Form 3514 California Earned Income Tax Credit 2024-2026

What is the Form 3514 California Earned Income Tax Credit

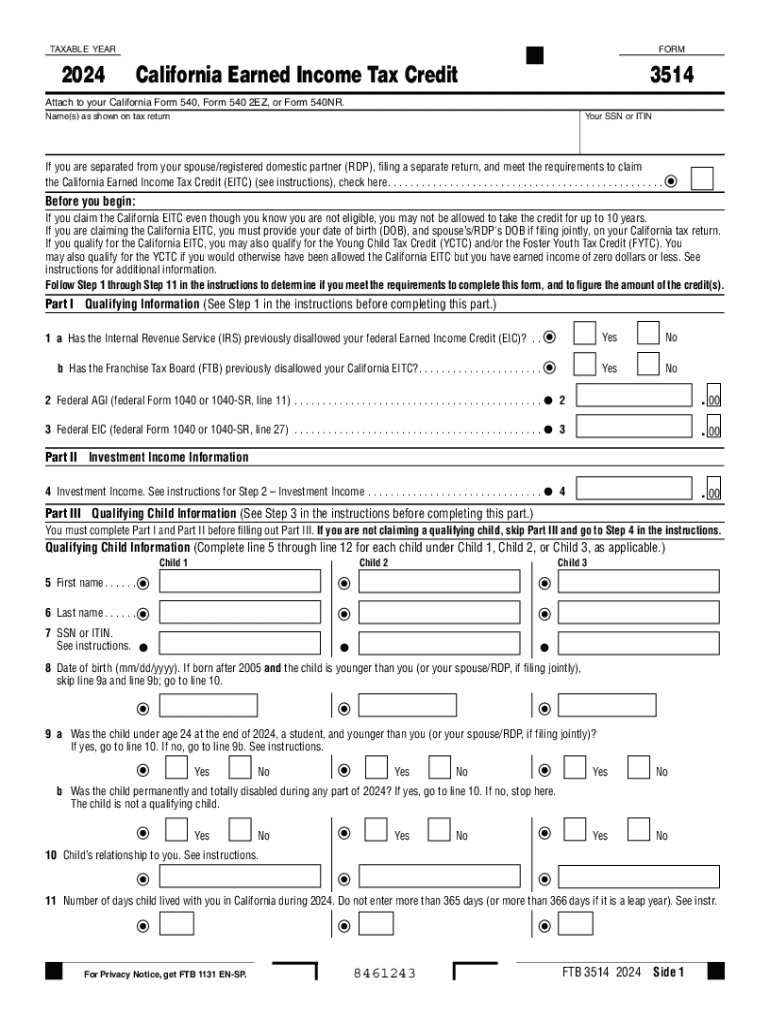

The 2024 FTB 3514 is a crucial form for California residents seeking to claim the California Earned Income Tax Credit (CalEITC). This tax credit is designed to assist low-income working individuals and families by reducing their tax liability and, in some cases, providing a refund. The form helps taxpayers determine their eligibility based on income, filing status, and the number of qualifying children. Understanding the purpose of this form is essential for maximizing potential tax benefits.

Eligibility Criteria for the Form 3514 California Earned Income Tax Credit

To qualify for the California Earned Income Tax Credit using the FTB 3514, taxpayers must meet specific eligibility requirements. These include:

- Filing status: Taxpayers must file as single, married filing jointly, head of household, or qualifying widow(er).

- Income limits: The adjusted gross income (AGI) must fall below certain thresholds, which vary based on filing status and the number of dependents.

- Residency: Taxpayers must be residents of California for the entire tax year.

- Age: Generally, taxpayers must be at least 18 years old, and if claiming children, those children must also meet specific age requirements.

Meeting these criteria is essential for successfully claiming the credit and receiving any potential refund.

Steps to Complete the Form 3514 California Earned Income Tax Credit

Completing the 2024 FTB 3514 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary documents, including your W-2 forms, 1099s, and any other income statements.

- Determine your filing status and number of qualifying children, as these factors influence your eligibility.

- Calculate your adjusted gross income (AGI) to ensure it falls within the required limits.

- Fill out the FTB 3514 form, following the instructions carefully to report your income and any applicable deductions.

- Review the completed form for accuracy, ensuring all calculations and information are correct.

- Submit the form with your California state tax return by the filing deadline.

Following these steps can help streamline the process and enhance the likelihood of a successful claim.

How to Obtain the Form 3514 California Earned Income Tax Credit

The 2024 FTB 3514 form can be easily obtained through various methods. Taxpayers can:

- Visit the California Franchise Tax Board (FTB) website to download a printable version of the form.

- Request a physical copy by contacting the FTB directly or visiting a local FTB office.

- Access the form through tax preparation software that includes state tax forms.

Ensuring you have the correct and most current version of the form is essential for accurate filing.

Key Elements of the Form 3514 California Earned Income Tax Credit

Understanding the key elements of the FTB 3514 is vital for effective completion. Important sections of the form include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Information: Report all sources of income, including wages, self-employment income, and other earnings.

- Dependent Information: Provide details about qualifying children, including their names and Social Security numbers.

- Credit Calculation: This section helps determine the amount of credit you may qualify for based on your income and number of dependents.

Familiarity with these elements can help ensure that taxpayers complete the form accurately and maximize their eligible credits.

Form Submission Methods for the 2024 FTB 3514

Taxpayers have several options for submitting the 2024 FTB 3514 form. These methods include:

- Online Submission: If filing electronically, the form can be submitted through approved e-file providers.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the FTB.

- In-Person: Taxpayers may also submit the form in person at designated FTB offices during business hours.

Selecting the appropriate submission method can help ensure timely processing of your tax return and any potential credits.

Create this form in 5 minutes or less

Find and fill out the correct form 3514 california earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the form 3514 california earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 ftb 3514 form and why is it important?

The 2024 ftb 3514 form is a crucial document for California taxpayers, as it helps in reporting various tax credits and deductions. Understanding this form is essential for accurate tax filing and maximizing potential refunds. Using airSlate SignNow can simplify the process of signing and submitting this form electronically.

-

How can airSlate SignNow assist with the 2024 ftb 3514 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing the 2024 ftb 3514 form. With its intuitive interface, users can quickly fill out, sign, and send the form, ensuring compliance and efficiency. This streamlines the tax filing process, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the 2024 ftb 3514?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for handling the 2024 ftb 3514 form. Users can choose from monthly or annual subscriptions, with options that include additional features for enhanced document management. This ensures that businesses can find a plan that fits their budget while efficiently managing their tax documents.

-

What features does airSlate SignNow offer for managing the 2024 ftb 3514?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, all of which are beneficial for managing the 2024 ftb 3514 form. These tools help users streamline their workflow, ensuring that all necessary documents are easily accessible and securely stored. Additionally, the platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other software for the 2024 ftb 3514?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing the management of the 2024 ftb 3514 form. This includes popular tools like CRM systems, accounting software, and cloud storage services. Such integrations allow for a more cohesive workflow, making it easier to manage all aspects of document handling.

-

What are the benefits of using airSlate SignNow for the 2024 ftb 3514?

Using airSlate SignNow for the 2024 ftb 3514 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick electronic signatures, which speeds up the filing process and minimizes delays. Additionally, it ensures that sensitive information is protected through advanced security measures.

-

Is airSlate SignNow user-friendly for filing the 2024 ftb 3514?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and file the 2024 ftb 3514 form. The straightforward interface allows users to quickly learn how to upload, sign, and send documents without any technical expertise. This accessibility is ideal for both individuals and businesses.

Get more for Form 3514 California Earned Income Tax Credit

- Generator preventive maintenance checklist excel form

- Speakout upper intermediate teachers book answer key form

- Wellmed appeal form

- Supplement cit alabama form

- Tainui kaumatua grants form

- Lights retention scale 5th edition pdf form

- Join us every thursday night from 6pm930pm for jammin form

- Department of natural resources law enforcement di form

Find out other Form 3514 California Earned Income Tax Credit

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF