Minnesota Fillable Tax Forms 2011

What is the Minnesota Fillable Tax Forms

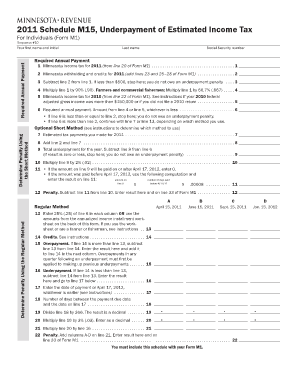

The Minnesota fillable tax forms are official documents used by residents and businesses in Minnesota to report income, calculate taxes owed, and claim deductions or credits. These forms are designed to be completed electronically, allowing users to fill in their information directly on the document. Common examples include the Minnesota M15 and other related tax forms. The fillable format streamlines the process, making it easier for taxpayers to ensure accuracy and compliance with state tax regulations.

How to use the Minnesota Fillable Tax Forms

Using the Minnesota fillable tax forms involves several straightforward steps. First, access the desired form from a reliable source. Once you have the form, open it using a compatible PDF reader that supports fillable fields. Enter your details in the designated areas, ensuring that all required information is accurately filled out. After completing the form, you can save it for your records or print it for submission. If you choose to eSign the document, ensure that you use a trusted electronic signature solution that complies with legal requirements.

Steps to complete the Minnesota Fillable Tax Forms

Completing the Minnesota fillable tax forms can be done efficiently by following these steps:

- Download the appropriate fillable tax form from the Minnesota Department of Revenue website.

- Open the form in a PDF reader that supports fillable fields.

- Fill in your personal information, including your name, address, and Social Security number.

- Input your income details, deductions, and credits as applicable.

- Review the completed form for accuracy.

- Save the form to retain a copy for your records.

- Submit the form either electronically or by mailing it to the appropriate tax authority.

Legal use of the Minnesota Fillable Tax Forms

The Minnesota fillable tax forms are legally binding documents when completed and submitted according to state regulations. To ensure their legal validity, it is essential to follow all instructions provided with the forms. This includes signing the document, either physically or electronically, using a compliant eSignature solution. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial for the acceptance of electronically signed documents.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota fillable tax forms are critical for taxpayers to observe. Typically, individual income tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any specific extensions or changes that may apply to particular tax years. Keeping track of these dates helps avoid penalties and ensures compliance with state tax laws.

Required Documents

To accurately complete the Minnesota fillable tax forms, certain documents are typically required. These may include:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any additional income received, such as freelance or contract work.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Records of any tax credits claimed.

Having these documents readily available simplifies the completion process and helps ensure accurate reporting.

Quick guide on how to complete minnesota fillable tax forms

Complete Minnesota Fillable Tax Forms effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed files, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Minnesota Fillable Tax Forms on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

Efficiently modify and electronically sign Minnesota Fillable Tax Forms with ease

- Locate Minnesota Fillable Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Select your preferred method to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Minnesota Fillable Tax Forms and ensure exceptional communication throughout the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota fillable tax forms

Create this form in 5 minutes!

People also ask

-

What are Minnesota fillable tax forms?

Minnesota fillable tax forms are digital tax documents specifically designed for taxpayers in Minnesota. These forms allow users to enter their information directly into the form fields, making the process of preparing and filing taxes much more straightforward. Utilizing airSlate SignNow can enhance your experience by allowing easy e-signature and document management.

-

How can I access Minnesota fillable tax forms through airSlate SignNow?

You can easily access Minnesota fillable tax forms on airSlate SignNow's platform. Simply log in or create an account, navigate to the forms section, and search for the relevant Minnesota tax forms you need. The platform provides a user-friendly interface to streamline the process of locating and filling out your tax documents.

-

Are Minnesota fillable tax forms free to use?

While airSlate SignNow offers a range of features, accessing Minnesota fillable tax forms may come with associated costs depending on the plan you choose. However, the platform is known for its cost-effective solutions that can greatly simplify document signing and management. Visit our pricing page to explore the available options.

-

What features do Minnesota fillable tax forms on airSlate SignNow include?

The Minnesota fillable tax forms on airSlate SignNow come with several features designed for convenience. Users can easily fill out forms, e-sign documents, and save their work securely. Additionally, you can collaborate with tax professionals or family members seamlessly through the platform.

-

Can I integrate airSlate SignNow with other accounting software for Minnesota fillable tax forms?

Yes, airSlate SignNow offers integrations with popular accounting and tax software, enhancing your experience with Minnesota fillable tax forms. This compatibility allows you to streamline your workflow, keeping all your financial data organized and easily accessible. Check our integrations page for more details on compatible software.

-

What are the benefits of using airSlate SignNow for Minnesota fillable tax forms?

Using airSlate SignNow for Minnesota fillable tax forms provides signNow benefits, including ease of use and enhanced efficiency. The ability to fill out and e-sign documents all in one place minimizes the hassle of traditional paper processes. Plus, the security features ensure your sensitive tax information is well-protected.

-

Are Minnesota fillable tax forms available on mobile devices?

Absolutely! Minnesota fillable tax forms can be accessed and completed on mobile devices using the airSlate SignNow app. This flexibility allows you to fill out, e-sign, and manage your tax documents on the go, ensuring you never miss an important deadline.

Get more for Minnesota Fillable Tax Forms

- Child accident or unusual 396005880 form

- Chapter spotlightihi institute for healthcare improvement form

- 999 green bay road glencoe il 60022 847 835 3030 fax 847 835 7279 form

- Green light driving school 34 n island ave ste e batavia il form

- Ace forms and downloadsschool of the art institute of

- Cmp form 1360

- Frequently asked questionsemory universityatlanta ga form

- Two dozen practice administrators form

Find out other Minnesota Fillable Tax Forms

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document