Schedule M15, Underpayment of Estimated Income Tax 2020

What is the Schedule M15, Underpayment Of Estimated Income Tax

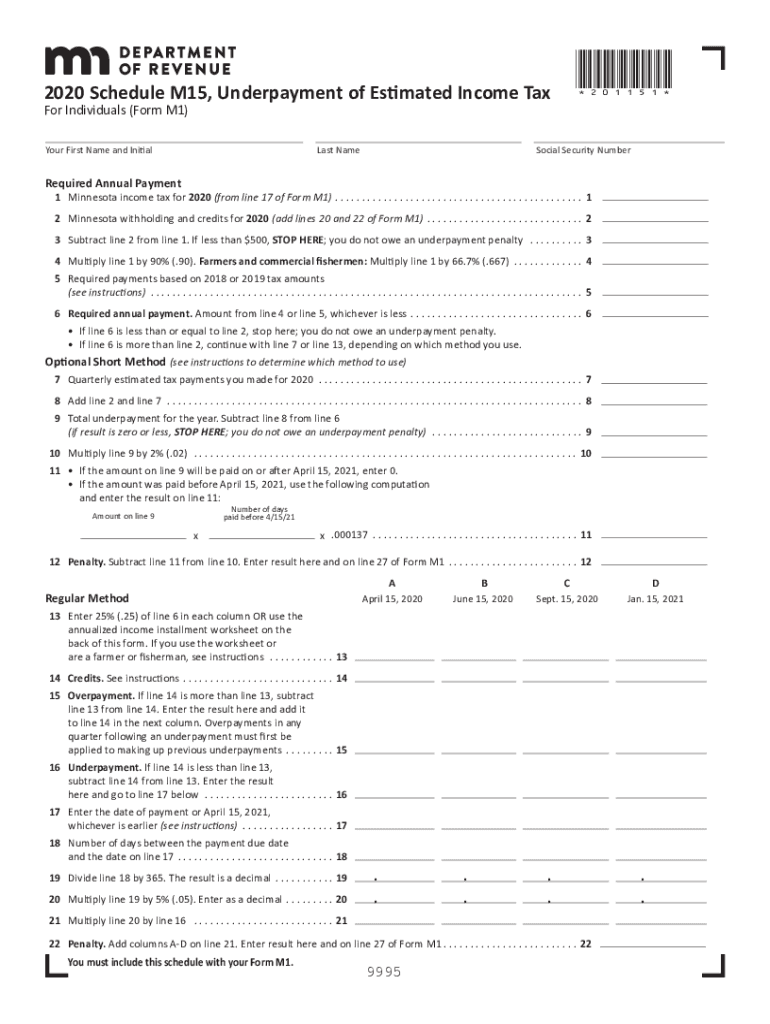

The Schedule M15, Underpayment Of Estimated Income Tax, is a form used by taxpayers in the United States to calculate any penalties for underpayment of estimated taxes. This form is essential for individuals who have not paid enough tax throughout the year, either through withholding or estimated tax payments. The IRS requires this form to ensure that taxpayers meet their tax obligations and avoid penalties. Understanding the M15 form helps taxpayers manage their finances effectively and stay compliant with federal tax regulations.

How to use the Schedule M15, Underpayment Of Estimated Income Tax

Using the Schedule M15 involves several steps. First, gather all relevant financial information, including your total income, tax withheld, and any estimated tax payments made during the year. Next, calculate your total tax liability for the year. After determining your tax liability, compare it to the amount of tax you have already paid. If you find that you have underpaid, complete the M15 form to calculate the penalty based on the amount owed and the duration of the underpayment. Finally, submit the completed form with your tax return to the IRS.

Steps to complete the Schedule M15, Underpayment Of Estimated Income Tax

Completing the Schedule M15 requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and records of estimated payments.

- Calculate your total tax liability for the year based on your income.

- Determine the total amount of tax you have paid through withholding and estimated payments.

- Use the M15 form to input your figures and calculate any penalties for underpayment.

- Review your calculations for accuracy before submitting the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Schedule M15. Generally, the form must be submitted along with your annual tax return, which is typically due on April fifteenth of each year. If you are unable to file by this date, you may apply for an extension, but any taxes owed must still be paid by the original deadline to avoid additional penalties. Keeping track of these important dates helps ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failing to file the Schedule M15 or underpaying estimated taxes can result in significant penalties. The IRS may impose a penalty based on the amount of underpayment and the length of time it remains unpaid. Additionally, interest may accrue on the unpaid balance, increasing the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate tax payments to avoid financial repercussions.

Digital vs. Paper Version

Taxpayers have the option to complete the Schedule M15 either digitally or on paper. The digital version allows for easier calculations and automatic updates, reducing the likelihood of errors. Additionally, using a digital platform often provides enhanced security features, such as encryption and secure storage. On the other hand, some individuals may prefer the traditional paper method for its simplicity. Regardless of the chosen method, ensuring that the form is completed accurately and submitted on time is essential.

Quick guide on how to complete schedule m15 underpayment of estimated income tax

Complete Schedule M15, Underpayment Of Estimated Income Tax effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule M15, Underpayment Of Estimated Income Tax on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Schedule M15, Underpayment Of Estimated Income Tax effortlessly

- Obtain Schedule M15, Underpayment Of Estimated Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule M15, Underpayment Of Estimated Income Tax to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule m15 underpayment of estimated income tax

Create this form in 5 minutes!

People also ask

-

What is Schedule M15, Underpayment Of Estimated Income Tax?

Schedule M15, Underpayment Of Estimated Income Tax, is a form used by taxpayers to calculate their estimated tax payment shortfall. This schedule helps you assess if you owe additional taxes due to underestimating your income tax obligations. Knowing how to fill it out correctly can save you from penalties.

-

How can airSlate SignNow assist with Schedule M15 documentation?

With airSlate SignNow, you can easily fill out, send, and eSign your Schedule M15, Underpayment Of Estimated Income Tax forms. Our user-friendly platform simplifies the process, ensuring that your documents are accurate and submitted on time. This efficiency can signNowly reduce your stress during tax season.

-

What pricing options does airSlate SignNow offer for its services?

airSlate SignNow provides a variety of pricing plans designed to accommodate different business needs. You can choose from monthly or yearly subscriptions, each tailored to ensure you have access to essential features for documents like Schedule M15, Underpayment Of Estimated Income Tax. Check our website for the latest promotions and packages.

-

What features make airSlate SignNow a suitable choice for tax-related documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSignature capabilities. These tools streamline the handling of crucial forms, like the Schedule M15, Underpayment Of Estimated Income Tax, making it easier to stay compliant and organized. Experience document tracking to ensure you're always on top of your filing responsibilities.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This connectivity allows you to manage your documentation for Schedule M15, Underpayment Of Estimated Income Tax efficiently alongside other crucial business processes. Enhance your workflow and improve productivity with our integration capabilities.

-

How securely does airSlate SignNow handle sensitive tax information?

airSlate SignNow takes security very seriously and utilizes advanced encryption protocols to protect your sensitive tax information, such as Schedule M15, Underpayment Of Estimated Income Tax data. We comply with industry regulations to ensure the confidentiality of your documents. Rest assured, your information is safe with us.

-

Is it easy to request signatures on Schedule M15, Underpayment Of Estimated Income Tax forms using airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly simple to request eSignatures on your Schedule M15, Underpayment Of Estimated Income Tax forms. You can send out signature requests directly from the platform and track the status in real-time, ensuring a smooth and efficient signing process.

Get more for Schedule M15, Underpayment Of Estimated Income Tax

Find out other Schedule M15, Underpayment Of Estimated Income Tax

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe