Dealer Application for Designated Agent Revenue Alabama 2014

What is the Dealer Application for Designated Agent Revenue Alabama

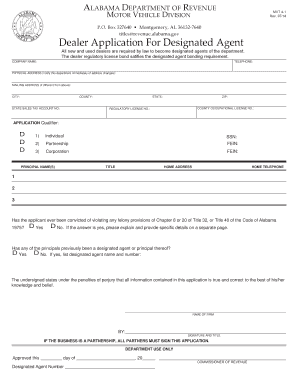

The Dealer Application for Designated Agent Revenue Alabama is a specific form required for businesses operating in the state of Alabama that wish to appoint a designated agent for revenue-related matters. This application allows a business to officially designate an individual or entity to act on its behalf in dealings with the Alabama Department of Revenue. The designated agent can manage tax filings, compliance issues, and other revenue-related tasks, streamlining operations for the business. Understanding the purpose and implications of this application is crucial for businesses to ensure proper representation and adherence to state regulations.

Steps to Complete the Dealer Application for Designated Agent Revenue Alabama

Completing the Dealer Application for Designated Agent Revenue Alabama involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary information about your business, including its legal name, address, and federal tax identification number.

- Identify the designated agent you wish to appoint, including their contact information and role within the business.

- Complete the application form, ensuring all fields are filled out accurately to avoid delays.

- Review the completed application for any errors or omissions.

- Submit the application through the appropriate channels, either online or via mail, as specified by the Alabama Department of Revenue.

Legal Use of the Dealer Application for Designated Agent Revenue Alabama

The legal use of the Dealer Application for Designated Agent Revenue Alabama is governed by state laws that dictate how businesses can appoint representatives for revenue matters. This form must be completed and submitted in accordance with Alabama regulations to ensure that the designated agent has the authority to act on behalf of the business. Proper use of this application helps to establish a clear line of communication between the business and the state, ensuring compliance with tax obligations and other revenue-related requirements. Failure to adhere to legal guidelines may result in penalties or complications in tax matters.

Required Documents for the Dealer Application for Designated Agent Revenue Alabama

When completing the Dealer Application for Designated Agent Revenue Alabama, certain documents are typically required to support the application. These may include:

- Proof of business registration in Alabama.

- Federal Employer Identification Number (EIN) documentation.

- Identification documents for the designated agent, such as a driver's license or state ID.

- Any additional documentation that may be requested by the Alabama Department of Revenue.

Having these documents ready can facilitate a smoother application process and help ensure compliance with state requirements.

How to Obtain the Dealer Application for Designated Agent Revenue Alabama

The Dealer Application for Designated Agent Revenue Alabama can be obtained through the Alabama Department of Revenue's official website or by contacting their office directly. The application is often available in a downloadable format, allowing businesses to fill it out at their convenience. Additionally, businesses may inquire about any specific requirements or updates regarding the application process by reaching out to the department's customer service. Ensuring that you have the most current version of the application is vital for compliance.

Eligibility Criteria for the Dealer Application for Designated Agent Revenue Alabama

To be eligible to submit the Dealer Application for Designated Agent Revenue Alabama, businesses must meet certain criteria set forth by the state. Typically, eligibility includes:

- Being a registered business entity in Alabama.

- Having a valid federal tax identification number.

- Designating an individual or entity capable of fulfilling the responsibilities of a designated agent.

Understanding these criteria is essential for businesses to ensure they qualify for the application process and can effectively manage their revenue-related responsibilities.

Quick guide on how to complete dealer application for designated agent revenue alabama

Effortlessly Prepare Dealer Application For Designated Agent Revenue Alabama on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any delays. Manage Dealer Application For Designated Agent Revenue Alabama on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to amend and electronically sign Dealer Application For Designated Agent Revenue Alabama effortlessly

- Find Dealer Application For Designated Agent Revenue Alabama and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Dealer Application For Designated Agent Revenue Alabama and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dealer application for designated agent revenue alabama

Create this form in 5 minutes!

People also ask

-

What is an Alabama designated agent?

An Alabama designated agent is an individual or business chosen to receive legal documents on behalf of a company. This role is crucial for ensuring that important paperwork, such as lawsuits or official notifications, is properly handled in Alabama. Utilizing airSlate SignNow can simplify this process by allowing businesses to manage their document workflows efficiently.

-

How can airSlate SignNow help me with my Alabama designated agent needs?

airSlate SignNow streamlines the electronic signing and documentation process, making it easy to manage the documents required when working with an Alabama designated agent. Our platform offers various templates and features designed to facilitate seamless communication and document exchange. This ensures that your designated agent receives necessary information quickly and securely.

-

Is airSlate SignNow a cost-effective solution for Alabama designated agents?

Yes, airSlate SignNow provides a cost-effective solution for managing documents related to Alabama designated agents. With transparent pricing and no hidden fees, businesses can save on traditional paper-based practices. Our plans are designed to fit various budgets, ensuring accessibility for all sizes of businesses in Alabama.

-

What features does airSlate SignNow offer for Alabama designated agent services?

airSlate SignNow includes features specifically beneficial for Alabama designated agents, such as electronic signatures, document templates, and secure cloud storage. Additionally, our collaboration tools allow for real-time edits and tracking, ensuring all parties involved are kept up to date. These features help streamline the entire documentation process, saving time and reducing errors.

-

Can I integrate airSlate SignNow with other tools for my Alabama designated agent?

Absolutely! airSlate SignNow offers seamless integrations with various business apps and platforms, making it an ideal choice for Alabama designated agents. Whether it's a CRM, project management tool, or accounting software, our integrations enhance your workflow and ensure that your documents align with your overall business strategy.

-

What benefits does using airSlate SignNow provide to my Alabama designated agent?

Using airSlate SignNow with your Alabama designated agent offers several benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced security features. Additionally, our platform ensures that all transactions comply with Alabama regulations, giving you peace of mind. By simplifying the signing process, you can focus more on your core business activities.

-

How do I become compliant with Alabama laws using airSlate SignNow?

To remain compliant with Alabama laws while using airSlate SignNow, you can rely on our platform's adherence to state regulations regarding electronic signatures. We ensure that all eSignatures provided through the platform meet legal standards. By using airSlate SignNow, you can confidently manage your documentation process with your Alabama designated agent.

Get more for Dealer Application For Designated Agent Revenue Alabama

- Fillable online sos ga georgia state board of cosmetology form

- Paul d pate application for amended secretary of state 572261039 form

- Everything you need to know about filing medical claims form

- Individual social worker application tricare west form

- Part i employers statement needed for both life or accidental death claims form

- Board of regents of the university system of georgia form

- Download the international patient form fox chase cancer center

- Skin script consent form rejuvalase

Find out other Dealer Application For Designated Agent Revenue Alabama

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe