Schedule M15, Underpayment of Estimated Income Tax 2022

What is the Schedule M15, Underpayment Of Estimated Income Tax

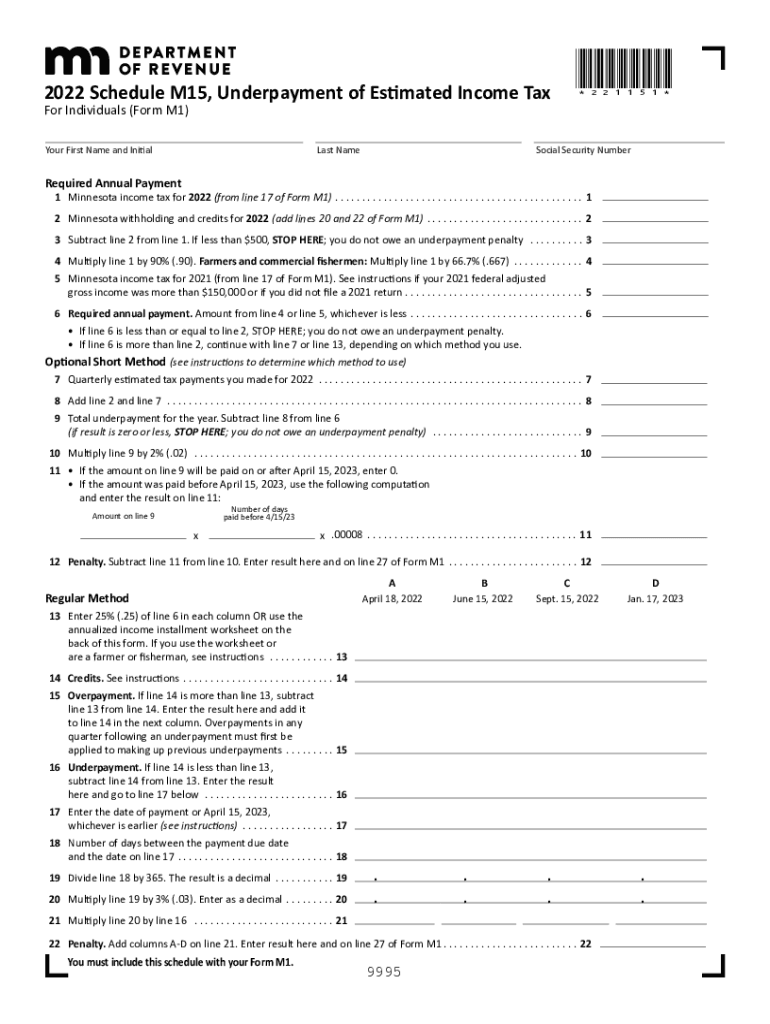

The Schedule M15 is a form used by taxpayers in Minnesota to report underpayment of estimated income tax. It is specifically designed for individuals who may not have paid enough tax throughout the year, either through withholding or estimated tax payments. This form helps taxpayers calculate any penalties that may apply due to underpayment and ensures compliance with state tax regulations.

How to use the Schedule M15, Underpayment Of Estimated Income Tax

Using the Schedule M15 involves a few straightforward steps. First, gather your income information for the tax year, including any estimated tax payments made. Next, complete the form by entering your total income, tax liability, and estimated payments. The form will guide you through calculating any penalties for underpayment based on the information provided. Once completed, ensure you review the form for accuracy before submission.

Steps to complete the Schedule M15, Underpayment Of Estimated Income Tax

Completing the Schedule M15 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information at the top of the form.

- Input your total income and calculate your tax liability.

- List any estimated tax payments you have made during the year.

- Calculate the difference between your tax liability and payments to determine if you have underpaid.

- Follow the instructions to compute any applicable penalties.

- Review all entries for accuracy before finalizing the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Schedule M15. Typically, the form must be submitted by the due date for your income tax return. If you are filing for an extension, ensure that the Schedule M15 is submitted along with your extended return. Keeping track of these dates helps avoid penalties and interest on underpaid taxes.

Penalties for Non-Compliance

Failure to file the Schedule M15 when required can result in penalties imposed by the Minnesota Department of Revenue. These penalties may include interest on the underpaid amount and additional fees for late filing. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate submission of this form.

Required Documents

To accurately complete the Schedule M15, you will need several documents. Gather your W-2 forms, 1099 forms, and any other documentation that reflects your income for the year. Additionally, have records of any estimated tax payments made, as these will be necessary for calculating your total tax liability and any penalties for underpayment.

Quick guide on how to complete 2022 schedule m15 underpayment of estimated income tax

Complete Schedule M15, Underpayment Of Estimated Income Tax effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily find the appropriate document and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Schedule M15, Underpayment Of Estimated Income Tax on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Schedule M15, Underpayment Of Estimated Income Tax with ease

- Obtain Schedule M15, Underpayment Of Estimated Income Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule M15, Underpayment Of Estimated Income Tax and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule m15 underpayment of estimated income tax

Create this form in 5 minutes!

People also ask

-

What is the schedule m15 feature in airSlate SignNow?

The schedule m15 feature in airSlate SignNow allows users to automate the signing process by setting specific times for document delivery and signing. This functionality ensures that all stakeholders receive documents promptly, making workflows more efficient and organized.

-

How much does it cost to use schedule m15 with airSlate SignNow?

Pricing for the schedule m15 feature is included in our airSlate SignNow subscription plans, which are designed to be cost-effective for businesses of all sizes. For detailed pricing information tailored to your needs, we recommend checking our website for the most current offers.

-

What are the main benefits of using the schedule m15 feature?

Using the schedule m15 feature enhances productivity by allowing teams to focus on other tasks while the software takes care of the timing for document signing. Additionally, it improves compliance and accountability by ensuring timely sign-offs from all parties involved.

-

Can I integrate schedule m15 with other applications?

Yes, airSlate SignNow offers seamless integration with various CRM and document management systems, which can enhance the functionality of the schedule m15 feature. This means you can connect your existing tools with airSlate SignNow for a more cohesive workflow.

-

Is it easy to set up the schedule m15 functionality?

Absolutely! Setting up the schedule m15 functionality in airSlate SignNow is straightforward and user-friendly. With guided prompts and easy navigation, you can get started without any technical expertise.

-

Does schedule m15 support multiple signers?

Yes, the schedule m15 feature in airSlate SignNow supports multiple signers, making it ideal for team-based projects. You can easily specify the order of signing and set reminders for all participants involved.

-

What types of documents can I manage with schedule m15?

You can manage a wide range of document types with the schedule m15 feature in airSlate SignNow, including contracts, agreements, and proposals. This flexibility makes it suitable for various industries and use cases.

Get more for Schedule M15, Underpayment Of Estimated Income Tax

- Residential rental lease application nebraska form

- Salary verification form for potential lease nebraska

- Landlord agreement to allow tenant alterations to premises nebraska form

- Notice of default on residential lease nebraska form

- Landlord tenant lease co signer agreement nebraska form

- Application for sublease nebraska form

- Inventory and condition of leased premises for pre lease and post lease nebraska form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out nebraska form

Find out other Schedule M15, Underpayment Of Estimated Income Tax

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS