MN Schedule M15 Fill Out Tax Template Online 2021

What is the MN Schedule M15?

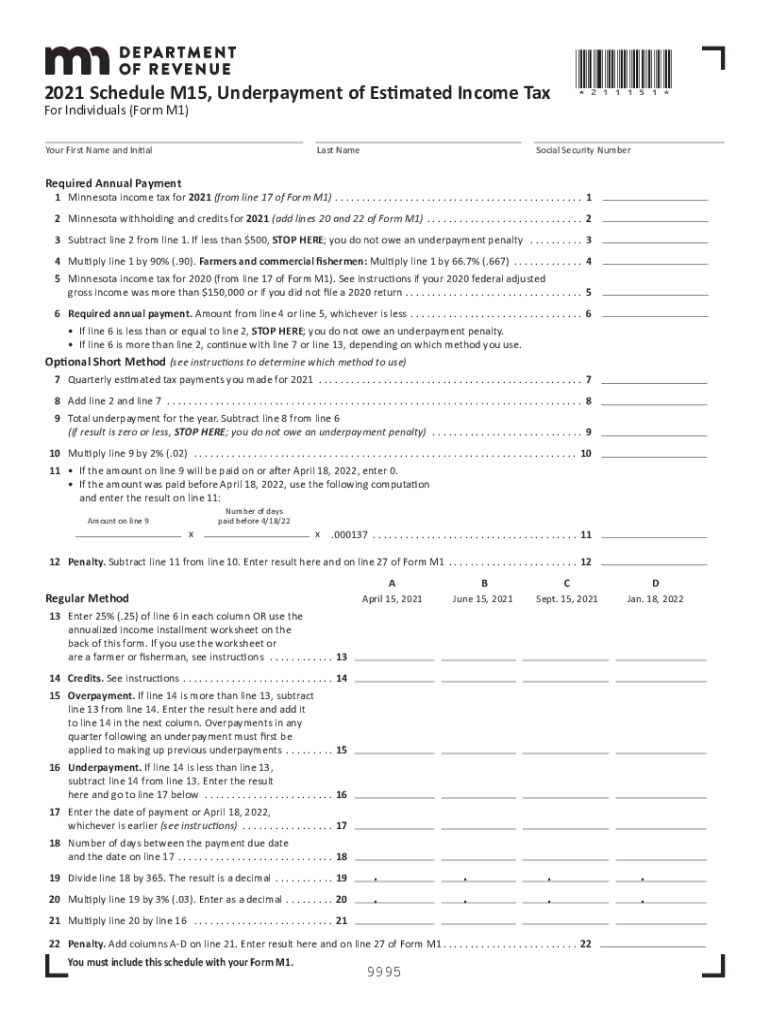

The MN Schedule M15 is a tax form used by Minnesota residents to report income and calculate tax liability. This form is specifically designed for individuals who may have underpayment issues or other tax-related concerns. It is essential for ensuring compliance with state tax laws and is part of the broader Minnesota tax filing process. Understanding the purpose of the MN Schedule M15 is crucial for accurate tax reporting and to avoid potential penalties.

Steps to complete the MN Schedule M15

Completing the MN Schedule M15 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and previous tax returns. Next, fill out the form by entering your personal information, income details, and any applicable deductions. Pay close attention to the calculations required for tax liability. Finally, review the completed form for accuracy before submission. Utilizing digital tools can streamline this process and enhance accuracy.

Legal use of the MN Schedule M15

The MN Schedule M15 is legally binding when completed and submitted according to Minnesota state tax regulations. To ensure its legal standing, it is important to follow the guidelines set forth by the Minnesota Department of Revenue. This includes providing accurate information, maintaining proper documentation, and adhering to deadlines. Utilizing eSignature solutions can further enhance the legal validity of the document, ensuring it meets all necessary compliance requirements.

Filing Deadlines / Important Dates

Filing deadlines for the MN Schedule M15 are crucial for taxpayers to observe. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, it is important to check for any state-specific extensions or changes that may affect this timeline. Missing the deadline can result in penalties and interest on unpaid taxes, making it essential to stay informed about important dates throughout the tax year.

Required Documents

When preparing to complete the MN Schedule M15, certain documents are required to ensure accurate reporting. These typically include W-2 forms, 1099 forms, and any other income-related documents. Additionally, records of deductions, credits, and previous tax returns should be gathered. Having these documents ready will facilitate a smoother completion process and help avoid errors that could lead to compliance issues.

Examples of using the MN Schedule M15

Examples of scenarios where the MN Schedule M15 may be used include situations involving underpayment of taxes or adjustments to previously filed returns. For instance, if a taxpayer discovers they owe additional taxes after filing, they may need to submit the MN Schedule M15 to rectify the situation. Another example is for individuals who have experienced changes in income or deductions that affect their tax liability. Understanding these scenarios can help taxpayers utilize the form effectively.

Form Submission Methods

The MN Schedule M15 can be submitted through various methods, including online, by mail, or in-person at designated tax offices. Online submission is often the most efficient option, allowing for quicker processing and confirmation of receipt. For those who prefer traditional methods, mailing the completed form to the appropriate tax authority is also acceptable. In-person submissions may be available during tax season at local offices, providing assistance for any questions or concerns.

Quick guide on how to complete mn schedule m15 2020 2021 fill out tax template online

Prepare MN Schedule M15 Fill Out Tax Template Online effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage MN Schedule M15 Fill Out Tax Template Online on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign MN Schedule M15 Fill Out Tax Template Online without hassle

- Locate MN Schedule M15 Fill Out Tax Template Online and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign MN Schedule M15 Fill Out Tax Template Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mn schedule m15 2020 2021 fill out tax template online

Create this form in 5 minutes!

How to create an eSignature for the mn schedule m15 2020 2021 fill out tax template online

The best way to create an e-signature for your PDF file online

The best way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an e-signature for a PDF on Android devices

People also ask

-

What is the mn schedule m15 2021, and how does it work?

The mn schedule m15 2021 is a specific tax schedule used by businesses to report certain income and expenses. Understanding this schedule is crucial for proper tax filing. AirSlate SignNow allows users to easily eSign and send documents related to their tax obligations, including forms linked to the mn schedule m15 2021.

-

How can airSlate SignNow help me manage my mn schedule m15 2021 documents?

airSlate SignNow provides an easy-to-use platform to manage your mn schedule m15 2021 documents. You can create, send, and securely eSign essential forms, ensuring compliance and timely submissions. Its user-friendly interface simplifies the document management process, helping you stay organized and efficient.

-

What are the pricing options for airSlate SignNow in relation to mn schedule m15 2021?

airSlate SignNow offers flexible pricing plans that can accommodate various business sizes, ensuring you get the best value for managing your mn schedule m15 2021 documents. The cost-effective solution allows businesses to choose a plan that fits their budget while having access to essential features for document eSigning.

-

What features does airSlate SignNow offer for handling mn schedule m15 2021 forms?

Key features of airSlate SignNow for mn schedule m15 2021 include eSigning, customizable templates, and advanced document tracking. These features enhance efficiency by streamlining the process of preparing and managing your tax schedule forms. Additionally, you can automate reminders, ensuring that you don’t miss important deadlines.

-

Is airSlate SignNow compliant with tax regulations related to mn schedule m15 2021?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that your documents related to the mn schedule m15 2021 meet all necessary tax regulations. The platform uses secure encryption and maintains audit trails for compliance. This means you can eSign and manage your tax documents with confidence.

-

Can I integrate airSlate SignNow with other software for my mn schedule m15 2021 needs?

Absolutely! airSlate SignNow offers numerous integrations with accounting and financial software, allowing for seamless management of your mn schedule m15 2021 documents. This ensures that relevant data can flow between platforms, making it easier to input and track your tax information.

-

What benefits can I expect from using airSlate SignNow for mn schedule m15 2021?

Using airSlate SignNow for your mn schedule m15 2021 will enhance your document workflow efficiency and reduce errors. The ability to eSign documents quickly and securely saves time and improves accessibility. This leads to better organization and timely submission of your tax documents, ultimately supporting your business's compliance efforts.

Get more for MN Schedule M15 Fill Out Tax Template Online

- Name change notification package for brides court ordered name change divorced marriage for florida florida form

- Florida name change 497303232 form

- Florida commercial lease form

- Florida legal documents form

- Florida guardian legal form

- Life tenant florida form

- Florida northern district bankruptcy guide and forms package for chapters 7 or 13 florida

- Fl bankruptcy guide form

Find out other MN Schedule M15 Fill Out Tax Template Online

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now