Louisiana Form it 540ES Estimated Tax Voucher for 2025-2026

Understanding the Louisiana Form IT 540ES Estimated Tax Voucher

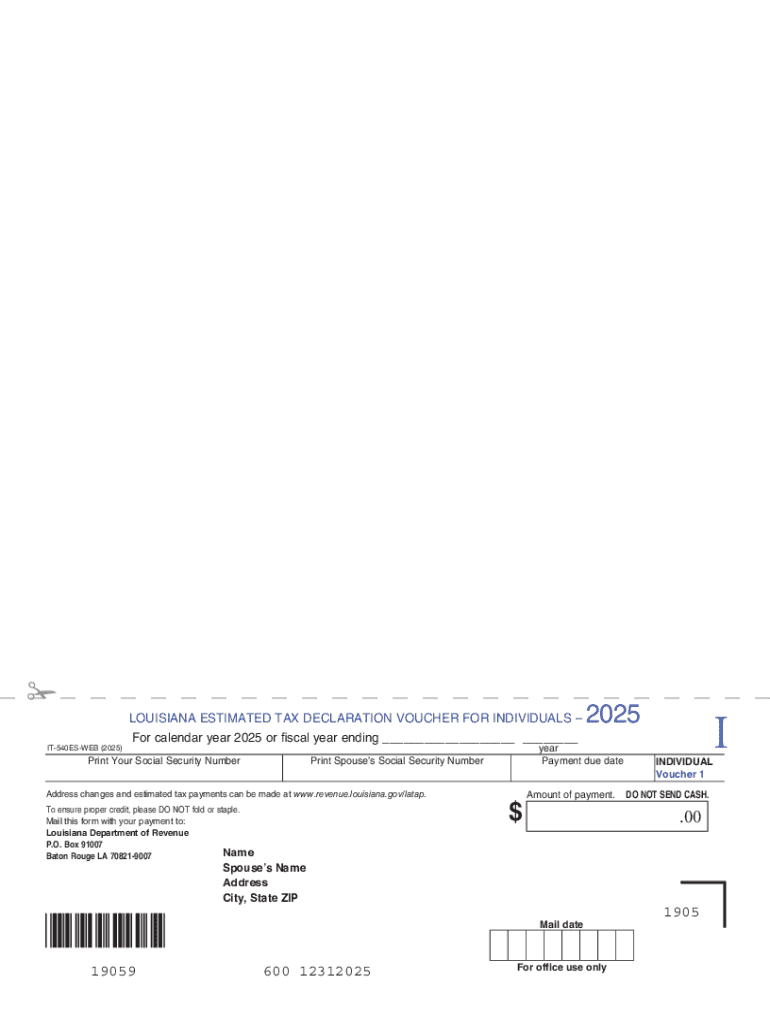

The Louisiana Form IT 540ES is designed for individuals who need to make estimated tax payments to the state. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when they file their annual return. It helps ensure that individuals meet their tax obligations throughout the year, rather than facing a large bill at tax time.

How to Complete the Louisiana Form IT 540ES

Filling out the Louisiana Form IT 540ES involves several key steps. First, gather your financial information, including your expected income and deductions for the year. Next, calculate your estimated tax liability using the state's tax tables. Enter the calculated amount on the form, along with any previous payments made. Finally, ensure that you sign and date the form before submission.

Obtaining the Louisiana Form IT 540ES

The Louisiana Form IT 540ES can be obtained through the Louisiana Department of Revenue's website or by visiting local tax offices. It is also available at various financial institutions and libraries. Ensure you have the most current version of the form for the tax year you are filing.

Important Dates for Filing the Louisiana Form IT 540ES

Taxpayers should be aware of the filing deadlines associated with the Louisiana Form IT 540ES. Generally, estimated tax payments are due on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Legal Considerations for the Louisiana Form IT 540ES

Using the Louisiana Form IT 540ES is a legal requirement for certain taxpayers. It is important to understand that failure to file or pay estimated taxes can lead to penalties. The state has specific guidelines that outline the consequences of non-compliance, which can include fines and additional interest on unpaid amounts.

Key Components of the Louisiana Form IT 540ES

The Louisiana Form IT 540ES includes several important sections. Taxpayers must provide their name, address, and Social Security number. Additionally, the form requires information about estimated income, deductions, and the total amount owed. Accurate completion of these sections is crucial for proper processing.

Examples of Scenarios Requiring the Louisiana Form IT 540ES

Various taxpayer scenarios may necessitate the use of the Louisiana Form IT 540ES. For instance, self-employed individuals often need to make estimated payments due to fluctuating income. Similarly, retirees with substantial income from investments may also find themselves required to file this form to avoid underpayment penalties.

Create this form in 5 minutes or less

Find and fill out the correct louisiana form it 540es estimated tax voucher for

Create this form in 5 minutes!

How to create an eSignature for the louisiana form it 540es estimated tax voucher for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana estimated tax form?

The louisiana estimated tax form is a document used by individuals and businesses in Louisiana to report and pay estimated income taxes. This form helps taxpayers calculate their expected tax liability for the year and make timely payments to avoid penalties. Understanding how to fill out this form is crucial for effective tax planning.

-

How can airSlate SignNow help with the louisiana estimated tax form?

airSlate SignNow simplifies the process of completing and submitting the louisiana estimated tax form by allowing users to eSign documents securely and efficiently. Our platform provides templates and tools that make it easy to fill out and manage tax forms. This ensures that your tax submissions are accurate and timely.

-

What are the pricing options for using airSlate SignNow for the louisiana estimated tax form?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and enterprises. Each plan provides access to features that streamline the completion of the louisiana estimated tax form. You can choose a plan that fits your budget while ensuring you have the necessary tools for efficient tax management.

-

Are there any features specifically designed for the louisiana estimated tax form?

Yes, airSlate SignNow includes features tailored for the louisiana estimated tax form, such as customizable templates and automated reminders for payment deadlines. These features help ensure that you never miss a deadline and that your forms are filled out correctly. Our platform is designed to enhance your tax filing experience.

-

Can I integrate airSlate SignNow with other accounting software for the louisiana estimated tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your financial documents, including the louisiana estimated tax form. This integration allows for automatic data transfer and ensures that your tax information is always up-to-date and accurate.

-

What are the benefits of using airSlate SignNow for tax forms like the louisiana estimated tax form?

Using airSlate SignNow for the louisiana estimated tax form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents from anywhere, saving you time and effort. Additionally, the secure storage of your documents ensures that your sensitive information is protected.

-

Is airSlate SignNow user-friendly for completing the louisiana estimated tax form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the louisiana estimated tax form. The intuitive interface guides you through the process, ensuring that you can fill out and eSign your forms without any hassle. Our customer support is also available to assist you if needed.

Get more for Louisiana Form IT 540ES Estimated Tax Voucher For

- Nevada landlord in form

- Nevada landlord tenant 497320666 form

- Landlord tenant use 497320667 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497320668 form

- Letter tenant notice template 497320669 form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497320670 form

- Nv violation form

- Letter tenant rent sample 497320672 form

Find out other Louisiana Form IT 540ES Estimated Tax Voucher For

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast