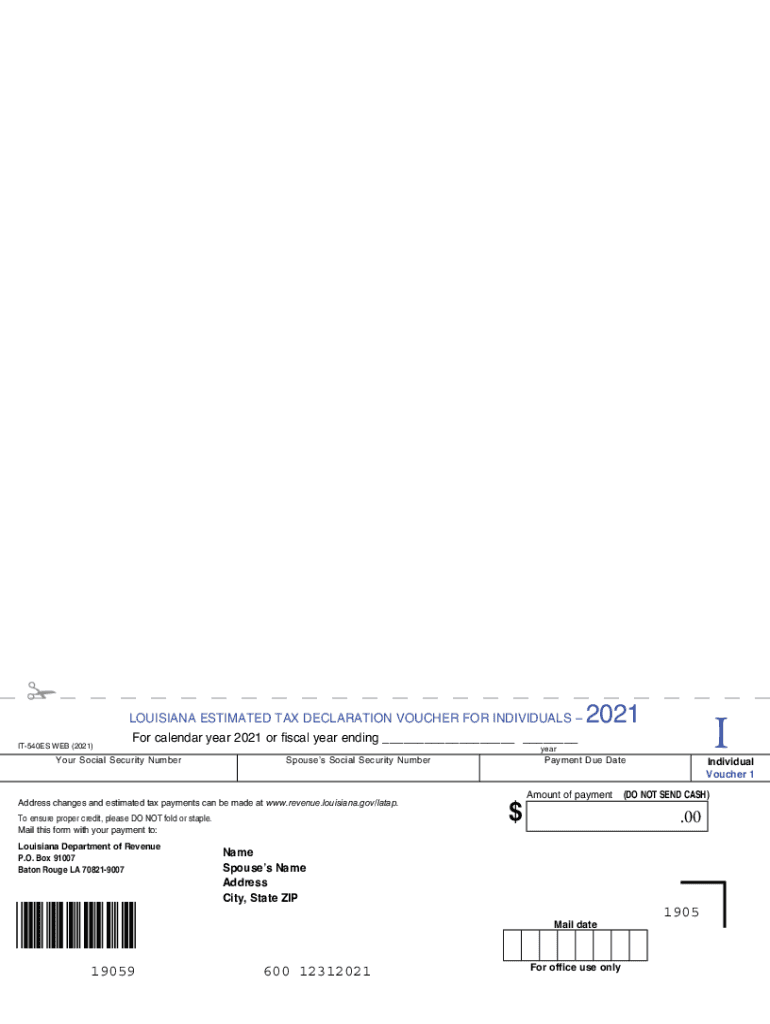

for Calendar Year or Fiscal Year Ending 2021

Understanding the it540es Form for Tax Filings

The it540es form is essential for individuals in Louisiana who need to report estimated tax payments for the calendar year or fiscal year. This form allows taxpayers to calculate and submit their estimated tax obligations, ensuring compliance with state tax regulations. Understanding the purpose and requirements of the it540es is crucial for accurate tax reporting and avoidance of penalties.

Steps to Complete the it540es Form

Completing the it540es form involves several straightforward steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability based on your expected income for the year.

- Fill out the it540es form with accurate figures, ensuring all calculations align with your financial data.

- Review the form for accuracy before submission to prevent errors that could lead to penalties.

- Submit the completed form either electronically through a secure platform or by mailing it to the appropriate tax authority.

Filing Deadlines for the it540es Form

Timely submission of the it540es form is critical to avoid penalties. The deadlines for filing this form typically align with the estimated tax payment schedule set by the Louisiana Department of Revenue. Taxpayers should be aware of quarterly deadlines, which usually fall on the 15th of April, June, September, and January of the following year. Keeping track of these dates helps ensure compliance and avoid unnecessary fees.

Legal Use of the it540es Form

The it540es form holds legal significance as it serves as an official document for reporting estimated tax payments. When completed and submitted correctly, it establishes a taxpayer's commitment to fulfilling their tax obligations. The form must comply with state regulations, and electronic submissions are considered legally binding when conducted through a certified eSignature platform, ensuring the integrity of the document.

Required Documents for Completing the it540es Form

To accurately complete the it540es form, taxpayers should have the following documents ready:

- Income statements, such as W-2s or 1099s, detailing earnings.

- Previous year’s tax return, which can provide a basis for estimating current tax obligations.

- Records of any deductions or credits that may apply to the current tax year.

- Documentation of any other income sources that may affect tax calculations.

Who Issues the it540es Form

The it540es form is issued by the Louisiana Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's official website or through authorized tax preparation software that includes Louisiana tax forms.

Quick guide on how to complete for calendar year 2021 or fiscal year ending

Complete For Calendar Year Or Fiscal Year Ending effortlessly on any device

Digital document management has increased in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without interruptions. Manage For Calendar Year Or Fiscal Year Ending on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign For Calendar Year Or Fiscal Year Ending without any hassle

- Obtain For Calendar Year Or Fiscal Year Ending and click on Get Form to commence.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign For Calendar Year Or Fiscal Year Ending to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for calendar year 2021 or fiscal year ending

Create this form in 5 minutes!

How to create an eSignature for the for calendar year 2021 or fiscal year ending

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is it540es and how does it relate to airSlate SignNow?

The it540es is a form used for E-file and state income tax returns. airSlate SignNow can streamline your tax document processes, allowing you to sign and send the it540es electronically, which saves time and reduces errors.

-

What are the pricing options for using airSlate SignNow with it540es?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. Each plan provides access to essential features for managing documents like it540es, ensuring you receive a cost-effective solution that fits your budget.

-

What features does airSlate SignNow offer for managing it540es?

With airSlate SignNow, users can easily upload, sign, and manage it540es documents online. The platform offers features such as customizable templates, secure cloud storage, and real-time collaboration, enhancing the efficiency of your document workflow.

-

How does airSlate SignNow benefit users dealing with it540es?

By using airSlate SignNow, users benefit from a faster and more secure way to handle it540es. The platform facilitates electronic signatures and reduces the need for physical paperwork, making tax filing much more efficient.

-

Can I integrate airSlate SignNow with other applications for it540es?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow when processing it540es. This includes compatibility with popular tools like Google Drive, Dropbox, and CRMs to streamline document management.

-

Is airSlate SignNow compliant with the regulations for it540es?

Yes, airSlate SignNow complies with industry standards for electronic signatures and document handling, making it a reliable choice for it540es. Users can rest assured that their documents meet legal requirements for e-signing.

-

How secure is airSlate SignNow when managing sensitive documents like it540es?

airSlate SignNow employs advanced security protocols, including encryption and multi-factor authentication, to ensure that sensitive documents like it540es are protected. You can confidently manage your documents knowing they are safe.

Get more for For Calendar Year Or Fiscal Year Ending

Find out other For Calendar Year Or Fiscal Year Ending

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer