Foreign Corporation Qualification Form State Department of Dat State Md

Understanding the Foreign Corporation Qualification Form

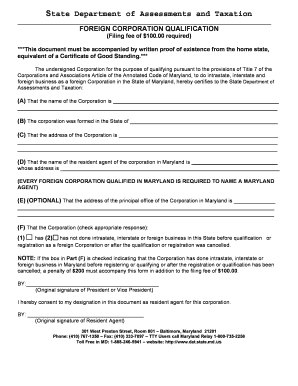

The Foreign Corporation Qualification Form is essential for any business entity that wishes to operate in a state where it is not incorporated. In Maryland, this form allows foreign corporations to register and conduct business legally. It ensures compliance with state regulations and provides the necessary framework for taxation and legal obligations. Understanding the purpose and requirements of this form is crucial for maintaining good standing and avoiding penalties.

Steps to Complete the Foreign Corporation Qualification Form

Completing the Foreign Corporation Qualification Form involves several key steps. First, gather all necessary information about your corporation, including its legal name, principal office address, and the names of its officers and directors. Next, ensure you have the required documents, such as a certificate of good standing from your home state. Once you have all information and documents ready, fill out the form accurately, ensuring that all details match your official records. Finally, submit the form along with any applicable fees to the Maryland State Department of Assessments and Taxation.

Required Documents for Submission

When submitting the Foreign Corporation Qualification Form, specific documents are required to validate your application. These typically include:

- A certificate of good standing from the state where your corporation is incorporated.

- Details of your corporation’s registered agent in Maryland.

- Any amendments or changes to the articles of incorporation, if applicable.

Having these documents ready will streamline the submission process and help ensure that your application is processed without delays.

Legal Use of the Foreign Corporation Qualification Form

The legal use of the Foreign Corporation Qualification Form is vital for compliance with state laws. By filing this form, foreign corporations can legally conduct business in Maryland, which includes entering contracts, hiring employees, and engaging in sales. Failure to file this form may result in penalties, including fines and the inability to enforce contracts in Maryland courts. Therefore, it is crucial to understand the legal implications and ensure timely submission.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is essential for foreign corporations. Generally, the Foreign Corporation Qualification Form should be submitted before commencing business operations in Maryland. While there may not be a strict deadline for filing, it is advisable to complete the process promptly to avoid potential legal issues or penalties. Regularly check for any updates or changes to filing requirements to ensure compliance.

State-Specific Rules for Foreign Corporations

Each state has its own rules and regulations governing foreign corporations. In Maryland, specific requirements must be met to qualify as a foreign corporation. This includes appointing a registered agent who has a physical address in Maryland and ensuring that your corporation complies with local business laws. Understanding these state-specific rules is essential for successful operation and compliance.

Penalties for Non-Compliance

Failure to comply with the requirements of the Foreign Corporation Qualification Form can lead to significant penalties. These may include fines, loss of good standing, and restrictions on conducting business in Maryland. In severe cases, a corporation may face legal action or be barred from pursuing claims in court. Therefore, it is crucial to adhere to all filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete foreign corporation qualification form state department of dat state md

Handle Foreign Corporation Qualification Form State Department Of Dat State Md effortlessly on any gadget

Web-based document control has become favored among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can find the right template and safely store it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and eSign your papers promptly without delays. Manage Foreign Corporation Qualification Form State Department Of Dat State Md on any device with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to alter and eSign Foreign Corporation Qualification Form State Department Of Dat State Md seamlessly

- Obtain Foreign Corporation Qualification Form State Department Of Dat State Md and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize signNow sections of your files or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Foreign Corporation Qualification Form State Department Of Dat State Md and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct foreign corporation qualification form state department of dat state md

Create this form in 5 minutes!

People also ask

-

What is an airSlate SignNow foreign form?

An airSlate SignNow foreign form refers to a document that requires signatures or approvals across different countries or regions. With our platform, businesses can easily send and eSign these documents, ensuring compliance and efficiency. Our solution simplifies the process, making international transactions smoother.

-

How does airSlate SignNow handle foreign form integrations?

AirSlate SignNow offers seamless integrations with various platforms that enable users to manage foreign forms effortlessly. Whether it's connecting with CRM systems, payment gateways, or other business software, our solution streamlines the entire workflow. This ensures that all necessary data and documents are readily accessible.

-

What are the pricing options for using airSlate SignNow for foreign forms?

We provide flexible pricing plans for businesses looking to manage foreign forms efficiently. Our plans are designed to be cost-effective while offering essential features for document management and eSigning. You can choose a plan that best suits your business size and specific needs.

-

Can I customize foreign forms with airSlate SignNow?

Yes, airSlate SignNow allows users to customize foreign forms to meet their specific requirements. You can add fields, define signing roles, and incorporate company branding to create a professional appearance. This level of customization helps maintain consistency across documents.

-

What are the benefits of using airSlate SignNow for foreign forms?

Using airSlate SignNow for foreign forms enhances business efficiency by simplifying the eSigning process. It reduces turnaround time, mitigates human error, and ensures secure document handling. Additionally, our platform is user-friendly, making it accessible to all team members.

-

Is airSlate SignNow secure for processing foreign forms?

Absolutely! AirSlate SignNow prioritizes security, especially when handling foreign forms. We utilize advanced encryption and adhere to industry-standard security protocols to protect your documents and user data. Compliance with regulations ensures safe transactions across borders.

-

How can I track the status of foreign forms sent through airSlate SignNow?

AirSlate SignNow provides robust tracking features that allow you to monitor the status of all foreign forms you send. You can receive notifications when documents are opened, signed, and completed. This transparency ensures you can manage your workflow effectively.

Get more for Foreign Corporation Qualification Form State Department Of Dat State Md

Find out other Foreign Corporation Qualification Form State Department Of Dat State Md

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe