracy and completeness before submitting.

Each step is crucial to ensure that the form is filled out correctly and submitted on time.

How to obtain the California Form 3514 California Earned Income Tax Credit

The California Form 3514 can be obtained through several methods:

- Download the form directly from the California Department of Tax and Fee Administration (CDTFA) website.

- Request a paper form to be mailed to you by contacting the CDTFA.

- Access the form through tax preparation software that includes California tax forms.

Having the correct version of the form is essential for accurate filing and compliance with state tax regulations.

Legal use of the California Form 3514 California Earned Income Tax Credit

The legal use of the California Form 3514 requires adherence to specific guidelines set forth by the California tax authorities. This includes:

- Ensuring that all information provided is truthful and accurate.

- Filing the form by the designated deadline to avoid penalties.

- Maintaining documentation to support claims made on the form, such as income statements and identification.

Compliance with these legal requirements is vital to avoid complications or audits in the future.

Quick guide on how to complete california form 3514 california earned income tax credit

Effortlessly Prepare California Form 3514 California Earned Income Tax Credit on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents efficiently and without delays. Handle California Form 3514 California Earned Income Tax Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign California Form 3514 California Earned Income Tax Credit with ease

- Find California Form 3514 California Earned Income Tax Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sharing the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Modify and eSign California Form 3514 California Earned Income Tax Credit and maintain excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3514 california earned income tax credit

Create this form in 5 minutes!

People also ask

-

What is the California Form 3514 California Earned Income Tax Credit?

The California Form 3514 California Earned Income Tax Credit is a tax form used by eligible taxpayers to claim the California Earned Income Tax Credit (EITC). This credit is aimed at low to moderate-income households, providing a financial boost by lowering tax liability and potentially resulting in a refund.

-

How can airSlate SignNow help with the California Form 3514 California Earned Income Tax Credit?

airSlate SignNow simplifies the process of submitting the California Form 3514 California Earned Income Tax Credit by allowing users to eSign and send documents securely. Our platform ensures that you can complete tax forms quickly, minimizing delays and enhancing compliance.

-

Is there a cost to use airSlate SignNow for submitting the California Form 3514 California Earned Income Tax Credit?

While airSlate SignNow offers various pricing plans, the cost will vary based on your chosen features and number of users. Investing in our service can be cost-effective given the efficiency and ease of securely submitting the California Form 3514 California Earned Income Tax Credit.

-

What features does airSlate SignNow offer for handling the California Form 3514 California Earned Income Tax Credit?

Our platform offers features such as easy document creation, eSignature capabilities, and secure storage, all tailored to streamline your experience with the California Form 3514 California Earned Income Tax Credit. These features combine to save time and reduce the likelihood of errors.

-

Can I integrate airSlate SignNow with other software for California Form 3514 California Earned Income Tax Credit processing?

Yes, airSlate SignNow can be integrated with various accounting and tax preparation software to facilitate a seamless workflow for managing the California Form 3514 California Earned Income Tax Credit. These integrations ensure that you have all necessary tools at your disposal to enhance efficiency.

-

What benefits does airSlate SignNow provide for businesses filing the California Form 3514 California Earned Income Tax Credit?

Utilizing airSlate SignNow for the California Form 3514 California Earned Income Tax Credit offers businesses notable benefits, including increased speed, enhanced collaboration, and reduced paperwork. Our solution helps ensure that your business meets deadlines while maximizing potential tax credits.

-

Is the California Form 3514 California Earned Income Tax Credit applicable to all taxpayers?

No, the California Form 3514 California Earned Income Tax Credit is specifically designed for certain low to moderate-income taxpayers who meet eligibility requirements. It’s crucial to assess your eligibility based on income level and number of dependents before applying.

Get more for California Form 3514 California Earned Income Tax Credit

- Electrical contract for contractor ohio form

- Sheetrock drywall contract for contractor ohio form

- Flooring contract for contractor ohio form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract ohio form

- Notice of intent to enforce forfeiture provisions of contact for deed ohio form

- Final notice of forfeiture and request to vacate property under contract for deed ohio form

- Buyers request for accounting from seller under contract for deed ohio form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed ohio form

Find out other California Form 3514 California Earned Income Tax Credit

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now