M15, Underpayment of Estimated Income Tax for Individuals M15, Underpayment of Estimated Income Tax for Individuals 2024

Understanding the Minnesota Schedule M15

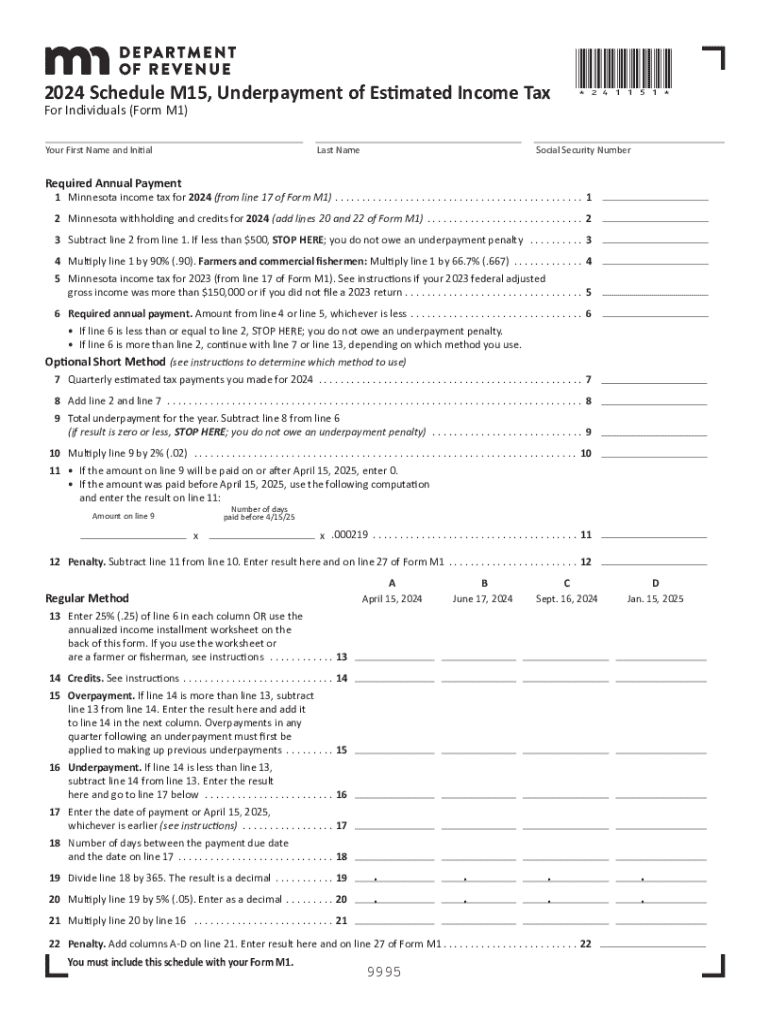

The Minnesota Schedule M15 is a tax form specifically designed for individuals who need to report underpayment of estimated income tax. This form is essential for taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated payments. The M15 helps calculate any penalties that may apply due to underpayment, ensuring compliance with state tax regulations.

How to Complete the Minnesota Schedule M15

Completing the Minnesota M15 involves several steps to accurately report your estimated tax payments. First, gather all relevant financial documents, including income statements and previous tax returns. Next, determine your total tax liability for the year and compare it to the amount you have already paid. If you find a discrepancy indicating underpayment, fill out the M15 form by entering your calculated amounts in the appropriate sections. Ensure all figures are accurate to avoid penalties.

Obtaining the Minnesota Schedule M15

The Minnesota Schedule M15 can be obtained from the Minnesota Department of Revenue's website or through tax preparation software that supports Minnesota tax forms. It is important to ensure you have the correct version for the tax year you are filing. For the 2024 tax year, make sure to download the 2024 M15 form to reflect any updates or changes in tax law.

Key Elements of the Minnesota Schedule M15

The M15 form includes several key components that taxpayers must understand. These elements typically include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Estimated Tax Payments: A section to report any estimated tax payments made throughout the year.

- Penalty Calculation: A formula to determine any penalties for underpayment based on the difference between your total tax liability and what has been paid.

Filing Deadlines for the Minnesota Schedule M15

It is crucial to be aware of the filing deadlines for the Minnesota Schedule M15. Typically, the form must be submitted by the same deadline as your annual tax return. For most individuals, this means filing by April 15 of the following year. If you owe penalties, timely filing can help mitigate additional charges.

Penalties for Non-Compliance with the Minnesota Schedule M15

Failure to file the Minnesota M15 or to pay the required estimated taxes can result in significant penalties. The state may impose fines based on the amount of underpayment and the duration of the delay. Understanding these penalties can help taxpayers take proactive steps to avoid them, such as making timely payments and accurately completing the form.

Examples of Using the Minnesota Schedule M15

Consider a self-employed individual who has not made sufficient estimated tax payments throughout the year. By using the Minnesota M15, they can calculate the penalty for underpayment and report it accurately. Another example includes a taxpayer who experiences fluctuating income, leading to unexpected tax liabilities. The M15 allows them to address these discrepancies and ensure compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct m15 underpayment of estimated income tax for individuals m15 underpayment of estimated income tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the m15 underpayment of estimated income tax for individuals m15 underpayment of estimated income tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mn schedule m15 and how does it work with airSlate SignNow?

The mn schedule m15 is a specific scheduling tool that integrates seamlessly with airSlate SignNow. It allows users to manage their document signing processes efficiently, ensuring that all parties are on the same page regarding timelines and deadlines.

-

How much does airSlate SignNow cost for users interested in the mn schedule m15?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing the mn schedule m15. Users can select from different tiers that best fit their business needs, ensuring they get the most value for their investment.

-

What features does airSlate SignNow offer for managing the mn schedule m15?

airSlate SignNow provides a range of features tailored for the mn schedule m15, including document templates, automated reminders, and real-time tracking. These features enhance productivity and streamline the signing process, making it easier for users to stay organized.

-

Can I integrate airSlate SignNow with other tools while using the mn schedule m15?

Yes, airSlate SignNow offers robust integrations with various applications, allowing users to enhance their workflow while managing the mn schedule m15. This flexibility ensures that you can connect with tools you already use, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the mn schedule m15?

Using airSlate SignNow for the mn schedule m15 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The platform's user-friendly interface makes it easy for teams to adopt and utilize effectively.

-

Is airSlate SignNow secure for handling documents related to the mn schedule m15?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the mn schedule m15 are protected. With features like encryption and secure access controls, users can trust that their sensitive information is safe.

-

How can I get started with airSlate SignNow for the mn schedule m15?

Getting started with airSlate SignNow for the mn schedule m15 is simple. You can sign up for a free trial on our website, explore the features, and see how it can streamline your document signing process before committing to a plan.

Get more for M15, Underpayment Of Estimated Income Tax For Individuals M15, Underpayment Of Estimated Income Tax For Individuals

Find out other M15, Underpayment Of Estimated Income Tax For Individuals M15, Underpayment Of Estimated Income Tax For Individuals

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document